Washington D.c. Tax Rate

Understanding the tax landscape is crucial for individuals and businesses alike, especially when considering a specific region like Washington, D.C. The District of Columbia has its own unique tax system, and delving into its intricacies can provide valuable insights for tax planning and financial strategies. This article aims to offer a comprehensive guide to Washington, D.C.'s tax rates, exploring the various taxes levied, their rates, and how they impact residents and businesses in the nation's capital.

Tax Structure in Washington, D.C.

Washington, D.C., boasts a robust tax system that contributes significantly to the city’s revenue and overall economic stability. The tax structure in the district encompasses a range of taxes, each serving a specific purpose and catering to different taxpayer segments.

Income Tax

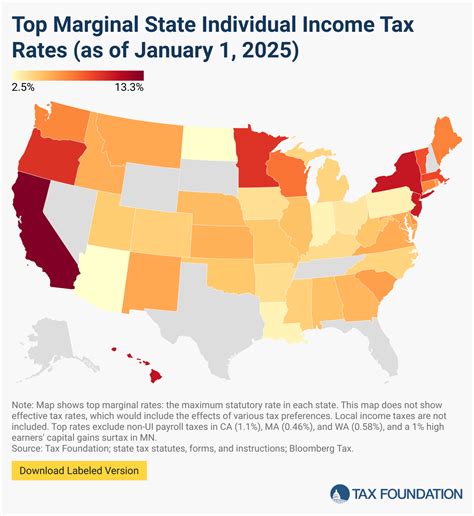

One of the primary sources of revenue for Washington, D.C., is the individual income tax. The district follows a progressive tax system, meaning that higher income brackets are subject to higher tax rates. As of the most recent tax year, the income tax rates in D.C. are as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 4.00% |

| $10,001 - $40,000 | 6.00% |

| $40,001 - $60,000 | 8.25% |

| $60,001 - $125,000 | 8.50% |

| Over $125,000 | 8.75% |

It's important to note that these rates are subject to change annually, so staying updated with the latest tax legislation is crucial for accurate planning.

Corporate Income Tax

Businesses operating in Washington, D.C., are subject to a corporate income tax based on their net income. The corporate tax rate in the district is currently set at 8.85%, making it one of the higher corporate tax rates among U.S. jurisdictions. This tax applies to both domestic and foreign corporations doing business in the district.

Sales and Use Tax

The sales and use tax is another significant component of Washington, D.C.’s tax system. This tax is levied on the sale of tangible personal property and certain services. The general sales tax rate in the district is 5.75%, but there are also additional tax rates that apply to specific items like alcohol and tobacco products.

Property Tax

Real property owners in Washington, D.C., are subject to a property tax, which is assessed based on the fair market value of the property. The tax rate for residential properties is typically lower than that for commercial properties. The exact tax rate can vary depending on the location within the district, with some neighborhoods offering tax incentives to encourage development.

Other Taxes and Fees

In addition to the aforementioned taxes, Washington, D.C., imposes various other taxes and fees to generate revenue and support specific initiatives. These include:

- Excise Taxes: Levied on specific goods and services like gasoline, cigarettes, and amusement activities.

- Hotel Accommodation Tax: Applicable to the rental of hotel rooms and similar accommodations.

- Unincorporated Business Franchise Tax: A tax on the privilege of doing business in the district, applicable to certain unincorporated businesses.

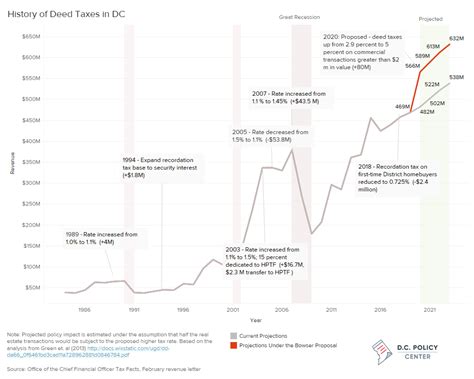

- Recordation Tax: Imposed on the transfer of real property interests within the district.

Tax Incentives and Credits

Washington, D.C., recognizes the importance of encouraging economic growth and supporting specific industries. As such, the district offers a range of tax incentives and credits to attract businesses and promote various initiatives.

Business Incentives

The District of Columbia offers a variety of business tax incentives, including:

- Research and Development Tax Credit: A credit available to businesses engaged in qualified research activities, aimed at fostering innovation.

- High Impact Business Tax Credit: Designed to attract and retain high-impact businesses, offering a credit based on job creation and investment.

- Biotechnology Tax Credit: A credit to support the growth of the biotechnology industry in the district.

Personal Tax Credits

Washington, D.C., also provides personal tax credits to support various social and economic initiatives. These credits include:

- District Earned Income Tax Credit (EITC): A refundable tax credit for low- and moderate-income working individuals and families, modeled after the federal EITC.

- Child and Dependent Care Tax Credit: Aimed at reducing the cost of child and dependent care, allowing working parents to save on eligible expenses.

- Historic Preservation Tax Credit: A credit for the rehabilitation of historic structures, encouraging the preservation of the district's rich architectural heritage.

Impact on Residents and Businesses

The tax rates and incentives in Washington, D.C., have a significant impact on both residents and businesses. For individuals, the progressive income tax structure means that higher-income earners contribute a larger share of their income in taxes. This can influence financial planning, especially for those considering relocation or retirement.

Businesses, on the other hand, must carefully consider the district's corporate tax rate and various other taxes when deciding to establish or expand operations in Washington, D.C. The availability of tax incentives can be a crucial factor in attracting and retaining businesses, particularly in a highly competitive market.

Conclusion

Understanding Washington, D.C.’s tax rates and incentives is a critical aspect of financial planning for both individuals and businesses. The district’s tax system, with its range of taxes and incentives, plays a vital role in shaping the economic landscape and supporting various initiatives. By staying informed and utilizing available resources, taxpayers can navigate this complex system with greater ease and confidence.

FAQ

What is the current income tax rate for residents of Washington, D.C.?

+As of the most recent tax year, the income tax rates for residents of Washington, D.C., are progressive, ranging from 4.00% for income up to 10,000 to 8.75% for income over 125,000.

Are there any tax incentives available for businesses in Washington, D.C.?

+Yes, Washington, D.C., offers a range of business tax incentives, including credits for research and development, high-impact businesses, and the biotechnology industry. These incentives are aimed at attracting and supporting specific industries.

How does Washington, D.C.’s corporate income tax rate compare to other jurisdictions in the U.S.?

+Washington, D.C.’s corporate income tax rate of 8.85% is among the higher rates in the U.S. This rate can influence a business’s decision to operate in the district, especially when compared to other jurisdictions with lower corporate tax rates.

Are there any tax breaks for homeowners in Washington, D.C.?

+Yes, Washington, D.C., offers a homestead deduction for primary residence owners, which can significantly reduce their property tax liability. This incentive aims to encourage homeownership and stabilize the housing market.