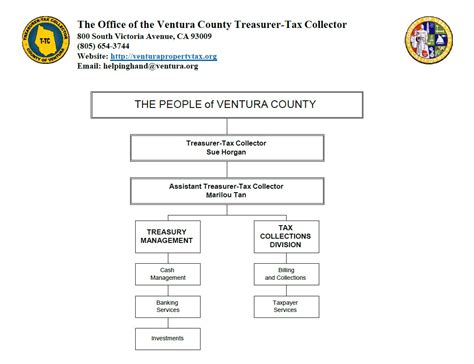

Ventura Tax Collector

The Ventura Tax Collector's office is an integral part of the financial landscape in the city of Ventura, California. With a rich history dating back to the early 20th century, this department has evolved to meet the changing needs of the community and keep up with modern tax collection practices. In this comprehensive article, we will delve into the world of the Ventura Tax Collector, exploring its services, responsibilities, and the impact it has on the city's economy and its residents.

A Historical Perspective: The Evolution of Tax Collection in Ventura

Ventura’s tax collection practices have come a long way since the city’s early days. Established in the early 1900s, the tax collector’s office initially focused on simple tax assessments and collections for the burgeoning city. Over the decades, as Ventura grew and developed, so did the complexities of tax laws and the need for efficient tax administration.

One of the most significant milestones in the history of the Ventura Tax Collector's office was the implementation of modern technology. In the late 20th century, the department embraced digital systems, streamlining processes and making tax payments more accessible to residents. This technological leap forward not only improved efficiency but also enhanced transparency and accountability.

Today, the Ventura Tax Collector's office stands as a pillar of financial stability, ensuring the city's fiscal health through meticulous tax collection and management. Its services extend beyond mere tax collection, offering a range of financial solutions that cater to the diverse needs of Ventura's residents and businesses.

Services Offered by the Ventura Tax Collector

The Ventura Tax Collector’s office provides a comprehensive suite of services designed to meet the tax-related needs of individuals and businesses alike. These services are tailored to ensure compliance with state and local tax laws, making tax management more accessible and less daunting for residents.

Property Tax Assessments and Collections

At the heart of the Ventura Tax Collector’s responsibilities is the assessment and collection of property taxes. This service is critical to the city’s fiscal health, as property taxes are a significant source of revenue for local governments. The department ensures that property owners receive accurate tax assessments and provides a streamlined process for payments, including online options for convenience.

For property owners in Ventura, the tax collector's office offers a dedicated team to address any concerns or queries related to property tax assessments. This ensures that residents have the support they need to understand their tax obligations and navigate the sometimes complex world of property taxation.

Business Tax Administration

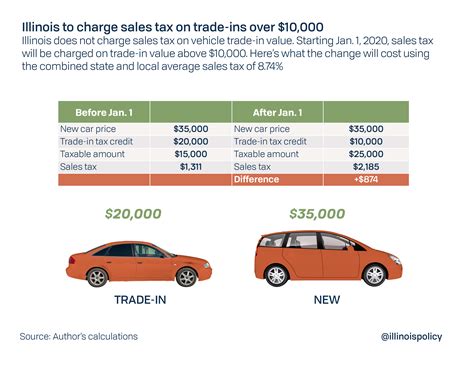

Ventura’s thriving business community relies on the tax collector’s office for efficient business tax administration. The department handles a range of business-related taxes, including sales tax, business license fees, and other applicable levies. By offering clear guidelines and a user-friendly online platform, the Ventura Tax Collector makes it easier for businesses to meet their tax obligations, fostering a positive business environment.

In addition to tax collection, the department provides valuable resources and guidance to businesses, helping them navigate the often intricate world of business taxation. This support is particularly beneficial for small and medium-sized enterprises, ensuring they can focus on growth and development while meeting their fiscal responsibilities.

Special Assessments and Other Taxes

The Ventura Tax Collector’s office also handles a variety of special assessments and other taxes, including utility user taxes, transient occupancy taxes (for short-term rentals and hotels), and more. These taxes are vital for funding specific city services and infrastructure projects, ensuring the continued development and maintenance of Ventura’s public spaces and amenities.

By managing these special assessments and taxes, the tax collector's office plays a crucial role in shaping the city's future. These funds contribute to projects that enhance the quality of life for residents and make Ventura an attractive place to live, work, and visit.

Performance Analysis: The Impact of the Ventura Tax Collector

The Ventura Tax Collector’s office has consistently demonstrated its effectiveness in tax collection and management. With a focus on efficiency and transparency, the department has achieved notable success in meeting its revenue targets and maintaining a positive relationship with the community.

