Define Sales Tax

Sales tax is a crucial aspect of the global economy, impacting businesses and consumers alike. It is a form of indirect tax levied on the sale of goods and services, playing a significant role in generating revenue for governments and shaping consumer behavior.

Understanding Sales Tax

Sales tax is a mandatory charge added to the purchase price of goods or services, typically calculated as a percentage of the total transaction value. It is an essential revenue stream for governments, enabling them to fund public services, infrastructure development, and social welfare programs.

The sales tax system varies widely across jurisdictions, with each country, state, or region implementing its own unique regulations and rates. This diversity can make navigating sales tax a complex task for businesses operating in multiple locations.

Key Characteristics of Sales Tax

- Sales tax is generally imposed on the end consumer, with the seller acting as a collection agent for the government.

- The tax rate can vary based on the type of goods or services being sold, with certain items exempt or subject to reduced rates.

- Sales tax is often calculated on a transaction-by-transaction basis, meaning the tax amount can vary with each purchase.

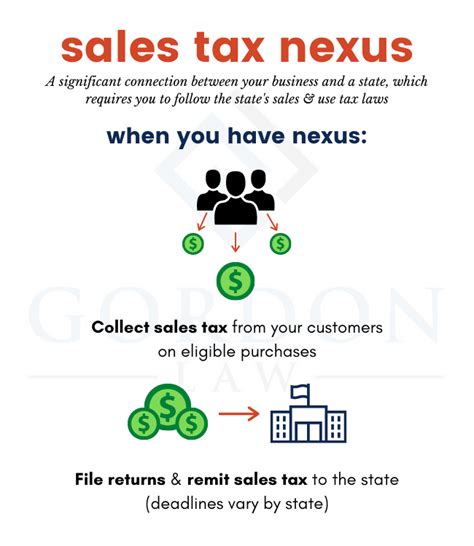

- Businesses are responsible for collecting, reporting, and remitting sales tax to the relevant tax authorities.

How Sales Tax Works

When a customer purchases a product or service, the seller calculates the sales tax based on the applicable rate and adds it to the purchase price. This tax is then included in the total amount paid by the customer. The seller is responsible for keeping accurate records of sales transactions and the associated tax amounts.

At regular intervals, usually monthly or quarterly, businesses are required to submit sales tax returns to the tax authorities, declaring the total sales tax collected during that period. These returns must be accompanied by the remittance of the collected tax amounts. Failure to comply with sales tax regulations can result in penalties and legal consequences.

Exemptions and Special Considerations

Sales tax exemptions vary widely depending on the jurisdiction. Common exemptions include sales tax on certain essential items like groceries, prescription medications, and educational materials. Additionally, some jurisdictions offer reduced sales tax rates for specific industries or types of transactions.

In certain cases, businesses may be eligible for sales tax exemptions or reduced rates under specific circumstances. For example, some jurisdictions offer tax incentives for businesses that invest in local communities or create jobs.

Impact on Business and Consumers

Sales tax has a significant impact on both businesses and consumers. For businesses, it adds to the cost of doing business and requires careful tax planning and compliance. Properly managing sales tax obligations is crucial for maintaining a positive relationship with tax authorities and avoiding penalties.

For consumers, sales tax affects their purchasing decisions and overall spending. Higher sales tax rates can discourage spending, while lower rates or exemptions can encourage consumer spending and stimulate the economy. The visibility of sales tax on price tags also influences consumer perception and purchasing behavior.

Sales Tax and E-commerce

The rise of e-commerce has introduced new complexities to sales tax regulations. Online retailers must navigate the diverse sales tax laws of multiple jurisdictions, especially when selling to customers in different states or countries. This often requires businesses to implement advanced sales tax calculation and compliance systems to ensure accurate tax collection and reporting.

The Future of Sales Tax

As the global economy continues to evolve, so does the sales tax landscape. Governments are increasingly recognizing the potential of sales tax as a flexible and responsive revenue source. This has led to ongoing discussions and initiatives aimed at modernizing sales tax regulations, improving compliance, and enhancing tax collection efficiency.

One notable trend is the move towards destination-based sales tax, where the tax rate is determined by the location of the purchaser rather than the seller. This approach aims to simplify sales tax regulations and make them more consistent across jurisdictions. However, implementing such a system requires significant coordination and collaboration between different tax authorities.

Sales Tax Technology and Automation

The advancement of technology has also played a significant role in shaping the future of sales tax. Specialized software and automation tools are now available to help businesses navigate the complexities of sales tax compliance. These tools can automate sales tax calculation, filing, and remittance processes, reducing the risk of errors and improving overall efficiency.

| Sales Tax Technology Benefits |

|---|

| Improved accuracy in sales tax calculations |

| Enhanced compliance with changing regulations |

| Streamlined sales tax filing and remittance processes |

| Reduced risk of penalties and legal consequences |

Conclusion

Sales tax is a critical component of the global economy, impacting both businesses and consumers. Understanding the intricacies of sales tax regulations is essential for businesses to navigate the complex tax landscape and ensure compliance. With ongoing technological advancements and regulatory changes, the future of sales tax promises increased efficiency and improved compliance.

What is the difference between sales tax and value-added tax (VAT)?

+Sales tax and value-added tax (VAT) are both indirect taxes levied on the sale of goods and services, but they differ in their implementation and impact. Sales tax is typically imposed on the end consumer and is calculated as a percentage of the purchase price, while VAT is applied at each stage of the supply chain and is included in the selling price. VAT is often considered more complex due to its multi-stage nature and can have different rates for different products.

How do businesses determine the applicable sales tax rate for their transactions?

+Businesses must research and understand the sales tax regulations of the jurisdiction where the sale occurs. This includes considering factors such as the location of the seller, the location of the purchaser, and the specific goods or services being sold. Online tools and software can assist in determining the correct sales tax rate based on these factors.

What happens if a business fails to collect and remit sales tax?

+Failure to collect and remit sales tax can result in significant penalties and legal consequences. Tax authorities have the authority to impose fines, interest charges, and even criminal penalties for non-compliance. It is crucial for businesses to stay informed about their sales tax obligations and ensure timely and accurate remittance to avoid such issues.