Property Tax St Louis County

Property taxes are an essential component of any county's revenue system, and St. Louis County is no exception. Understanding how property taxes work and how they impact homeowners is crucial for both residents and potential buyers. This comprehensive guide will delve into the intricacies of Property Tax St. Louis County, exploring the assessment process, tax rates, exemptions, and the overall impact on the community.

Understanding the Property Tax Assessment Process

The property tax assessment process in St. Louis County is a meticulous and well-regulated system. It begins with the County Assessor's Office, which is responsible for evaluating the value of all taxable properties within the county. This includes residential, commercial, and industrial properties.

The assessment process typically involves physical inspections, market value analyses, and the application of state-mandated assessment guidelines. Assessors consider factors such as property size, improvements, location, and recent sales data to determine the fair market value of each property. This value forms the basis for calculating property taxes.

To ensure fairness and accuracy, the County Assessor's Office maintains detailed records and regularly updates its assessment methods. Property owners have the right to appeal their assessed values if they believe the evaluation is inaccurate or inconsistent with market trends.

Timeline and Notifications

The assessment cycle in St. Louis County follows a specific timeline. Typically, assessments are conducted every odd-numbered year, with property owners receiving notification of their assessed value by a certain date. This notification provides an opportunity for homeowners to review and, if necessary, contest the assessed value before the tax bills are issued.

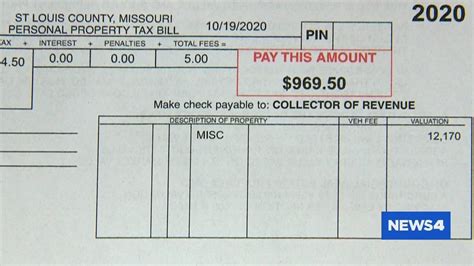

The notification process is designed to be transparent and accessible, allowing property owners to understand the basis of their tax liability. It includes information on the assessed value, the applicable tax rates, and any exemptions or deductions that may apply.

Property Tax Rates and Calculations

Property tax rates in St. Louis County are determined by the local taxing authorities, including the county government, school districts, and special taxing districts. These entities use property taxes to fund various services and infrastructure projects.

The tax rate is expressed as a percentage and is applied to the assessed value of the property. For instance, if a property has an assessed value of $200,000 and the tax rate is 1.5%, the annual property tax would be calculated as follows: $200,000 x 0.015 = $3,000. This amount is then divided into installments, typically due twice a year.

It's important to note that property tax rates can vary significantly within the county, depending on the specific taxing district in which a property is located. This is because each district has its own budget and financial needs, which influence the tax rate they set.

Special Assessments and Millage Rates

In addition to the standard property tax rate, St. Louis County may also impose special assessments for specific purposes. These assessments are typically used to fund infrastructure improvements or provide additional services to certain areas. Special assessments are usually based on the benefit a property receives from the improvement.

The millage rate is another term used in property tax calculations. It represents the tax rate in mills, where one mill is equal to $1 of tax for every $1,000 of assessed value. For example, a millage rate of 100 mills would mean $10 of tax for every $1,000 of assessed value.

Exemptions and Deductions

St. Louis County offers various exemptions and deductions to reduce the property tax burden on eligible homeowners. These incentives aim to promote homeownership, support seniors, and assist individuals with disabilities or limited incomes.

Homestead Exemption

The Homestead Exemption is a popular tax relief program in St. Louis County. It provides a reduction in the assessed value of a primary residence, effectively lowering the property taxes owed. To qualify, homeowners must meet certain residency and ownership requirements and must apply for the exemption annually.

The amount of the Homestead Exemption varies, but it typically ranges from a few hundred to a few thousand dollars, depending on the county's policies and the homeowner's eligibility. This exemption is a valuable tool for long-term residents and can significantly impact their overall tax liability.

Senior Citizen and Disabled Persons' Exemptions

St. Louis County recognizes the financial challenges faced by senior citizens and individuals with disabilities. As such, it offers specific exemptions tailored to these groups. The Senior Citizen Exemption provides a reduction in property taxes for homeowners aged 65 or older, while the Disabled Persons' Exemption assists individuals with qualifying disabilities.

Both exemptions have eligibility criteria, including income limits and residency requirements. These exemptions can offer substantial savings, making it more affordable for seniors and individuals with disabilities to maintain their homes.

Other Deductions

In addition to the above exemptions, St. Louis County provides various other deductions to eligible homeowners. These may include deductions for military service, agricultural land use, and energy-efficient improvements. Each deduction has its own set of rules and application processes.

The Impact of Property Taxes on the Community

Property taxes play a crucial role in shaping the financial health and services provided by St. Louis County. The revenue generated from these taxes funds essential services such as education, public safety, infrastructure maintenance, and social programs.

Education Funding

A significant portion of property tax revenue in St. Louis County goes towards funding public education. This includes schools at various levels, from elementary to high school, as well as support for vocational and technical education programs. Property taxes ensure that local schools receive the necessary resources to provide quality education to the county's youth.

Infrastructure and Community Development

Property taxes also contribute to the development and maintenance of the county's infrastructure. This encompasses roads, bridges, public transportation, and utilities. Additionally, property tax revenue is used for community improvement projects, such as parks, recreational facilities, and cultural centers. These investments enhance the overall quality of life for residents.

Public Safety and Emergency Services

St. Louis County relies on property taxes to fund its public safety initiatives. This includes police and fire departments, emergency medical services, and disaster response teams. Adequate funding ensures that the county can provide timely and effective responses to various emergencies, keeping residents safe.

Economic Development and Social Programs

Property tax revenue is utilized to promote economic development within the county. This may involve supporting local businesses, attracting new industries, and creating job opportunities. Additionally, a portion of the revenue is allocated to social programs, such as healthcare, welfare assistance, and community outreach initiatives.

Frequently Asked Questions

How often are property assessments conducted in St. Louis County?

+Property assessments in St. Louis County are generally conducted every odd-numbered year. This means assessments occur in years ending with 1, 3, 5, 7, and 9. The assessments are part of a comprehensive process to ensure fairness and accuracy in property tax calculations.

Can property owners appeal their assessed values?

+Absolutely! Property owners have the right to appeal their assessed values if they believe the assessment is inaccurate or inconsistent with market trends. The appeals process is designed to provide a fair and impartial review. Property owners should consult the County Assessor's Office for specific guidelines and timelines for appealing an assessment.

What is the average property tax rate in St. Louis County?

+The average property tax rate in St. Louis County can vary significantly depending on the specific taxing district. As of [current year], the average rate ranges from approximately [rate 1] to [rate 2], with some districts having higher or lower rates. It's essential to check the tax rates for your specific area to get an accurate estimate.

Are there any exemptions or deductions available for homeowners in St. Louis County?

+Yes, St. Louis County offers a range of exemptions and deductions to eligible homeowners. These include the Homestead Exemption, Senior Citizen Exemption, Disabled Persons' Exemption, and various other deductions. Each exemption has its own eligibility criteria and application process. It's recommended to consult the County Assessor's Office or a tax professional for detailed information on available exemptions.

How do property taxes impact the local economy and community development in St. Louis County?

+Property taxes play a vital role in shaping the local economy and community development in St. Louis County. The revenue generated from these taxes funds essential services such as education, infrastructure, public safety, and social programs. It contributes to economic growth, attracts businesses, and enhances the overall quality of life for residents. Well-maintained infrastructure, high-quality education, and robust community services all contribute to a thriving and sustainable community.