Employee Medicare Tax

Employee Medicare tax is an essential component of the US tax system, contributing significantly to the funding of Medicare, a federal program that provides health insurance coverage to eligible individuals. This article delves into the intricacies of employee Medicare tax, exploring its history, purpose, and impact on employees and the healthcare system. With a comprehensive understanding of this tax, we can better grasp its role in maintaining the stability and accessibility of healthcare services in the United States.

The Historical Perspective and Purpose of Employee Medicare Tax

Employee Medicare tax, officially known as the Hospital Insurance (HI) tax, was introduced as part of the Social Security Amendments of 1965. This legislation, signed into law by President Lyndon B. Johnson, marked a pivotal moment in US history, establishing Medicare as a vital component of the nation’s social safety net.

The primary purpose of the tax is to finance Medicare Part A, which covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health care services. It serves as a dedicated funding stream to ensure the sustainability and accessibility of these essential healthcare services for eligible individuals, primarily those aged 65 and older.

Understanding the Tax Structure

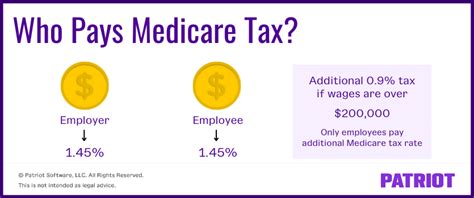

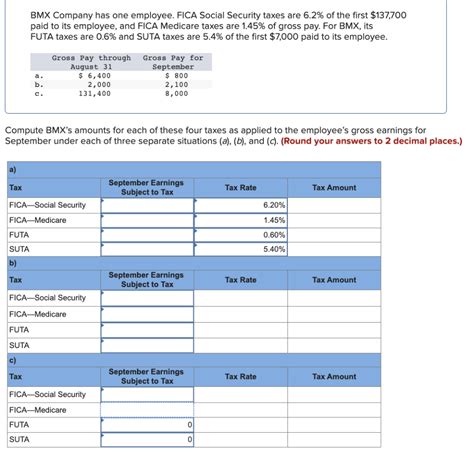

Employee Medicare tax is a payroll tax, which means it is deducted from an employee’s wages or salary. The tax rate is currently set at 1.45% of the employee’s earnings, with employers matching this contribution, bringing the total tax rate to 2.9%.

This tax is applicable to all forms of compensation, including salaries, wages, bonuses, commissions, and tips. It is calculated based on the employee's gross earnings, with no exemption or threshold amount. The tax is withheld from each paycheck, ensuring a consistent and stable revenue stream for Medicare funding.

For high-income earners, there is an additional Medicare tax. This additional tax, known as the Medicare surtax, applies to individuals earning more than $200,000 as a single filer, $250,000 as a married joint filer, or $125,000 as a married separate filer. The surtax rate is 0.9%, and it is the employee's sole responsibility, with no matching contribution from the employer.

Key Features of Employee Medicare Tax

- The tax is a fixed percentage of an employee’s earnings, making it straightforward to calculate and consistent across different income levels.

- It is a mandatory tax, with no option for employees to opt out. This ensures a steady and reliable source of funding for Medicare.

- The tax is applied to all forms of compensation, providing a comprehensive coverage of an employee’s income.

- The matching contribution by employers demonstrates a shared responsibility for funding healthcare services.

Impact on Employees and the Healthcare System

Employee Medicare tax plays a critical role in ensuring the availability and affordability of healthcare services for millions of Americans. By contributing to Medicare Part A, the tax provides a safety net for individuals who may face significant healthcare costs due to illness, injury, or old age.

For employees, the tax is a tangible reminder of their contribution to a vital social program. While it may be viewed as a financial burden, it is important to recognize the broader societal benefits. By contributing to Medicare, employees are not only securing their own healthcare coverage but also supporting the well-being of their communities, especially those who are most vulnerable.

The tax also has a stabilizing effect on the healthcare system. With a dedicated funding stream, Medicare can provide predictable and consistent coverage, reducing the financial burden on hospitals and healthcare providers. This, in turn, can lead to more accessible and affordable healthcare services for all Americans.

