Ohio Sales Tax Rate: The Ultimate Definitive Guide

When navigating the complex landscape of sales taxation in the United States, Ohio presents a distinctive case with its unique rate structures, local variations, and evolving regulations. For new business owners, tax professionals, or curious citizens seeking clarity, understanding Ohio’s sales tax rate demands a nuanced approach rooted in current data, legal frameworks, and practical insights. This guide aims to serve as an authoritative resource, blending precise analysis with accessible explanations, to demystify Ohio’s sales tax system and support strategic decision-making.

Understanding Ohio’s Sales Tax Rate: The Foundation of Commerce & Compliance

Ohio’s sales tax rate is not static; it reflects a layered interplay between state-imposed levies and local government additions. As of 2024, the core state rate is established at 5.75%, but this is merely the starting point for what goods and services might cost in total sales taxes. Localities—counties and municipalities—enact additional levies, which can substantially increase the total percentage paid by consumers and businesses alike. The complexity arises from these layered jurisdictions and the specific taxable status of goods and services, which vary according to legislation, judicial rulings, and policy adjustments.

Historical Development and Regulatory Context of Ohio Sales Tax

Ohio’s sales tax system emerged in the mid-20th century, with the framework refined to support the state’s budgetary needs and public infrastructure funding. Originally designed with a simple rate structure, it has expanded in scope and complexity, particularly in response to economic shifts and technological advancements. The Ohio Department of Taxation (ODT) manages and updates the regulations, emphasizing transparency, fairness, and compliance. The evolution reflects a broader trend nationally—adapting sales tax policies to capture digital goods, remote sales, and service-based transactions.

| Relevant Category | Substantive Data |

|---|---|

| State Sales Tax Rate | 5.75% — fixed by Ohio law as of 2024 |

| Local Additions | Up to 4.5%, with certain jurisdictions exceeding this based on local voter-approved levies |

| Total Average Sales Tax Rate | Approximate 7.2%, varying by location and specific transaction type |

Breaking Down Ohio’s Sales Tax Components: State, Local, and Special Districts

The layered nature of Ohio’s sales taxation system results in a multi-tiered rate that varies significantly across jurisdictions. The state’s base rate of 5.75% is augmented by optional local taxes imposed to fund schools, transportation infrastructure, or public safety initiatives. These local taxes are approved via votes and tend to have a maximum cap, but in practice, many counties and cities impose their own additional rates, reflecting community priorities.

State-Level Mechanics and Taxable Goods & Services

The Ohio Department of Taxation defines taxable transactions in detailed guidelines, influenced by classifications such as tangible personal property, digital goods, and certain services. Purchases of tangible goods like clothing (exempt under certain thresholds), electronics, and household items generally attract sales tax. Conversely, many services—legal, medical, and education—are exempt unless explicitly taxed or part of a taxable bundle.

| Relevant Category | Substantive Data |

|---|---|

| Taxable Goods | Electronics, furniture, appliances, clothing (in specific contexts) |

| Taxable Services | Limited—includes certain repair, installation, or telecommunications services |

| Exemptions | Groceries, prescription medicine, certain educational services |

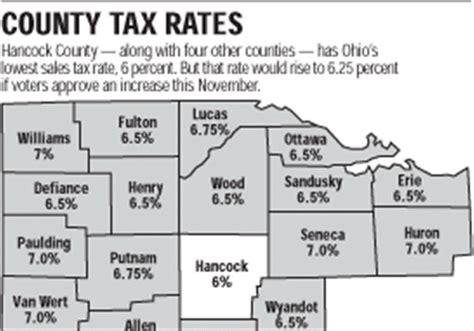

How Local Taxes Shape the Final Sales Tax Rate in Ohio

While the state rate sets a baseline, localoption taxes are the primary drivers behind the actual total sales tax consumers and businesses encounter. For instance, in Cuyahoga County, the combined rate can approach nearly 8%, reflecting local school district levies and regional transportation taxes. Rural areas may have lower cumulative rates, but the trend toward regional cooperation and voter-backed levies means ongoing rate adjustments are common.

Regional Variations and Notable Cases

Some Ohio cities exemplify the variation: Columbus adds approximately 2.25%, while Cincinnati’s combined rate can reach around 7.8%. These differences influence consumer behavior, business location decisions, and tax revenue projections. Moreover, certain districts impose special taxes on specific products like alcohol or tobacco, further complicating the landscape.

| Relevant Category | Substantive Data |

|---|---|

| City of Cleveland | Additional 2.25% city tax, totaling approximately 7.25% in the region |

| Dayton | Combined local rate of approximately 7.25% |

| Rural Areas | Typically at or just above the state minimum, around 5.75–6% |

Tax Collection, Reporting, and Remittance in Ohio

Tax collection begins at the point of sale, with retailers—brick-and-mortar or online—obliged to register with the Ohio Department of Taxation. The registration process involves detailed filings, periodic reporting, and remittance protocols designed to ensure compliance and transparency. Ohio’s e-file system supports efficient compliance, yet errors in rate application or classification can lead to audits, penalties, or back taxes.

Best Practices for Ohio Sales Tax Compliance

Implementing robust point-of-sale (POS) systems that automatically update with current rates, maintaining meticulous transaction records, and staying abreast of legislative updates are essential. For online sellers, integrating tax calculation APIs like Avalara or TaxJar can streamline compliance, particularly given Ohio’s frequent local rate variations.

| Relevant Category | Substantive Data |

|---|---|

| Registration Threshold | Businesses making taxable sales exceeding $100,000 annually or 200 transactions must register |

| Filing Frequency | Monthly, quarterly, or annual submissions based on volume |

| Penalty for Non-Compliance | Late filings, underpayment, or misapplication can incur fines up to 25% of the owed amount |

Practical Strategies for Navigating Ohio’s Sales Tax Landscape

For entrepreneurs planning expansion, understanding tax rate implications influences pricing strategies, supply chain logistics, and compliance budgets. Coalescing accurate data with strategic planning ensures legal adherence and optimal market positioning.

Key Actions for Businesses

- Maintain updated integration with Ohio’s sales tax rate databases and local tax jurisdictions

- Consult with tax professionals for complex or unusual transactions, especially involving digital goods or out-of-state shipping

- Utilize automated tax collection tools to minimize human error and ensure real-time compliance

Frequently Asked Questions about Ohio Sales Tax Rate

What is the current statewide sales tax rate in Ohio?

+As of 2024, the state sales tax rate in Ohio is 5.75%. However, this rate can be increased by local taxes, which vary across jurisdictions.

How do local taxes affect the total sales tax rate?

+Local taxes are added on top of the state rate, often ranging from 0.25% to over 4.5%, depending on the city or county. When combined, the total sales tax can approach or exceed 7%, influencing consumer prices and revenue collection.

Are online sales subject to Ohio sales tax?

+Yes. Since the Supreme Court decision in South Dakota v. Wayfair (2018), states—including Ohio—require remote sellers with economic nexus thresholds to collect and remit sales tax based on the purchaser’s location.

What transactions are exempt from Ohio sales tax?

+Exemptions include most groceries, prescription medications, certain educational and childcare services, and sales for resale under proper certification. However, specifics depend on current legislation and classifications.

How often must businesses report sales tax in Ohio?

+Reporting frequency varies from monthly, quarterly, to annually, primarily based on the business’s volume of taxable sales. The Ohio Department of Taxation assigns the appropriate schedule during registration.