Twitch Tax Forms

For those who are new to the world of streaming or are considering it as a potential career, understanding the tax implications is crucial. One of the most commonly discussed topics among streamers and content creators is the Twitch tax forms, which can be a bit daunting, especially for those who are not familiar with the tax system and its requirements.

In this comprehensive guide, we will delve into the world of tax forms for Twitch streamers, breaking down the essential information, providing real-world examples, and offering valuable insights to ensure you stay compliant and navigate the tax landscape with confidence.

Understanding Twitch’s Role in Taxation

Twitch, as a platform that facilitates income generation for its creators, plays a crucial role in the tax process. While Twitch itself is not directly responsible for your taxes, it provides the tools and resources to help you stay organized and compliant. Understanding how Twitch interacts with tax authorities is the first step towards a smooth tax journey.

Twitch operates under the legal framework of each country, which means its policies and practices may vary based on regional tax laws. For instance, in the United States, Twitch follows the Internal Revenue Service (IRS) guidelines, whereas in Europe, it aligns with the European Union's tax regulations. This regional variance is important to consider when discussing tax forms and obligations.

Twitch’s Tax Reporting Tools

Twitch offers several features to assist streamers in tracking their earnings and expenses. One of the most useful tools is the Creator Dashboard, which provides a detailed overview of your earnings, including subscriptions, bits, ads, and other revenue streams. This dashboard acts as a central hub, helping you monitor your income throughout the year.

Additionally, Twitch has partnered with various tax preparation services, offering discounts and resources to its streamers. These partnerships aim to simplify the tax process and provide specialized support for content creators. By leveraging these tools, you can stay organized and ensure accurate reporting of your Twitch-related income.

| Tax Reporting Feature | Description |

|---|---|

| Creator Dashboard | A comprehensive overview of earnings, including subscriptions, bits, and ads. |

| Tax Partner Programs | Discounts and resources provided by tax preparation services specifically for Twitch streamers. |

Common Tax Forms for Twitch Streamers

When it comes to tax forms, the specific documents you’ll need depend on your country of residence and the nature of your streaming activities. However, there are a few forms that are commonly used by Twitch streamers around the world.

Form 1099-K (United States)

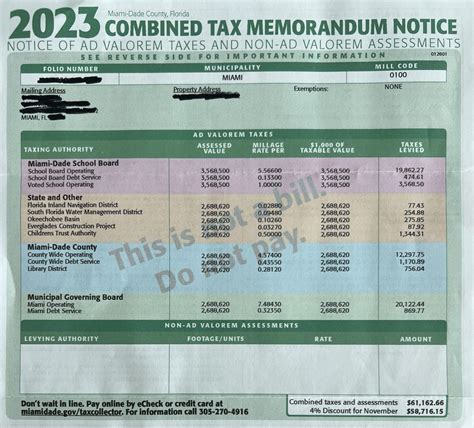

In the United States, if you receive payments through a third-party payment processor, such as Twitch’s payment system, you may receive a Form 1099-K. This form reports the gross amount of payment card and third-party network transactions. If your Twitch earnings exceed $20,000 and you have more than 200 transactions in a year, you are likely to receive this form.

It's important to note that the 1099-K form only reports the gross income, meaning it does not account for any expenses you may have incurred. As a result, it's crucial to maintain accurate records of your expenses to ensure you receive the appropriate tax deductions.

Self-Assessment Tax Returns (United Kingdom)

In the United Kingdom, self-assessment tax returns are the primary way to report income from Twitch and other online platforms. The Self-Assessment process allows you to declare your earnings, including those from streaming, and calculate your tax liability.

When completing your self-assessment, you'll need to include all income sources, such as subscriptions, bits, and any other earnings related to your streaming activities. It's essential to keep detailed records of your income and expenses to ensure an accurate declaration.

VAT Registration and Returns (European Union)

For streamers based in the European Union, Value Added Tax (VAT) is an important consideration. If your Twitch earnings exceed the VAT registration threshold in your country, you may need to register for VAT and submit regular VAT returns.

VAT registration and returns can be complex, as they involve tracking and reporting your sales and purchases. It's advisable to seek professional advice to ensure you understand your obligations and maintain compliance with EU tax regulations.

Other International Tax Forms

Beyond the United States, United Kingdom, and European Union, there are numerous other tax forms and regulations that may apply to Twitch streamers. These can vary greatly depending on the country and the specific tax system in place.

For example, in Australia, streamers may need to complete a Business Activity Statement (BAS) to report their income and GST (Goods and Services Tax). In Canada, the T2 Corporation Income Tax Return may be required for corporations, while individuals may use the T1 Individual Tax Return. These are just a few examples, and it's crucial to understand the specific tax requirements in your region.

Streamlining Your Tax Process: Tips and Strategies

Managing your tax obligations as a Twitch streamer can be complex, but there are strategies you can implement to streamline the process and make it more manageable.

