Anderson County Taxes

Anderson County, located in the state of South Carolina, is renowned for its diverse landscapes, vibrant communities, and thriving economy. As an integral part of the state's tax system, Anderson County Taxes play a pivotal role in funding essential services, infrastructure development, and community initiatives. This comprehensive guide aims to shed light on the various aspects of Anderson County Taxes, offering a detailed analysis of tax rates, assessment processes, and the impact of these taxes on residents and businesses alike.

Understanding Anderson County Taxes: An Overview

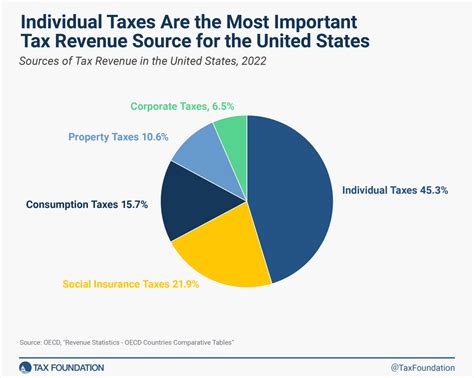

Anderson County, with its strategic location and thriving industries, is a vital contributor to the state’s economy. The county’s tax system is designed to support the region’s growth and development while ensuring fair and equitable taxation for its residents. The county’s tax structure encompasses a range of taxes, including property taxes, sales taxes, and various other levies, each playing a unique role in funding public services and initiatives.

Property Taxes: A Cornerstone of Anderson County’s Revenue

Property taxes are a significant component of Anderson County’s tax revenue. These taxes are assessed on real estate properties, including residential homes, commercial establishments, and industrial facilities. The county employs a systematic approach to property assessment, utilizing market values, recent sales data, and other relevant factors to determine the assessed value of each property.

The assessed value of a property serves as the basis for calculating the property tax liability. Anderson County utilizes a millage rate, expressed in mills per dollar of assessed value, to determine the property tax rate. For instance, a millage rate of 100 mills would equate to $0.10 in property tax for every dollar of assessed value. This rate is subject to change annually, influenced by factors such as budget requirements and the need to fund specific projects or services.

| Property Type | Assessment Rate | Millage Rate |

|---|---|---|

| Residential Properties | 4% | Varies by year |

| Commercial Properties | 5% | Varies by year |

| Industrial Properties | 6% | Varies by year |

Property owners in Anderson County receive an annual tax notice detailing their assessed value, applicable millage rate, and the resulting tax liability. This notice provides transparency and allows property owners to understand the components of their tax bill. Property taxes are a crucial source of revenue for the county, funding vital services such as education, public safety, infrastructure maintenance, and community development projects.

Sales and Use Taxes: Supporting Local Businesses and Services

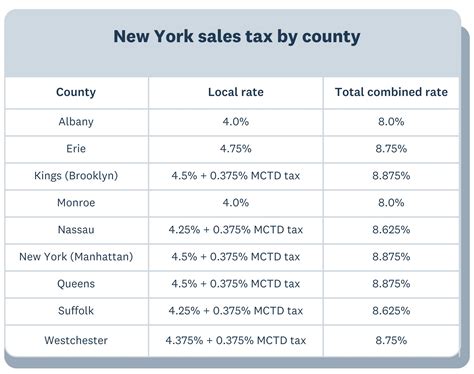

Anderson County, like many other jurisdictions, imposes sales and use taxes on retail transactions. These taxes are collected by businesses and remitted to the county government, contributing to the overall tax revenue. The sales tax rate in Anderson County is subject to change and is influenced by factors such as state and local tax laws, as well as the need to support specific initiatives or projects.

Sales taxes are levied on the sale of goods and certain services within the county. The rate is typically expressed as a percentage of the sale price, with the county's sales tax rate often added to the state sales tax rate. For instance, if the state sales tax rate is 6% and the county sales tax rate is 2%, the total sales tax applicable within Anderson County would be 8%.