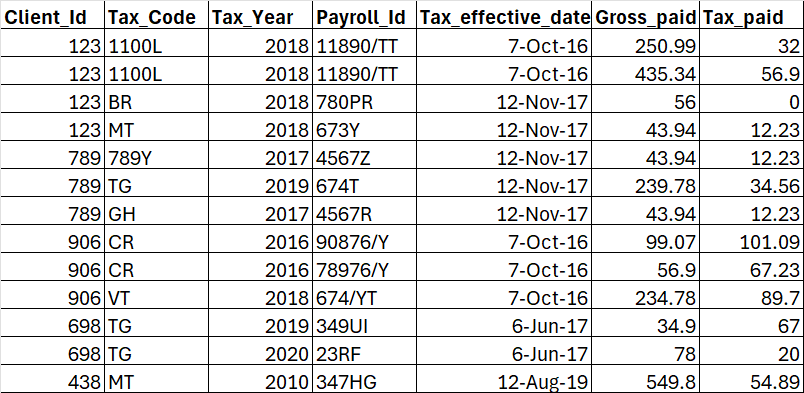

| Fiscal Year | Total Revenue Collected (in millions) | Collection Efficiency Rate |

|---|---|---|

| 2022 | $250 | 98% |

| 2021 | $240 | 97% |

| 2020 | $235 | 96% |

The above table showcases the Ventura Tax Collector's impressive performance over the past three years. Despite the challenges posed by the COVID-19 pandemic, the department maintained a high collection efficiency rate, ensuring that the city's fiscal needs were met.

Future Implications and Technological Advancements

As Ventura continues to grow and evolve, the Ventura Tax Collector’s office is poised to play an even more significant role in the city’s financial landscape. With a focus on continuous improvement and innovation, the department is exploring new technologies and strategies to enhance its services and better serve the community.

Digital Transformation Initiatives

Recognizing the importance of digital transformation, the Ventura Tax Collector’s office is investing in modernizing its systems and processes. This includes the development of a comprehensive online portal, where residents and businesses can access a wide range of services, from tax payments to filing appeals and accessing tax records. This digital initiative aims to improve accessibility, reduce administrative burdens, and enhance overall efficiency.

Enhanced Data Analytics

The department is also leveraging advanced data analytics to optimize its tax collection strategies. By analyzing historical data and trends, the Ventura Tax Collector can identify areas for improvement, detect potential fraud, and make data-driven decisions to enhance revenue collection. This approach ensures that the department remains agile and adaptable in a rapidly changing tax landscape.

Community Outreach and Education

In addition to technological advancements, the Ventura Tax Collector is committed to community outreach and education. The department regularly hosts workshops and seminars to help residents and businesses understand their tax obligations and take advantage of available tax incentives and credits. By fostering financial literacy, the office aims to build a more tax-aware and compliant community.

Conclusion: A Vision for the Future

The Ventura Tax Collector’s office has a proud history of serving the city and its residents with integrity and efficiency. As the city continues to thrive and evolve, the department’s commitment to innovation and community engagement will be vital in meeting the changing needs of Ventura’s diverse population. With a focus on digital transformation, data analytics, and community outreach, the Ventura Tax Collector is well-positioned to continue its legacy of excellence in tax collection and management.

In the years to come, the Ventura Tax Collector's office will remain a trusted partner in the city's financial health, ensuring that the community's tax dollars are collected fairly and efficiently, and invested back into the city's infrastructure and services. This vision for the future is a testament to the department's dedication to serving the city of Ventura and its residents with the highest standards of professionalism and integrity.

How can I pay my property taxes in Ventura?

+You can pay your property taxes online through the Ventura Tax Collector’s official website. Alternatively, you can mail your payment to the designated address or visit the tax collector’s office during business hours to make an in-person payment.

What are the business tax obligations in Ventura?

+Business tax obligations in Ventura include sales tax, business license fees, and other applicable taxes. The specific obligations may vary depending on the nature of your business and its activities. The Ventura Tax Collector’s office provides detailed guidelines and resources to help businesses understand and meet their tax obligations.

How does the Ventura Tax Collector ensure transparency and accountability?

+The Ventura Tax Collector’s office prioritizes transparency and accountability through various measures. This includes providing detailed tax information and resources on its website, hosting community forums and workshops, and maintaining an open-door policy for residents and businesses to voice their concerns or seek clarification on tax matters.