The Truth About Sales Tax Arkansas: Debunking Common Myths

Sales tax is a foundational element of revenue generation for many states, including Arkansas. Its complexities often foster misconceptions among consumers, business owners, and policymakers alike. Clarifying these ambiguities requires a nuanced understanding rooted in legal statutes, fiscal policy history, and economic implications. This comprehensive review aims to dissect the intricacies of Arkansas's sales tax system, dispel prevalent myths, and synthesize evidence-based insights to promote transparency and informed decision-making.

The Structural Framework of Arkansas Sales Tax

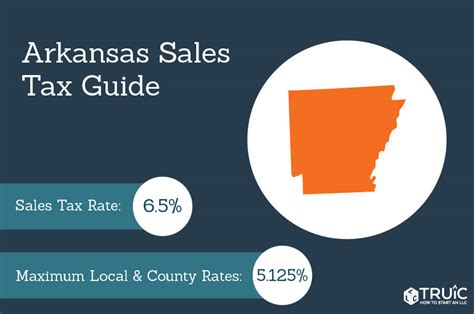

Arkansas imposes a state-wide sales tax governed primarily by the Arkansas Department of Finance and Administration (DFA). As of 2024, the state levies a base rate of 6.5% on tangible personal property and certain services, complemented by local option taxes that can significantly elevate the overall rate in specific jurisdictions. The variability in local sales taxes exemplifies Arkansas’s decentralized approach to fiscal policy, allowing municipalities to tailor revenue streams to their unique needs.

Understanding the statutory basis of Arkansas’s sales tax involves examining constitutional provisions, legislative enactments, and administrative rulings. The Arkansas Code Annotated (ACA) Title 26, Chapter 52, comprehensively delineates taxable transactions, exemptions, and procedural mechanisms, establishing a legal framework that balances revenue collection with taxpayer rights. Analytical scrutiny reveals that sales tax in Arkansas functions as a consumption tax designed to diversify funding sources without disproportionately burdening particular economic sectors.

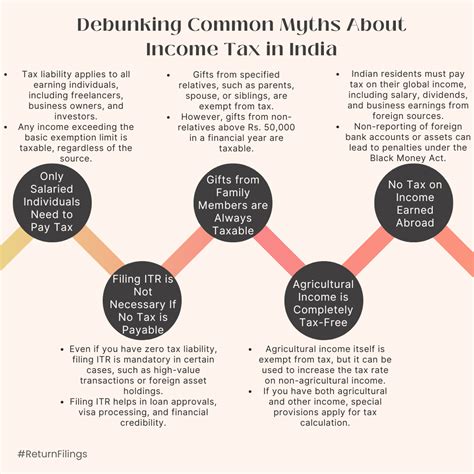

Debunking Common Myths about Arkansas Sales Tax

Key Points

- Myth 1: Arkansas sales tax is among the highest in the nation. Data indicates that Arkansas’s combined state and local sales tax rate averages around 9.4%, which ranks it in the mid-tier nationally rather than at the top.

- Myth 2: Food items are generally exempt from Arkansas sales tax. While initially believed to be fully exempt, the reality is complex, with some prepared foods taxed and certain grocery items exempt under specific conditions.

- Myth 3: The sales tax doesn’t apply to online transactions in Arkansas. As of recent legal developments, Arkansas applies sales tax to remote sales via economic nexus standards aligned with the South Dakota v. Wayfair decision.

- Myth 4: Sales tax revenue overwhelmingly funds education alone. In practice, Arkansas allocates sales tax revenue across multiple sectors, including transportation, health services, and public safety.

- Myth 5: The sales tax rate is fixed and does not fluctuate with economic or legislative changes. Rate adjustments occur periodically via legislative amendments, reflecting economic conditions and policy priorities.

Legal and Policy Foundations Governing Arkansas Sales Tax

The legal structure underpinning Arkansas sales tax is rooted in the Arkansas Constitution, which authorizes the state to levy taxes for public purposes. Articles 5 and 16 explicitly confer authority to impose taxes, while enabling statutes specify taxable transactions and exemptions. Jurisprudence from Arkansas courts has historically upheld the tax’s constitutionality, emphasizing its role as a revenue tool compatible with constitutional protections against excessive taxation.