In addition to sales taxes, Anderson County also imposes use taxes on goods purchased outside the county but used or consumed within its borders. This ensures fairness and prevents tax evasion. The use tax rate mirrors the sales tax rate, ensuring consistency in taxation.

Sales and use taxes play a critical role in funding essential services, such as education, public health programs, and infrastructure development. These taxes also support local businesses by generating revenue that can be reinvested in the community, fostering economic growth and job creation.

Other Taxes and Fees: A Comprehensive Funding Approach

Beyond property and sales taxes, Anderson County utilizes a range of other taxes and fees to generate revenue and fund specific initiatives. These additional levies contribute to the county’s overall tax structure and help address unique funding needs.

- Accommodation Taxes: Anderson County imposes a tax on short-term rentals and accommodations, such as hotels and vacation rentals. This tax, often referred to as a "lodging tax" or "hotel tax," contributes to funding tourism-related initiatives, infrastructure improvements, and the promotion of the county's attractions.

- Vehicle Registration Fees: Vehicle owners in Anderson County are subject to registration fees, which contribute to funding road maintenance, transportation projects, and public safety initiatives. These fees are typically paid annually and are based on the vehicle's type, age, and other relevant factors.

- Special Assessment Districts: In certain areas of Anderson County, special assessment districts are established to fund specific infrastructure improvements or services. These districts levy additional taxes or fees on properties within the district, ensuring that the cost of these improvements is borne by those who directly benefit from them.

- Business License Fees: Anderson County requires businesses to obtain licenses and permits, which are accompanied by fees. These fees vary based on the nature of the business and its size. The revenue generated from business license fees contributes to funding regulatory services, economic development initiatives, and community support programs.

These additional taxes and fees, while varying in nature and purpose, collectively contribute to the county's comprehensive funding approach. They ensure that the cost of essential services, infrastructure development, and community initiatives is distributed fairly among residents, businesses, and visitors.

The Impact of Anderson County Taxes: A Comprehensive Analysis

Anderson County Taxes have a profound impact on the lives of residents, businesses, and the overall economic landscape of the region. Understanding this impact is crucial for stakeholders, from homeowners and business owners to community leaders and policymakers.

Tax Burden and Affordability

The tax burden borne by residents and businesses is a key consideration in assessing the impact of Anderson County Taxes. While property taxes are a significant component of the tax system, the county’s tax structure is designed to ensure a balanced and equitable approach. The millage rate, subject to annual adjustments, allows for flexibility in managing the tax burden.

For homeowners, the assessed value of their property and the corresponding tax liability can vary based on market conditions and property characteristics. The county's assessment process aims to ensure fairness and transparency, providing property owners with a clear understanding of their tax obligations. Homeowners can access information on assessment methodologies, appeal processes, and tax relief programs to navigate the tax system effectively.

Businesses, too, face varying tax obligations based on their size, industry, and location within the county. The county's tax structure recognizes the diverse nature of businesses and offers incentives and tax breaks to support economic growth and job creation. By offering a competitive tax environment, Anderson County aims to attract and retain businesses, contributing to a thriving local economy.

Funding Essential Services and Community Initiatives

Anderson County Taxes play a pivotal role in funding a wide array of essential services and community initiatives. Property taxes, sales taxes, and other levies collectively contribute to supporting public education, public safety, healthcare, and social services. These taxes fund the construction and maintenance of schools, hospitals, fire stations, and other critical infrastructure.

Additionally, Anderson County Taxes support community development initiatives, such as affordable housing programs, cultural and recreational facilities, and economic development projects. The tax revenue enables the county to invest in initiatives that enhance the quality of life for residents, foster economic growth, and attract new businesses and residents.

Economic Growth and Job Creation

The tax environment in Anderson County plays a crucial role in driving economic growth and job creation. The county’s tax structure, including incentives and tax breaks for businesses, encourages investment and entrepreneurship. By offering a competitive tax climate, Anderson County positions itself as an attractive destination for businesses, leading to job creation and economic prosperity.

