Ny Estate Tax

Welcome to a comprehensive guide on the intricacies of the New York Estate Tax, a critical component of financial planning for many residents and businesses in the state. Understanding this tax is essential for making informed decisions about estate planning, ensuring compliance with state regulations, and maximizing the value of one's estate. As we delve into the complexities of this topic, we'll explore the nuances of the tax law, provide real-world examples, and offer expert insights to help you navigate this crucial aspect of financial management.

Unraveling the Complexity: An Overview of the NY Estate Tax

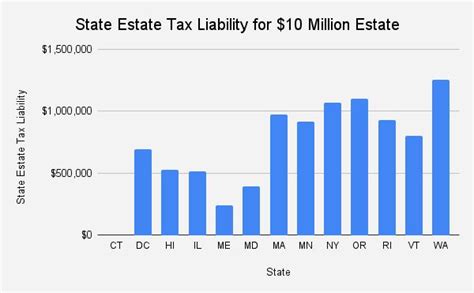

The New York Estate Tax, often referred to as the inheritance tax or death tax, is a state-level levy on the transfer of an individual’s assets after their death. This tax is distinct from the federal estate tax and is administered by the New York State Department of Taxation and Finance. It’s a critical consideration for many New Yorkers, especially those with substantial assets, as it can significantly impact the value of an estate and the legacy left behind.

The tax is calculated based on the value of the decedent's taxable estate, which includes most assets owned by the individual at the time of death. This can encompass a wide range of property, from real estate and personal belongings to financial assets like stocks, bonds, and business interests. The complexity arises from the various exemptions, deductions, and credits that can reduce the taxable value of an estate, as well as the progressive tax rates that apply to different brackets of estate value.

Exemptions and Credits: Navigating the NY Estate Tax Landscape

One of the key aspects of the New York Estate Tax is the availability of exemptions and credits that can reduce or eliminate the tax liability. The most significant of these is the basic exclusion amount, which is currently set at $5.93 million for deaths occurring in 2023. This amount is adjusted annually for inflation, providing a substantial threshold before the estate tax kicks in. Additionally, New York offers a spouse exemption, allowing a surviving spouse to inherit an unlimited amount without incurring estate tax.

Beyond these basic exclusions, there are several other strategies that can be employed to minimize estate tax liability. These include gift planning, where individuals can give away assets during their lifetime to reduce the value of their estate, and the use of trusts, which can provide flexibility and control over the distribution of assets while also offering potential tax benefits. Understanding these strategies and how they interact with New York's estate tax laws is crucial for effective financial planning.

| Exemption Type | Description |

|---|---|

| Basic Exclusion Amount | Current value: $5.93 million (2023). Adjusted annually for inflation. |

| Spouse Exemption | Unlimited transfer between spouses without incurring estate tax. |

| Gift Planning | Reducing estate value by giving away assets during lifetime. |

| Trusts | Flexible asset distribution with potential tax advantages. |

Case Studies: Real-World Examples of NY Estate Tax in Action

To illustrate the practical application of the NY Estate Tax, let’s explore two case studies. These examples will demonstrate how the tax works in different scenarios and the impact it can have on the value of an estate.

Scenario 1: The Impact of the Basic Exclusion Amount

Consider a hypothetical individual, John, who passes away in 2023 with an estate valued at 6 million. Since the basic exclusion amount for that year is 5.93 million, John’s estate would be subject to the NY Estate Tax. The taxable value of his estate would be calculated as the difference between his total estate value and the exclusion amount, resulting in a taxable amount of $67,000.

Assuming a progressive tax rate structure, the tax liability for this scenario could range from a few thousand dollars to a substantial amount, depending on the specific rate brackets and other applicable deductions or credits. This example highlights the importance of staying informed about the current exclusion amount and understanding how it impacts your specific estate value.

Scenario 2: Utilizing Exemptions and Trusts

Now, let’s consider a more complex scenario involving a married couple, Sarah and David. They have a combined estate valued at $10 million, with real estate holdings, financial investments, and a successful business. Given the substantial value of their estate, they’ve engaged in advanced estate planning to minimize tax liability.

