How Are Rsus Taxed

Understanding how Restricted Stock Units (RSUs) are taxed is crucial for individuals who receive them as part of their compensation or investment strategies. RSUs are a form of equity compensation that grant recipients the right to receive company stock once certain conditions are met, often after a specified vesting period. The tax implications of RSUs can vary depending on the jurisdiction and the specific terms of the grant, but this article will provide a comprehensive overview of the taxation process for RSUs in a typical scenario.

The Basics of RSU Taxation

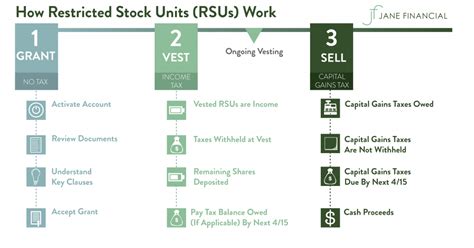

When an employee or investor receives RSUs, they are essentially granted the right to own a certain number of shares of the company’s stock. These RSUs typically have a vesting schedule, meaning that the recipient gains full ownership of the shares over time, often in annual or quarterly installments. The taxation of RSUs can be divided into two main stages: when the RSUs vest and when the recipient sells the vested shares.

Taxation at Vesting

When RSUs vest, they become taxable income for the recipient. This is because the recipient has earned the right to own the shares and can exercise that right at any time. The fair market value (FMV) of the vested RSUs on the vesting date is considered ordinary income and is subject to income tax withholding. Additionally, depending on the jurisdiction, the recipient may also be subject to payroll taxes, such as Social Security and Medicare taxes.

For example, let's say an employee is granted 1,000 RSUs with a grant price of $20 per share. If the FMV of the company's stock on the vesting date is $30 per share, the employee will have taxable income of $10,000 ($30 - $20 = $10 x 1,000 shares). This amount will be subject to income tax and payroll tax withholdings, and the employee will receive the net amount after these deductions.

| Grant Price per Share | $20 |

|---|---|

| FMV per Share on Vesting Date | $30 |

| Number of RSUs | 1,000 |

| Taxable Income | $10,000 |

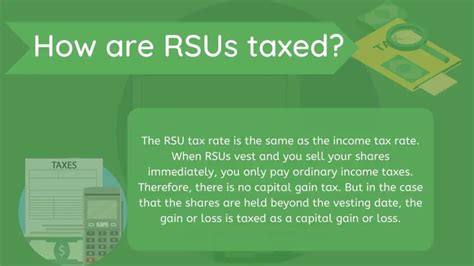

Taxation at Sale

Once the RSUs have vested, the recipient has the option to sell the vested shares. When the shares are sold, any additional gain or loss between the FMV on the vesting date and the sale price is considered a capital gain or loss. The tax treatment of these capital gains or losses depends on the holding period and the jurisdiction’s tax laws.

If the shares are held for more than one year after the vesting date, the capital gain is typically taxed at a lower rate than ordinary income. This is known as a long-term capital gain. However, if the shares are sold within one year of vesting, the gain is considered a short-term capital gain and is taxed at the ordinary income tax rate.

Let's continue with our example. If the employee decides to sell the vested shares one year after vesting when the stock price is $35 per share, they will have a long-term capital gain of $5,000 ($35 - $30 = $5 x 1,000 shares). This gain will be taxed at the applicable long-term capital gains tax rate.

| Sale Price per Share | $35 |

|---|---|

| Capital Gain per Share | $5 |

| Total Capital Gain | $5,000 |

Tax Withholding and Reporting

Employers or grant administrators are typically responsible for withholding taxes on vested RSUs. They will calculate the tax liability based on the FMV of the vested shares and withhold the appropriate amount from the recipient’s pay or provide other means for the recipient to pay the taxes due.

Recipients of RSUs should also be aware of their reporting obligations. In most jurisdictions, they will need to report the vesting of RSUs and any subsequent sale of shares on their annual tax return. This often involves completing specific tax forms, such as the W-2 for employees in the United States, to report the income and withholdings.

Tax Strategies and Considerations

Exercise and Hold Strategy

One strategy that recipients of RSUs can consider is to exercise their right to own the shares immediately upon vesting and then hold onto the shares for a longer period. This allows them to potentially benefit from capital gains tax rates when they eventually sell the shares. However, this strategy requires careful consideration of the stock’s performance and market conditions.

Diversification and Tax Loss Harvesting

Recipients with a large number of RSUs may want to consider diversification strategies. By selling a portion of their vested shares and reinvesting the proceeds, they can manage their exposure to a single stock and potentially reduce their overall tax liability. Additionally, if the shares are sold at a loss, it can be used to offset other capital gains or even reduce ordinary income, depending on the tax laws.

Tax-Efficient Timing

The timing of vesting and the sale of shares can have a significant impact on the tax implications. Recipients should consider their personal financial goals and tax situation when deciding when to vest their RSUs and when to sell the vested shares. For instance, selling shares during a low-income year can reduce the overall tax burden.

Conclusion

The taxation of RSUs can be complex, and it’s essential for recipients to understand the tax implications at both the vesting and sale stages. By being aware of the tax obligations and considering various strategies, individuals can optimize their tax situation and make informed decisions about their RSUs. As always, consulting with a tax professional is advisable to ensure compliance and take advantage of any tax-saving opportunities.

What happens if I don’t sell my vested RSUs?

+If you choose not to sell your vested RSUs, you will still be subject to tax on the fair market value of the shares at vesting. You will have ordinary income equal to the value of the shares, and you may also be responsible for payroll taxes. However, by holding onto the shares, you have the potential to benefit from any future appreciation in the stock price.

Are there any tax advantages to receiving RSUs over other forms of compensation?

+The tax treatment of RSUs can offer certain advantages compared to other forms of compensation. For instance, if the stock price increases significantly over time, the recipient can benefit from capital gains tax rates when they sell the shares. Additionally, RSUs can provide a sense of ownership and alignment with the company’s success, which may not be the case with other forms of compensation.

Can I defer the tax liability on my RSUs?

+In some jurisdictions, there may be options to defer the tax liability on RSUs through specific tax-deferred compensation plans. These plans allow recipients to delay the tax event until a future date, often when they are in a lower tax bracket. However, these plans have strict rules and limitations, and not all employers offer such options.