Is Employer Id The Same As Tax Id

The Employer Identification Number (EIN) and the Tax Identification Number (TIN) are often misunderstood and used interchangeably, but they serve distinct purposes and have unique implications for businesses and individuals alike. In this comprehensive exploration, we delve into the intricacies of these identifiers, unraveling their definitions, applications, and the critical differences that set them apart.

Unraveling the EIN: The Backbone of Business Identification

The Employer Identification Number, or EIN, is a unique nine-digit code issued by the Internal Revenue Service (IRS) in the United States. It serves as a vital identifier for businesses of all sizes and structures, from sole proprietorships to multinational corporations.

Here's a deeper dive into the world of EINs:

EIN Definition and Purpose

An EIN is essentially a taxpayer identification number specifically assigned to businesses. It plays a crucial role in various aspects of business operations, including tax filing, banking, and legal compliance.

EIN vs. Social Security Number

It’s important to distinguish between an EIN and a Social Security Number (SSN). While an SSN is assigned to individuals for personal tax and identification purposes, an EIN is exclusively for businesses. In fact, businesses often require an EIN to hire employees, open business bank accounts, and establish their presence in the economic landscape.

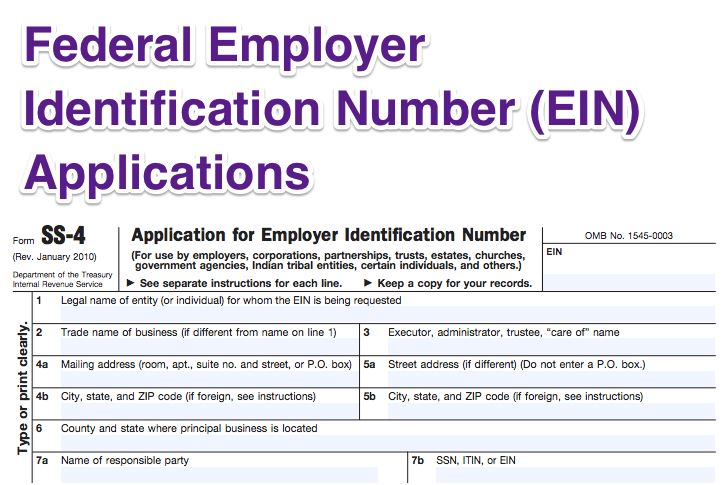

EIN Application Process

Obtaining an EIN involves a straightforward online application process through the IRS website. Businesses provide essential details, including the business name, address, and the responsible party’s information. The IRS typically issues EINs within a few business days, offering a swift and efficient means of establishing a business’s identity.

Types of Entities Requiring an EIN

- Sole Proprietorships: Even though sole proprietors may use their SSN for tax purposes, an EIN is recommended for banking and legal purposes.

- Partnerships and LLCs: These entities are legally distinct from their owners and typically require an EIN.

- Corporations: Both C-Corporations and S-Corporations need EINs for tax filing and business operations.

- Nonprofit Organizations: EINs are essential for nonprofits to establish their tax-exempt status.

EIN Structure and Format

An EIN follows a specific format: two digits, a hyphen, seven digits, and another hyphen. For instance, an EIN could look like XX-XXXXXXX. The initial two digits often signify the assigning office, while the remaining digits provide a unique identifier for the business.

Benefits of Using an EIN

- Privacy: Using an EIN instead of an SSN helps protect the business owner’s personal information.

- Banking and Loans: Many financial institutions require an EIN for business accounts and loan applications.

- Legal Compliance: Certain business licenses and permits may necessitate an EIN for compliance purposes.

The TIN: A Versatile Identifier for Tax Purposes

A Tax Identification Number, or TIN, is a broader term encompassing various identifiers used for tax purposes. It includes both the EIN and the Social Security Number (SSN), along with other unique identifiers for specific entities.

TIN Definition and Scope

A TIN is any number assigned by a taxing authority to identify a taxpayer. It is a critical component in the tax system, ensuring accurate tax reporting and compliance.

Types of TINs

- Social Security Number (SSN): As mentioned earlier, an SSN is a TIN assigned to individuals for personal tax purposes.

- Individual Taxpayer Identification Number (ITIN): An ITIN is issued by the IRS to individuals who are not eligible for an SSN but still have U.S. tax obligations.

- Adoption Taxpayer Identification Number (ATIN): An ATIN is a temporary TIN assigned to a child during the adoption process.