Sarah and David have established a credit shelter trust, a type of trust that allows them to utilize both their basic exclusion amounts. By placing assets valued at $5.93 million each into these trusts, they effectively shield a significant portion of their estate from the NY Estate Tax. Any remaining assets can be transferred directly to their beneficiaries without incurring tax, thanks to the unlimited spousal exemption.

This strategy not only reduces their tax liability but also provides flexibility in managing their assets during their lifetimes and ensures a smooth transfer of wealth to their heirs after their deaths. It's a prime example of how a well-planned estate strategy can navigate the complexities of the NY Estate Tax and protect the value of an estate.

Future Implications and Strategies for Compliance

As we look ahead, it’s essential to consider the future implications of the NY Estate Tax and how it may impact your financial planning. While the basic exclusion amount is adjusted annually for inflation, there are other factors that can influence the tax landscape. These include changes in state legislation, potential reforms to the tax code, and shifts in economic conditions.

Staying informed about these potential changes is crucial for maintaining compliance and ensuring your estate plan remains effective. Regular reviews of your financial situation and estate strategy can help you adapt to new regulations and take advantage of any beneficial changes. Additionally, it's important to keep an eye on federal estate tax laws, as changes at the federal level can have a ripple effect on state-level taxes.

Key Strategies for Compliance and Future-Proofing Your Estate

- Regular Review and Updates: Schedule periodic reviews of your estate plan to ensure it aligns with your current financial situation and goals. This allows you to adapt to any changes in tax laws or personal circumstances.

- Diversification and Asset Allocation: Consider diversifying your assets and implementing strategic asset allocation to optimize the value of your estate and minimize tax liability.

- Estate Planning Education: Stay informed about the latest developments in estate planning and tax laws. Attend workshops, webinars, or seminars to enhance your understanding and make more informed decisions.

- Seek Professional Guidance: Work closely with financial advisors, tax professionals, and estate planning specialists who can provide tailored advice based on your unique circumstances.

Conclusion: A Comprehensive Guide to Navigating the NY Estate Tax

In conclusion, the New York Estate Tax is a complex but crucial aspect of financial planning for many residents and businesses in the state. By understanding the nuances of this tax, from exemptions and credits to real-world case studies, you can make informed decisions about your estate and ensure compliance with state regulations.

This guide has provided a detailed overview of the NY Estate Tax, offering practical insights and strategies to help you navigate this intricate tax landscape. Whether you're looking to minimize tax liability, maximize the value of your estate, or simply ensure compliance, the information presented here serves as a valuable resource for your financial journey.

As you continue your financial planning, remember to consult with trusted professionals and stay informed about the latest developments in tax laws. With the right strategies and guidance, you can effectively manage your estate and leave a lasting legacy for your loved ones.

Frequently Asked Questions

What is the current basic exclusion amount for the NY Estate Tax in 2023?

+

The basic exclusion amount for the NY Estate Tax in 2023 is $5.93 million. This amount is adjusted annually for inflation, so it’s important to stay updated with the latest figures.

Are there any other exemptions or deductions available under the NY Estate Tax?

+

Yes, beyond the basic exclusion amount, New York offers a spousal exemption, allowing an unlimited transfer of assets between spouses without incurring estate tax. Additionally, there are other strategies like gift planning and trusts that can reduce tax liability.

How can I minimize my NY Estate Tax liability?

+

To minimize NY Estate Tax liability, consider strategies like gift planning during your lifetime, utilizing trusts, and staying informed about the latest tax laws and exemptions. Working with a financial advisor and tax professional can help you navigate these complexities.

What happens if I don’t plan for the NY Estate Tax in my financial strategy?

+

Failing to plan for the NY Estate Tax can result in a substantial tax liability for your heirs. This could significantly reduce the value of your estate and impact the legacy you leave behind. It’s crucial to consider estate tax planning as an integral part of your overall financial strategy.

Can I reduce my NY Estate Tax liability by donating to charity?

+

Yes, charitable donations can potentially reduce your NY Estate Tax liability. By donating a portion of your estate to a qualified charity, you can take advantage of the charitable deduction, which can lower the taxable value of your estate. Consult with a tax professional for more details.