The revenue generated from taxes is reinvested in the community, supporting initiatives that foster economic development. These initiatives may include infrastructure improvements, workforce development programs, and business support services. By creating an environment conducive to business growth, Anderson County strengthens its economic foundation and enhances its competitiveness in the region.

Community Engagement and Transparency

Anderson County prioritizes community engagement and transparency in its tax system. The county administration actively engages with residents, businesses, and community leaders to ensure that tax policies are aligned with community needs and aspirations. Open communication channels, public hearings, and feedback mechanisms allow stakeholders to voice their concerns and provide input on tax-related matters.

Transparency is a cornerstone of the county's tax system. Tax notices, assessment information, and budget details are readily accessible to the public, fostering trust and accountability. Residents and businesses can access information on tax rates, assessment methodologies, and the allocation of tax revenue, enabling them to make informed decisions and engage in meaningful dialogue with the county administration.

Future Implications and Strategic Tax Planning

As Anderson County continues to evolve and adapt to changing economic and social dynamics, the role of taxes in shaping its future becomes increasingly significant. Strategic tax planning and a forward-thinking approach are essential to ensure the county’s continued growth and prosperity.

Tax Policy Evolution and Economic Development

Anderson County’s tax policies are dynamic and subject to periodic review and adjustment. The county administration actively monitors economic trends, market conditions, and community needs to ensure that tax policies remain relevant and effective. By adapting tax policies to changing circumstances, the county can support economic development, attract investment, and foster a vibrant business environment.

Tax policy evolution may involve incentives for specific industries, tax breaks for job creation, or targeted investments in infrastructure. By proactively addressing the needs of businesses and residents, Anderson County can create a tax environment that fosters growth and innovation. This approach ensures that the county remains competitive in attracting businesses and retaining a skilled workforce, contributing to long-term economic prosperity.

Sustainable Funding and Infrastructure Development

Anderson County’s tax revenue plays a crucial role in funding infrastructure development and maintenance. As the county’s population and economic activities grow, the demand for modern infrastructure increases. Strategic tax planning ensures that the county can allocate sufficient resources to address infrastructure needs, such as road improvements, public transportation, and utility upgrades.

By investing in infrastructure, Anderson County enhances its competitiveness and quality of life. Well-maintained roads, efficient public transportation, and reliable utilities attract businesses and residents, contributing to economic growth. Sustainable funding for infrastructure development ensures that the county can accommodate future growth and meet the evolving needs of its residents and businesses.

Community Engagement and Tax Reform

Community engagement is a vital aspect of Anderson County’s tax planning process. By involving residents, businesses, and community leaders in tax discussions, the county administration ensures that tax policies are responsive to community needs and aspirations. Open dialogue and feedback mechanisms foster a sense of ownership and collaboration, leading to more effective and sustainable tax policies.

Tax reform initiatives, when necessary, are implemented with careful consideration of community input. The county administration works closely with stakeholders to understand their concerns and propose solutions that balance the needs of residents, businesses, and the overall community. This collaborative approach ensures that tax reforms are equitable, transparent, and aligned with the long-term interests of Anderson County.

How often are property tax assessments conducted in Anderson County?

+

Property tax assessments in Anderson County are conducted annually to ensure that property values are accurately reflected. This process helps determine the fair and equitable distribution of the tax burden among property owners.

Are there any tax incentives or breaks available for businesses in Anderson County?

+

Yes, Anderson County offers a range of tax incentives and breaks to support businesses. These incentives may include tax credits for job creation, investment in research and development, or specific industry-related tax breaks. The county aims to create a business-friendly environment, encouraging economic growth and job creation.

How does Anderson County ensure transparency in its tax system?

+

Anderson County prioritizes transparency by providing accessible information on tax rates, assessment methodologies, and budget allocations. Residents and businesses can access tax-related data and reports, ensuring clarity and accountability. The county also conducts public hearings and engages in open dialogue to address tax-related concerns and feedback.