- Prepared Settlement Fund Number (PSFN): A PSFN is a TIN for settlement funds established to compensate victims of securities fraud.

TIN Usage and Application

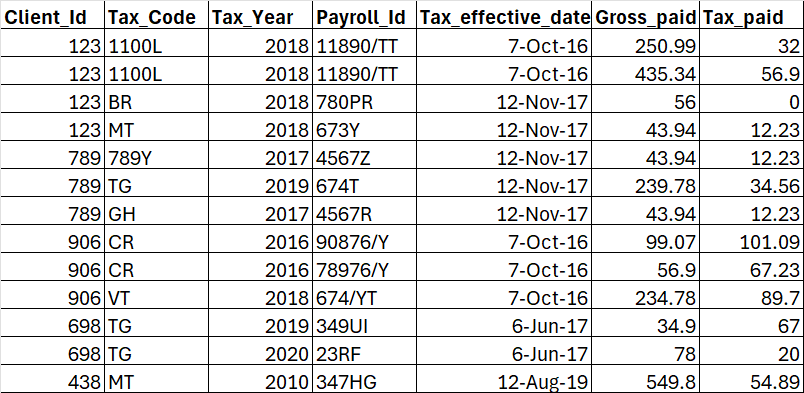

TINs are used extensively in tax-related matters. For instance, employers use TINs to report employee wages and tax withholdings on forms like the W-2. Similarly, businesses use TINs to report payments made to independent contractors on forms like the 1099-MISC.

The Critical Difference: EIN vs. TIN

While both the EIN and TIN serve crucial purposes in the realm of taxation and business identification, they differ significantly in scope and application.

| Attribute | EIN | TIN |

|---|---|---|

| Issuing Authority | Internal Revenue Service (IRS) | Various Taxing Authorities |

| Purpose | Business Identification and Tax Filing | Taxpayer Identification for Various Entities |

| Format | XX-XXXXXXX | Varies based on type (e.g., SSN: XXX-XX-XXXX) |

| Usage | Business Tax Filing, Banking, Legal Compliance | Tax Reporting for Individuals and Businesses |

Key Takeaways

- An EIN is specific to businesses and is essential for tax filing and business operations.

- A TIN encompasses various identifiers, including the EIN and SSN, used for tax reporting purposes.

- EINs and TINs are not interchangeable, and their usage depends on the context and entity type.

Real-World Implications and Insights

Understanding the distinction between an EIN and a TIN is not just an academic exercise; it has tangible implications for businesses and individuals alike.

Business Operations

For businesses, an EIN is a critical tool for establishing their identity, maintaining privacy, and navigating the complex world of tax compliance. It enables them to open business bank accounts, hire employees, and engage in various legal and financial activities.

Tax Reporting and Compliance

On the other hand, TINs, including the EIN, play a pivotal role in tax reporting. They ensure that tax obligations are met accurately and on time, whether it’s reporting employee wages, independent contractor payments, or personal income taxes.

Legal and Financial Considerations

The choice between using an EIN or a TIN can have legal and financial ramifications. For instance, using an SSN instead of an EIN for business purposes may expose personal information to public records, potentially leading to identity theft or other security risks. Similarly, using the wrong TIN for tax reporting can result in penalties and legal complications.

Expert Insights

Conclusion

In the complex world of taxation and business identification, the distinction between an EIN and a TIN is paramount. While both play essential roles, their unique characteristics and applications set them apart. By understanding these identifiers and their implications, businesses and individuals can navigate the tax landscape with confidence and compliance.

Frequently Asked Questions

Can I use my Social Security Number instead of an EIN for business purposes?

+

While it is possible to use your SSN for some business activities, especially as a sole proprietor, it is generally recommended to obtain an EIN. Using an EIN helps protect your personal information and can simplify various business processes, such as opening a business bank account or applying for loans.

What happens if I use the wrong TIN for tax reporting?

+

Using the wrong TIN for tax reporting can have serious consequences. It may lead to errors in tax filing, which could result in penalties, interest charges, or even legal action. It’s crucial to ensure you use the correct TIN for your specific entity type and tax situation.

How do I apply for an EIN if I’m a foreign business entity operating in the U.S.?

+

Foreign business entities can apply for an EIN through the IRS website. The application process is similar to that for domestic businesses, but additional information may be required, such as a valid passport or visa for the responsible party.