Chatham County Property Tax

Chatham County, located in the vibrant state of North Carolina, is a bustling region with a diverse real estate landscape. As property ownership is a significant financial commitment, understanding the intricacies of property taxes is crucial for both current and prospective homeowners. This article aims to provide an in-depth exploration of the Chatham County Property Tax, shedding light on its assessment process, rates, payment options, and strategies for managing this annual financial obligation.

The Comprehensive Guide to Chatham County Property Tax

In the heart of North Carolina, where vibrant cities meet picturesque landscapes, property ownership is a popular choice for both residents and investors. With its thriving communities, Chatham County has become a sought-after location, making an understanding of its property tax system essential.

Property taxes are a vital source of revenue for local governments, including Chatham County. These taxes fund essential services such as education, public safety, and infrastructure development, playing a pivotal role in shaping the community's future. For homeowners, navigating the property tax landscape can be complex, but with the right information, it becomes a manageable and predictable aspect of homeownership.

Understanding Property Tax Assessments in Chatham County

The foundation of property taxation lies in the assessment process, where the value of each property is determined. In Chatham County, the Chatham County Tax Assessor's Office plays a crucial role in this process. Here's a breakdown of how property assessments are conducted:

- Market Analysis: The Assessor's Office regularly monitors the real estate market, tracking sales and market trends. This data helps in establishing a fair market value for properties in the county.

- Physical Inspection: Assessor staff may conduct physical inspections of properties, especially if there have been significant improvements or changes since the last assessment.

- Tax Assessment Notices: Property owners receive tax assessment notices annually. These notices provide the assessed value of the property, along with the calculated tax amount.

- Appeal Process: If a property owner disagrees with the assessed value, they have the right to appeal. The appeal process in Chatham County is designed to ensure fairness and accuracy in taxation.

| Assessment Category | Description |

|---|---|

| Residential Properties | Homes are assessed based on their market value, considering factors like size, location, and recent sales data. |

| Commercial Properties | Businesses and commercial spaces are valued based on their income-generating potential and market rates. |

| Land Assessments | Vacant land is assessed separately, taking into account its development potential and location. |

Exploring Chatham County's Property Tax Rates

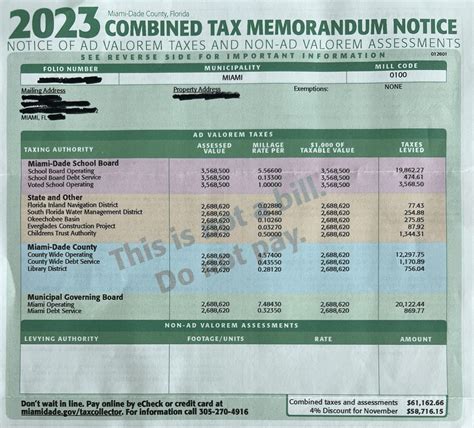

The property tax rate, often referred to as the mill rate, is a critical factor in determining the tax liability for property owners. In Chatham County, the tax rate is established annually by the county commissioners and other taxing authorities. The rate is typically expressed in mills, where one mill represents one-tenth of a cent. Here's a closer look at the property tax rates in Chatham County:

- Residential Properties: The mill rate for residential properties in Chatham County is 67.83 mills, which translates to $6.783 per $1,000 of assessed value.

- Commercial Properties: Commercial properties, including businesses and rental properties, face a higher mill rate of 105.52 mills, equating to $10.552 per $1,000 of assessed value.

- Special Districts: Some areas within Chatham County fall under special tax districts, which may have additional tax rates to fund specific services or improvements. These districts are typically created to support local initiatives.

Navigating Property Tax Payments in Chatham County

Paying property taxes is a mandatory responsibility for homeowners. In Chatham County, the Tax Collector's Office facilitates the collection of property taxes. Here's a step-by-step guide to navigating the payment process:

- Bill Delivery: Property tax bills are typically mailed to homeowners in late summer or early fall. These bills outline the assessed value, tax rate, and the total tax amount due.

- Payment Due Dates: Property taxes in Chatham County are due in two installments. The first installment is typically due in October, while the second installment is due in January of the following year.

- Payment Methods: Homeowners have several convenient payment options:

- Online Payment: The Tax Collector's Office offers an online payment portal, allowing secure payments through credit cards or e-checks.

- Mail-In Payments: Property owners can mail their tax payments to the designated address, ensuring the check is received before the due date.

- In-Person Payments: For those who prefer a personal approach, payments can be made in-person at the Tax Collector's Office during business hours.

- Late Payments and Penalties: Late payments are subject to interest and penalties. It's essential to stay informed about due dates to avoid additional fees.

Strategies for Managing Property Taxes in Chatham County

Property taxes are an annual commitment, but there are strategies homeowners can employ to manage this financial obligation effectively:

- Appeal Assessments: If you believe your property's assessed value is inaccurate, consider appealing. The process involves gathering evidence and presenting your case to the Chatham County Board of Equalization and Review. Successful appeals can lead to reduced tax liabilities.

- Exemptions and Deductions: Chatham County offers various exemptions and deductions to eligible homeowners. These include homestead exemptions, veterans' exemptions, and deductions for senior citizens. Exploring these options can lower your tax burden.

- Home Improvements: Strategic home improvements can increase your property's value, but it's essential to consider the potential impact on your tax assessment. Consult with a tax professional to understand the tax implications of any significant renovations.

- Payment Planning: Create a budget and plan your property tax payments in advance. Consider setting aside funds specifically for tax payments to ensure you have the necessary funds when due dates approach.

The Future of Property Taxation in Chatham County

As Chatham County continues to grow and develop, the property tax landscape is likely to evolve. The county's commitment to maintaining a fair and transparent taxation system is evident in its current practices. However, with changing economic conditions and real estate trends, property tax rates and assessment methodologies may undergo adjustments to ensure equity for all property owners.

Staying informed about property tax developments is crucial for homeowners. Regularly checking official county websites, attending public meetings, and engaging with local tax professionals can provide valuable insights into potential changes and their impact on your financial obligations.

How can I estimate my property tax before receiving the official assessment notice?

+Estimating your property tax involves a few simple steps. First, determine your property’s assessed value, which is typically available on the county’s property search portal. Then, multiply this value by the applicable mill rate for your property type (residential or commercial). This calculation will give you a rough estimate of your annual property tax.

Are there any payment plans available for property taxes in Chatham County?

+Yes, Chatham County offers payment plans to assist homeowners who may face financial challenges. These plans allow for the payment of property taxes in smaller installments over an extended period. Contact the Tax Collector’s Office for more information and to enroll in a suitable payment plan.

What happens if I don’t pay my property taxes on time?

+Late payment of property taxes can lead to interest and penalties. If left unpaid for an extended period, the county may initiate tax lien procedures, which can result in the sale of your property to satisfy the tax debt. It’s crucial to stay informed about due dates and make timely payments to avoid these consequences.