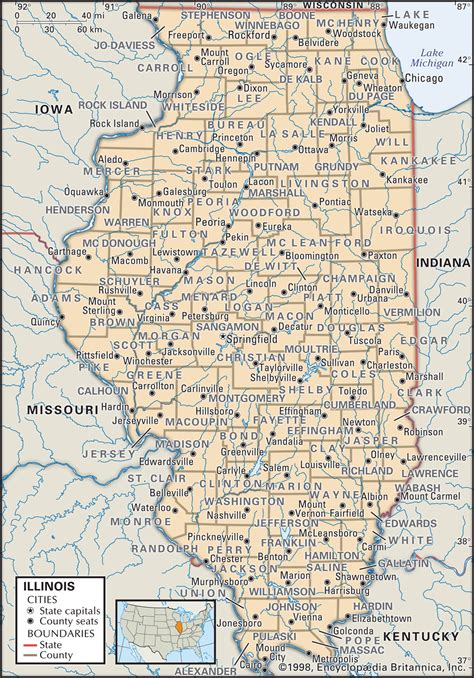

Illinois Track Tax Return

Welcome to our comprehensive guide on the Illinois Track Tax Return system, a crucial aspect of financial management for individuals and businesses operating within the state. As an expert in the field, I will delve into the intricacies of this system, providing you with an in-depth understanding of its features, benefits, and implications. By the end of this article, you'll have the knowledge and tools to navigate the Illinois Track Tax Return process with confidence.

Understanding the Illinois Track Tax Return

The Illinois Track Tax Return, officially known as the Illinois Income Tax Return, is an essential component of the state's revenue collection system. It is a process through which individuals, businesses, and entities report their income, deductions, and credits to the Illinois Department of Revenue (IDOR) and calculate their tax liability. This system ensures that residents and businesses contribute their fair share to the state's economy and public services.

Illinois, being one of the most populous and economically diverse states in the United States, has a robust tax system designed to support its vast infrastructure and social programs. The Track Tax Return system plays a pivotal role in maintaining the state's financial stability and sustainability.

Key Features of the Illinois Track Tax Return

- Electronic Filing Options: The IDOR encourages electronic filing of tax returns, offering various online platforms and software solutions for individuals and businesses. This method is not only more efficient but also reduces the risk of errors and ensures faster processing.

- Progressive Tax Rates: Illinois operates on a progressive tax structure, meaning that higher incomes are taxed at a higher rate. This system aims to distribute the tax burden fairly across different income levels.

- Deductions and Credits: The state offers a range of deductions and credits to reduce the tax liability of individuals and businesses. These include standard deductions, personal exemptions, and credits for various expenses and investments.

- Payment Options: Taxpayers have the flexibility to choose from several payment methods, including direct debit, credit/debit cards, and electronic funds transfer. The IDOR also provides payment plans for those who cannot afford to pay their taxes in full.

- Online Account Management: The Illinois Taxpayer Information System (TIS) allows registered users to manage their tax accounts online. This platform provides real-time access to tax information, including payment history, return status, and notifications.

Benefits and Advantages

The Illinois Track Tax Return system offers several advantages to taxpayers, including:

- Simplicity and Convenience: The online filing system simplifies the tax return process, making it accessible and user-friendly for taxpayers. This reduces the need for complex paperwork and manual calculations.

- Timely Refunds: Electronic filing and direct deposit options ensure that taxpayers receive their refunds promptly, often within a few weeks of filing.

- Error Reduction: The IDOR's electronic filing systems incorporate built-in error checks and validations, minimizing the chances of mistakes that could lead to audits or penalties.

- Tax Planning: By understanding the state's tax system, individuals and businesses can better plan their finances and optimize their tax strategies.

- Transparency: The IDOR provides clear guidelines and resources to help taxpayers understand their rights and responsibilities, promoting transparency and trust in the system.

How to Navigate the Illinois Track Tax Return Process

Now that we have a solid understanding of the system's features, let's explore the step-by-step process of filing an Illinois Track Tax Return.

Step 1: Gather Necessary Information

Before you begin, ensure you have all the required documentation and information. This includes:

- Social Security Numbers for yourself and any dependents.

- W-2 forms from all employers for the tax year.

- 1099 forms for any additional income, such as interest or dividends.

- Records of any deductions or credits you plan to claim, such as medical expenses, charitable donations, or education costs.

- Prior year's tax return (if available) for reference.

Step 2: Choose Your Filing Method

The IDOR offers several filing methods to cater to different preferences and needs:

- Online Filing: Visit the IDOR's official website and use their online filing platform or authorized software. This method is quick, secure, and often has built-in tax calculation tools.

- Paper Filing: If you prefer a traditional approach, you can download and print the appropriate tax forms from the IDOR's website. Fill them out manually and mail them to the specified address.

