Kansas Sales Tax On Cars

The state of Kansas, like many others in the United States, imposes a sales tax on vehicles purchased within its borders. This sales tax is an essential revenue stream for the state government, contributing to various public services and infrastructure projects. In this comprehensive guide, we will delve into the specifics of the Kansas sales tax on cars, exploring the rates, exemptions, and implications for car buyers.

Understanding the Kansas Sales Tax Structure

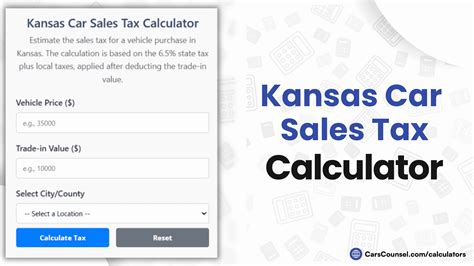

The Kansas Department of Revenue is responsible for overseeing the state’s tax policies, including the sales tax on vehicles. The sales tax in Kansas operates on a progressive rate system, which means the tax rate increases as the vehicle’s purchase price rises. This structure aims to ensure fairness and account for the varying financial capacities of car buyers.

The current sales tax rates in Kansas are as follows:

| Vehicle Purchase Price | Sales Tax Rate |

|---|---|

| Up to $5,000 | 5.3% |

| $5,001 - $10,000 | 5.6% |

| $10,001 - $25,000 | 5.7% |

| Above $25,000 | 6.15% |

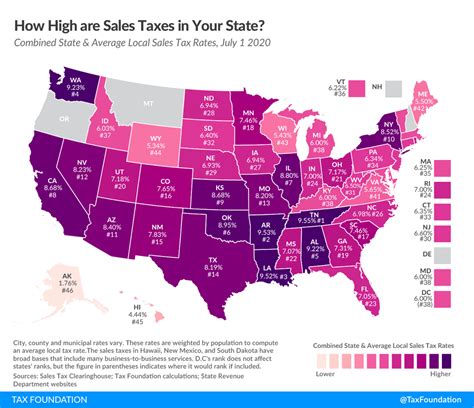

These rates are applicable to new and used vehicles alike, ensuring consistency across the market. It's important to note that these rates are in addition to any local sales taxes that may be imposed by cities or counties within Kansas. These local taxes can further increase the overall tax burden on vehicle purchases.

Exemptions and Special Considerations

While the sales tax on cars in Kansas applies broadly, there are certain exemptions and special cases that buyers should be aware of. Here are some notable exceptions:

- Trade-Ins: When trading in an old vehicle as part of a new purchase, the sales tax is calculated based on the difference in value between the new and old vehicles. This can result in a reduced tax liability for buyers.

- Military Personnel: Active-duty military members stationed in Kansas are exempt from paying sales tax on vehicles purchased for personal use. This exemption aims to support the military community and is a recognition of their service.

- Vehicle Type: Certain types of vehicles, such as motorcycles, recreational vehicles (RVs), and off-road vehicles, may have different tax rates or calculations. It's crucial to understand the specific rules for the type of vehicle you intend to purchase.

- Disability Exemptions: Kansas offers sales tax exemptions for individuals with disabilities who purchase vehicles modified to accommodate their needs. This exemption encourages accessibility and independence for those with disabilities.

The Impact of Sales Tax on Car Buying

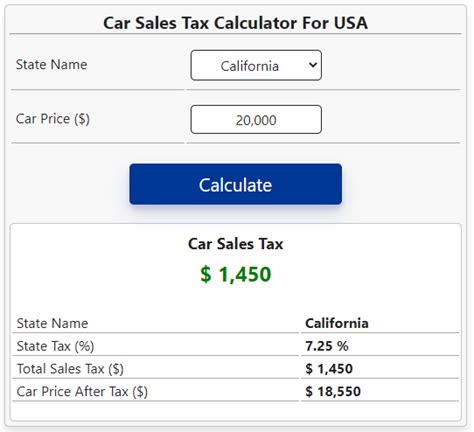

The sales tax on cars in Kansas can significantly impact the overall cost of purchasing a vehicle. Let’s consider a real-world example to illustrate this impact:

Imagine you're in the market for a new sedan, and you've set your budget at $30,000. The base price of your chosen vehicle is $28,000, and you plan to finance the purchase over a period of 60 months. Here's a breakdown of the sales tax implications:

- Sales Tax Calculation: For a vehicle priced between $10,000 and $25,000, the applicable sales tax rate is 5.7%. Applying this rate to your $28,000 vehicle, the sales tax amount comes to $1,596.