Keep Detailed Records

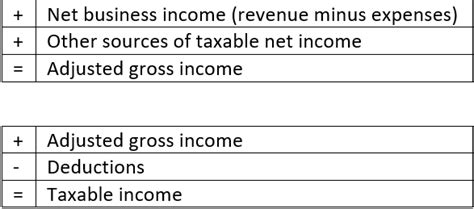

Maintaining accurate and detailed records is essential for tax purposes. Keep track of all your income sources, including subscriptions, bits, ad revenue, and any other earnings related to your streaming activities. Additionally, record all your expenses, such as equipment purchases, software subscriptions, and any other costs associated with your streaming setup.

Utilize Accounting Software

Consider using accounting software specifically designed for small businesses or freelancers. These tools can help you track income, expenses, and deductions, making it easier to prepare your tax forms. Some popular options include FreshBooks, QuickBooks, and Xero, which offer features tailored to the needs of content creators.

Seek Professional Tax Advice

While it may be tempting to tackle your taxes on your own, seeking professional tax advice can be invaluable. A tax advisor or accountant who specializes in the entertainment industry can provide personalized guidance, help you maximize deductions, and ensure you’re compliant with the latest tax laws and regulations.

When choosing a tax professional, look for someone who understands the unique nature of streaming income and can offer tailored advice. They can help you navigate the complexities of tax forms, deductions, and reporting requirements specific to your region.

Plan for Taxes Throughout the Year

Don’t wait until the last minute to start thinking about your taxes. Plan ahead and set aside funds throughout the year to cover your tax liabilities. This can help you avoid a large, unexpected tax bill and ensure you have the necessary funds to pay your taxes when they’re due.

Future Implications and Tax Strategies

As the streaming industry continues to grow and evolve, so do the tax implications. Staying informed about changes in tax laws and regulations is essential to ensure you remain compliant and maximize your deductions.

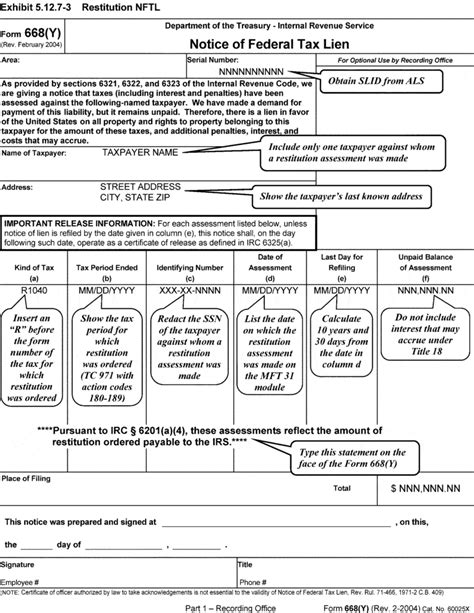

Changes in Tax Laws

Tax laws are subject to change, and it’s crucial to stay updated on any modifications that may impact your tax obligations. Keep an eye on announcements from tax authorities and seek professional advice if you’re unsure about the impact of new laws on your streaming income.

Maximizing Deductions and Credits

Understanding the deductions and tax credits available to you can significantly impact your tax liability. From equipment purchases to home office expenses, there are various deductions you may be eligible for. Work with your tax advisor to identify all potential deductions and ensure you’re taking advantage of every opportunity to minimize your tax burden.

Planning for Long-Term Financial Goals

As your streaming career progresses, it’s important to consider long-term financial planning. This includes setting financial goals, such as saving for retirement or investing in other ventures. A tax advisor can help you develop a strategy that aligns with your financial goals while minimizing your tax liabilities.

For example, you may want to consider setting up a retirement account, such as a Traditional IRA or a Roth IRA, which offer tax advantages and can help you save for the future. Additionally, exploring investment opportunities and understanding the tax implications can be beneficial for long-term financial growth.

Conclusion

Navigating the world of tax forms as a Twitch streamer can be challenging, but with the right tools, knowledge, and professional guidance, it becomes more manageable. Remember, staying organized, keeping detailed records, and seeking expert advice are key to ensuring a smooth tax journey.

By understanding the tax forms specific to your region, utilizing Twitch's tax reporting tools, and implementing strategic tax planning, you can confidently manage your tax obligations and focus on what matters most: your streaming career and your audience.

What happens if I don’t file my tax forms correctly as a Twitch streamer?

+Failing to file your tax forms correctly can lead to serious consequences, including fines, penalties, and even legal action. It’s important to take your tax obligations seriously and seek professional advice to ensure compliance.

Can I deduct my streaming equipment as a business expense on my tax forms?

+Yes, in many cases, you can deduct the cost of your streaming equipment as a business expense. This includes items such as cameras, microphones, lighting, and other equipment necessary for your streaming activities. Consult with a tax professional to ensure you’re claiming all eligible deductions.

Are there any tax advantages for donating to charities through Twitch?

+Donations made through Twitch’s charitable initiatives may be tax-deductible, depending on your country’s tax laws. It’s important to keep records of your donations and consult with a tax advisor to understand the specific deductions available to you.