Case Study: The Impact of Employee Medicare Tax in Action

To illustrate the real-world impact of employee Medicare tax, let’s consider the story of Sarah, a 67-year-old retired teacher. Sarah has been a diligent contributor to Medicare throughout her working life, with her employers matching her contributions. Now, as a Medicare beneficiary, she relies on the program to cover her healthcare expenses.

Recently, Sarah was diagnosed with a chronic condition that requires ongoing medical treatment. Without Medicare, the cost of her medications and specialist care would be financially devastating. However, thanks to the contributions of employees like Sarah and her former employers, she can access the necessary healthcare services without facing overwhelming financial strain.

Sarah's story highlights the critical role that employee Medicare tax plays in supporting individuals during their most vulnerable times. It demonstrates how a collective effort, through the payment of this tax, can make a significant difference in the lives of millions of Americans, ensuring their access to essential healthcare services.

Future Implications and Considerations

As the US population continues to age, the demand for Medicare services is expected to increase significantly. This trend underscores the importance of maintaining a stable and sustainable funding source for the program.

One key consideration is the potential for increasing the employee Medicare tax rate. While this could provide additional funding for Medicare, it must be carefully balanced against the impact on employees' take-home pay and the overall economic climate. Any changes to the tax rate would require a delicate analysis of the potential benefits and drawbacks.

Additionally, exploring alternative funding models, such as increasing employer contributions or introducing new revenue streams, could be considered to ensure the long-term viability of Medicare. These options, however, would need to be carefully evaluated to maintain the program's accessibility and ensure a fair distribution of the financial burden.

Addressing Healthcare Disparities

Employee Medicare tax, while crucial for funding healthcare services, does not directly address healthcare disparities. To ensure equitable access to healthcare, it is essential to consider additional measures, such as expanding Medicaid coverage, improving healthcare infrastructure in underserved areas, and addressing social determinants of health.

By combining a stable funding source for Medicare with targeted initiatives to address healthcare disparities, the US can work towards a more comprehensive and inclusive healthcare system.

Conclusion

Employee Medicare tax is a critical component of the US healthcare funding system, playing a pivotal role in sustaining Medicare and ensuring access to essential healthcare services. Through a shared effort between employees and employers, this tax contributes to the well-being of millions of Americans, particularly those in vulnerable situations.

As we navigate the complexities of healthcare financing, it is important to recognize the impact and importance of employee Medicare tax. By understanding its historical context, purpose, and real-world implications, we can appreciate the value of this tax and its role in supporting a robust and accessible healthcare system for all.

How is employee Medicare tax different from other payroll taxes?

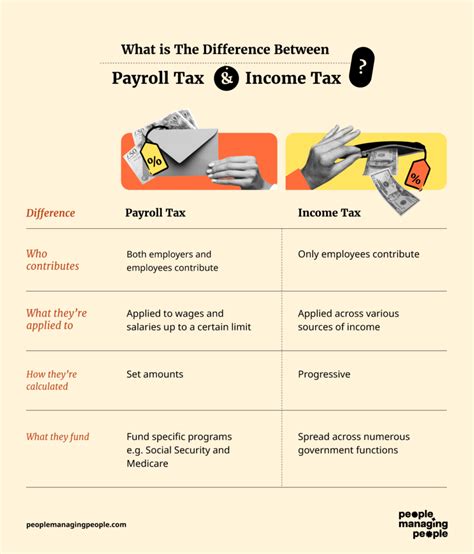

+Employee Medicare tax is specifically dedicated to funding Medicare Part A, which covers hospital insurance. In contrast, other payroll taxes, such as Social Security tax, fund different social programs. The Medicare tax is a fixed percentage of an employee’s earnings, while other payroll taxes may have thresholds or maximum contribution limits.

Are there any tax benefits for employees who contribute to Medicare?

+Employee contributions to Medicare are not considered a tax-deductible expense. However, by contributing to Medicare, employees gain access to vital healthcare coverage, providing peace of mind and financial protection in the event of illness or injury.

What happens if an employee’s earnings exceed the threshold for the additional Medicare tax?

+If an employee’s earnings exceed the threshold (200,000 for single filers, 250,000 for married joint filers, and $125,000 for married separate filers), they are responsible for paying the additional Medicare tax of 0.9% on their excess earnings. This tax is not matched by the employer and is deducted from the employee’s paycheck.