Policy debates often revolve around the regressive nature of sales taxes, their impact on low-income populations, and the balance between revenue needs and fairness. Arkansas has periodically adjusted exemption thresholds, especially for essential goods like food and medicine, to mitigate adverse effects. Additionally, policy discussions have centered on implementing e-commerce sales taxes effectively, recognizing the rapid shift in consumer behavior toward online shopping.

Economic Impact and Fiscal Significance

Sales tax in Arkansas accounts for a significant portion of the state’s general revenue. According to the Arkansas Budget Report (2023), approximately 35% of total state revenue derives from sales and use taxes, underscoring their critical fiscal role. The distribution of sales tax revenue reflects Arkansas’s economic composition, with substantial contributions from retail, manufacturing, and service sectors.

Empirical studies demonstrate that sales taxes influence consumer behavior and business operations. For instance, marginal rate increases correlate with shifts toward untaxed or lower-taxed goods and services, affecting overall economic activity. Moreover, the reliance on sales tax revenues can exacerbate income inequality, prompting policymakers to consider progressive reforms such as targeted exemptions or complementary revenue streams.

| Relevant Category | Substantive Data |

|---|---|

| Average Total Sales Tax Rate | 9.4% nationwide average, Arkansas-specific |

| Revenue from Sales Tax | $2.9 billion in FY 2023 |

| Tax on Food Items | Varies; some prepared foods taxed, edible groceries mostly exempt |

| Remote Sales Collection | Applied since 2018, in line with South Dakota v. Wayfair |

| Local Option Tax Variability | Up to 3% extra in certain counties |

Impact of Myths on Public Perception and Policy

Myth propagation can distort public discourse, influence voting behavior, and sway legislative agendas. For example, the myth that Arkansas’s sales tax is unreasonably high may discourage economic development initiatives or lead to unwarranted tax reductions, thereby affecting revenue stability. Conversely, misconceptions about exemptions and applicability can result in non-compliance or a lack of trust in tax administration.

To counteract misinformation, transparency initiatives and stakeholder education are paramount. Regularly updated public resources, accessible legislative summaries, and clear guidance on exemptions and online tax obligations foster a well-informed populace and contribute to equitable taxation practices.

Future Trends and Policy Considerations

Advancements in digital commerce and evolving legal standards are shaping the future landscape of Arkansas sales tax policy. The implementation of economic nexus laws and real-time tax collection platforms aims to improve compliance and broaden the tax base. Moreover, discussions around harmonizing sales tax rates across jurisdictions could mitigate distortions caused by spatial disparities.

Potential reforms include exploring sales tax reforms that integrate more equitable structures, such as expanding exemptions for essential goods, introducing tiered rates, or enhancing use tax compliance measures. These policies must be weighed against fiscal needs and the competitive stance of Arkansas in attracting commerce.

Does Arkansas charge sales tax on online purchases?

+Yes, Arkansas mandates collection of sales tax on remote sales exceeding economic thresholds, aligning with the Supreme Court’s decision in South Dakota v. Wayfair, Inc. This requires online sellers to collect and remit taxes regardless of physical presence.

Are groceries completely exempt from Arkansas sales tax?

+Not entirely. Most edible grocery items are exempt, but prepared foods, ready-to-eat meals, and some specialty products are taxed. Understanding specific exemptions involves consulting Arkansas tax code and recent updates.

How does local sales tax influence overall rates in Arkansas?

+Local option taxes can add up to 3% in certain counties, significantly affecting the total sales tax rate. These local levies fund specific projects like infrastructure or public safety, reflecting regional policy priorities.

What are the primary sectors funded by Arkansas sales tax?

+

Arkansas sales tax revenue primarily supports education, transportation infrastructure, health services, and public safety. Diversification in funding sources helps in balanced fiscal management.