Taxing Unrealized Gains

The concept of taxing unrealized gains has been a topic of debate and interest among economists, policymakers, and investors. As the name suggests, unrealized gains refer to the increase in the value of an asset that an individual holds but has not yet sold. These gains, though not yet monetized, represent potential future wealth and income. The question arises: Should these gains be taxed before they are realized, and if so, how would such a system work and what implications would it have on the economy and individual investors?

Understanding Unrealized Gains

When an investor purchases an asset, such as stocks, bonds, or real estate, and the value of that asset increases over time, the investor has accrued an unrealized gain. This gain is unrealized because it exists only on paper; the investor has not yet sold the asset and converted the increased value into cash. However, these gains represent a potential increase in wealth and a future source of income, which some argue should be taxed to ensure fairness and generate revenue.

The Case for Taxing Unrealized Gains

Proponents of taxing unrealized gains believe that it is a matter of equity and efficiency. They argue that the current system, which taxes gains only when assets are sold, creates an unfair advantage for those with substantial wealth. Here’s why they advocate for a change:

Promoting Fairness

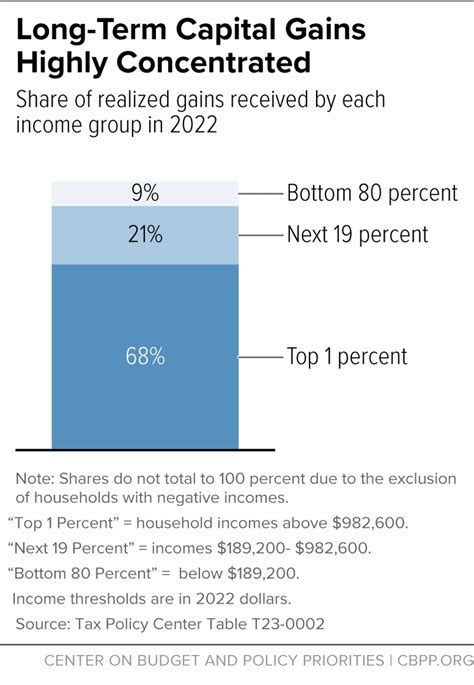

Under the current system, individuals can defer taxes on their investment gains indefinitely by holding onto their assets. This means that those with significant wealth can avoid paying taxes on their investment income for years, potentially until their death. This creates a disparity between those who realize their gains and those who hold onto their assets, as the latter can defer taxes and benefit from compounding returns.

For example, consider two individuals, Alice and Bob. Alice sells her stocks for a profit and pays taxes on her realized gains, while Bob holds onto his stocks for decades, allowing his wealth to grow tax-free. This disparity in tax treatment can lead to a situation where the wealthier individuals, like Bob, pay lower effective tax rates than those with lower incomes.

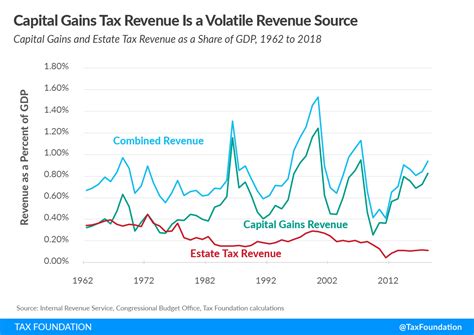

Enhancing Revenue Generation

Taxing unrealized gains could provide a significant source of revenue for governments. With a growing number of individuals holding substantial assets, the potential tax base is vast. This revenue could be used to fund various public initiatives, reduce deficits, or invest in social programs and infrastructure.

Addressing Market Inefficiencies

Some economists argue that the current system can lead to market inefficiencies. By allowing individuals to defer taxes indefinitely, it encourages a “lock-in” effect, where investors are incentivized to hold onto assets even if they would benefit from selling. This can restrict the liquidity of the market and limit the efficient allocation of resources.

Implementing a Tax on Unrealized Gains

The implementation of a tax on unrealized gains is a complex task and would require careful consideration of various factors. Here are some potential approaches:

Annual Mark-to-Market

One method is to require investors to mark their assets to market value annually. This means that the current value of an asset would be compared to its original purchase price, and any increase would be taxed as if the asset had been sold. This approach ensures that gains are taxed regularly, but it could also lead to administrative burdens and potential challenges in valuing certain assets.

Exemption for Long-Term Holdings

To encourage long-term investment and address concerns about frequent tax payments, a system could exempt assets held for a certain period, say 10 years or more. This would incentivize investors to hold onto their assets for the long term, potentially benefiting the market and reducing administrative costs.

Taxing Based on Risk

Another approach is to tax unrealized gains based on the risk associated with the asset. For example, more volatile assets like stocks might be taxed at a higher rate compared to more stable assets like bonds. This risk-based approach could encourage investors to diversify their portfolios and manage risk effectively.

Potential Challenges and Considerations

While the concept of taxing unrealized gains has its merits, it also presents several challenges and considerations:

Administrative Burden

Implementing a tax on unrealized gains would require significant administrative resources. Governments would need to develop systems to track and value assets, potentially leading to increased costs and complexity for both taxpayers and tax authorities.

Impact on Investment Behavior

A tax on unrealized gains could influence investment decisions. Investors might be more inclined to sell assets to avoid the tax, which could lead to increased market volatility. Alternatively, it could encourage investors to hold onto assets for longer periods, potentially impacting market liquidity.

Fairness and Complexity

Determining a fair and equitable way to tax unrealized gains is complex. Different assets have varying levels of liquidity and risk, and it can be challenging to ensure that the tax system treats all investors and assets fairly. Additionally, the complexity of such a system could lead to potential loopholes and tax avoidance strategies.

Real-World Examples and Implications

The idea of taxing unrealized gains is not entirely new. Some countries and jurisdictions have implemented variations of this concept. For instance, the United Kingdom has a capital gains tax system that applies to the disposal of assets, including gains on shares and property. While it doesn’t directly tax unrealized gains, it does capture a broader range of asset disposals.

In the United States, the capital gains tax applies only when assets are sold, but there have been discussions and proposals to tax unrealized gains. One notable proposal, known as the Buffett Rule, suggested taxing unrealized gains on assets held by the wealthiest individuals. This proposal aimed to address the issue of income inequality and ensure that the ultra-wealthy pay their fair share of taxes.

The Future of Unrealized Gains Taxation

The debate surrounding taxing unrealized gains is likely to continue, as it touches on fundamental issues of fairness, revenue generation, and market efficiency. As economies evolve and wealth becomes increasingly concentrated, the pressure to reform tax systems will likely increase. Policymakers will need to carefully consider the potential benefits and challenges of such a system to ensure that any changes promote economic growth and stability while maintaining fairness and simplicity.

Stay tuned as this discussion unfolds, and keep an eye on potential reforms that could shape the future of taxation and investment strategies.

What are the potential benefits of taxing unrealized gains?

+Taxing unrealized gains could promote fairness by ensuring that all investors pay taxes on their investment income. It can also generate significant revenue for governments and address market inefficiencies caused by indefinite deferral of taxes.

How might taxing unrealized gains impact investors’ behavior?

+Investors might be more inclined to sell assets to avoid the tax, potentially leading to increased market volatility. On the other hand, it could encourage long-term investment strategies, which could benefit market stability.

Are there any real-world examples of taxing unrealized gains?

+The United Kingdom has a capital gains tax system that captures a wide range of asset disposals. In the US, the Buffett Rule proposal aimed to tax unrealized gains on assets held by the wealthiest individuals, addressing income inequality concerns.