- Total Cost of Ownership: When you add the sales tax to the base price, your total purchase cost becomes $29,596. This means you'll need to factor in an additional $1,596 when budgeting for your new car.

- Financing Considerations: If you're financing the purchase, the sales tax amount will be included in your loan balance. This can impact your monthly payments and the overall interest you'll pay over the loan term.

This example highlights how the sales tax can substantially increase the overall cost of buying a vehicle. It's essential to factor in these tax implications when planning your car purchase to ensure you have a realistic budget.

Strategies for Managing Sales Tax

While the sales tax on cars is a necessary part of the purchasing process, there are strategies buyers can employ to manage this expense effectively:

- Research Local Tax Rates: Kansas has a diverse range of cities and counties, each with its own local sales tax rates. By researching the tax rates in your specific area, you can gain a more accurate understanding of the total tax burden.

- Explore Trade-In Options: Trading in your old vehicle can provide a financial benefit by reducing the taxable value of your new purchase. Explore trade-in deals and calculate the potential savings to determine if this strategy is advantageous for you.

- Consider Out-of-State Purchases: In some cases, purchasing a vehicle from an out-of-state dealer can offer tax benefits. However, it's crucial to understand the tax laws and potential fees associated with importing a vehicle across state lines.

- Negotiate the Price: While the sales tax is a fixed percentage, the base price of the vehicle is often negotiable. By negotiating a lower purchase price, you can effectively reduce the overall tax liability.

These strategies can help car buyers navigate the sales tax landscape more effectively and potentially save money on their vehicle purchases.

The Future of Sales Tax in Kansas

The sales tax system in Kansas, like many other states, is subject to periodic reviews and potential reforms. As economic conditions and public needs evolve, there may be proposals to adjust the tax rates or structures to better align with the state’s financial goals.

One potential future consideration is the harmonization of tax rates across different vehicle types. Currently, the sales tax rates vary based on the vehicle's purchase price, which can lead to complexities in tax calculations. A simplified, unified tax rate for all vehicles could provide clarity and ease of understanding for both buyers and tax administrators.

Additionally, with the rise of electric and hybrid vehicles, there may be discussions around incentivizing eco-friendly transportation. Some states have implemented tax credits or exemptions for these vehicles to encourage their adoption and reduce environmental impact. Kansas could explore similar initiatives to promote sustainable transportation options.

The future of the Kansas sales tax on cars is closely tied to the state's economic and environmental priorities. As the automotive industry evolves, so too may the tax policies surrounding vehicle purchases.

Conclusion

The sales tax on cars in Kansas is a crucial aspect of the vehicle purchasing process. By understanding the progressive tax rates, exemptions, and potential strategies, buyers can navigate this tax landscape with confidence. Whether you’re a first-time car buyer or a seasoned veteran, being aware of the sales tax implications can help you make informed decisions and manage your finances effectively.

As the automotive industry and tax policies evolve, staying informed about any changes will be essential for making the most advantageous choices when purchasing a vehicle in Kansas.

Frequently Asked Questions

How often are sales tax rates reviewed and updated in Kansas?

+

Sales tax rates in Kansas are typically reviewed and adjusted by the state legislature on a biennial basis. This means that changes to the rates can occur every two years to align with economic trends and revenue needs.

Are there any ongoing initiatives to simplify the sales tax structure for vehicles in Kansas?

+

Yes, there have been discussions and proposals to simplify the sales tax structure for vehicles in Kansas. The goal is to make the tax system more straightforward and understandable for both consumers and businesses. These initiatives aim to reduce complexities and ensure a fair and efficient tax system.

Can I claim a refund for overpaid sales tax on my vehicle purchase in Kansas?

+

In certain circumstances, it is possible to claim a refund for overpaid sales tax in Kansas. This typically applies when there are errors in the tax calculation or if you qualify for specific exemptions that were not initially applied. It’s important to consult with a tax professional or review the Kansas Department of Revenue’s guidelines for more information on claiming refunds.