- E-File with a Tax Professional: Consider engaging a certified tax preparer or accountant who can guide you through the process and ensure accuracy.

Step 3: Complete Your Tax Return

Follow these steps to complete your Illinois Track Tax Return:

- Select the correct tax form based on your filing status (single, married filing jointly, etc.).

- Enter your personal information, including your name, address, and Social Security Number.

- Report your income accurately, including wages, salaries, tips, and any other sources of income.

- Claim deductions and credits applicable to your situation. Be sure to review the IDOR's guidelines for eligibility.

- Calculate your taxable income and determine your tax liability using the provided tax tables or tax calculation tools.

- If you have any taxes due, choose your preferred payment method and ensure you meet the payment deadline.

- Review your return for accuracy and sign it electronically or physically, depending on your chosen filing method.

Step 4: Submit and Track Your Return

Once you've completed your tax return, submit it through the chosen filing method. If you're filing online, you'll receive a confirmation message or email.

To track the status of your return and refund (if applicable), you can:

- Use the IDOR's online tracking system, which provides real-time updates on the processing of your return.

- Check your bank account if you opted for direct deposit.

- Contact the IDOR's customer service for assistance.

Tips and Considerations for a Smooth Filing Experience

To ensure a seamless and stress-free tax filing process, keep the following tips in mind:

- Stay Informed: Stay updated with the latest tax laws, regulations, and IDOR announcements. This will help you take advantage of any new deductions or credits and avoid potential penalties.

- File on Time: Be mindful of the tax filing deadlines. Late filing can result in penalties and interest charges.

- Accurate Record-Keeping: Maintain organized records of your income, expenses, and deductions. This will make the filing process easier and provide evidence in case of an audit.

- Consider Professional Help: If you have a complex tax situation or lack confidence in your tax knowledge, consult a tax professional. They can provide expert guidance and ensure compliance.

- Review Your Return: Before submitting your tax return, carefully review it for errors or omissions. A simple mistake can lead to unnecessary complications.

The Future of Illinois Tax Returns

The Illinois Track Tax Return system is continually evolving to meet the changing needs of taxpayers and the state's economy. The IDOR is dedicated to improving its services and making the tax filing process more efficient and accessible.

Digital Transformation

The IDOR recognizes the importance of digital technologies in modern tax administration. They are investing in innovative solutions to enhance the online filing experience, improve data security, and provide real-time support to taxpayers.

One notable initiative is the development of a mobile app, allowing taxpayers to file their returns and manage their accounts conveniently from their smartphones.

Simplification and Education

The IDOR aims to simplify the tax system by streamlining processes and providing clear, concise guidelines. They actively engage with taxpayers through educational campaigns and outreach programs to promote tax literacy and compliance.

Expanding Deductions and Credits

Illinois is committed to supporting its residents and businesses through various tax incentives. The state regularly evaluates and introduces new deductions and credits to encourage economic growth and development.

For instance, the state offers tax credits for research and development, renewable energy investments, and historic preservation projects.

Interoperability and Data Sharing

The IDOR is exploring partnerships with other state agencies and federal bodies to improve data sharing and interoperability. This collaboration aims to streamline the tax filing process and reduce the burden on taxpayers by minimizing the need for redundant information.

Conclusion

The Illinois Track Tax Return system is a critical component of the state's financial framework, ensuring that residents and businesses contribute to the prosperity of the state. By understanding the system's features, benefits, and processes, taxpayers can navigate their tax obligations with confidence and precision.

As the state continues to invest in digital transformation and taxpayer education, the future of Illinois tax returns looks promising. The IDOR's commitment to simplifying processes, expanding incentives, and improving accessibility will benefit taxpayers and the state's economy alike.

Stay informed, plan ahead, and embrace the opportunities that a well-managed tax system provides. Remember, your taxes support the infrastructure, education, and services that make Illinois a great place to live and do business.

When is the Illinois tax filing deadline for individuals?

+The Illinois tax filing deadline for individuals is typically April 15th of each year. However, if this date falls on a weekend or a holiday, the deadline is extended to the next business day.

Are there any penalties for late filing or late payment of taxes in Illinois?

+Yes, Illinois imposes penalties for late filing and late payment of taxes. Late filing penalties can range from 5% to 100% of the unpaid tax amount, depending on the severity of the violation. Late payment penalties are generally 1% of the unpaid tax for each month or part of a month that the tax remains unpaid, up to a maximum of 25%.

Can I file my Illinois tax return electronically?

+Absolutely! The Illinois Department of Revenue encourages electronic filing as it is faster, more secure, and reduces the risk of errors. You can file your tax return online through the IDOR’s official website or authorized e-file providers.