Waterbury Taxes

Waterbury, Connecticut, is a vibrant city known for its rich history, diverse culture, and vibrant community. However, one aspect that often sparks curiosity and raises questions among residents and businesses alike is the topic of taxes. Understanding the tax landscape is crucial for individuals and businesses operating within the city, as it directly impacts financial planning and decision-making. In this comprehensive guide, we delve into the intricacies of Waterbury taxes, shedding light on the various tax obligations and providing valuable insights for those navigating the financial landscape of this dynamic city.

Unraveling the Complexities: An In-Depth Look at Waterbury Taxes

Waterbury, with its thriving economy and diverse population, presents a unique tax environment. From property taxes to income taxes and sales taxes, there are multiple layers to explore. Let’s delve into each aspect, offering a comprehensive understanding of the tax structure and its implications.

Property Taxes: A Pillar of Waterbury’s Revenue

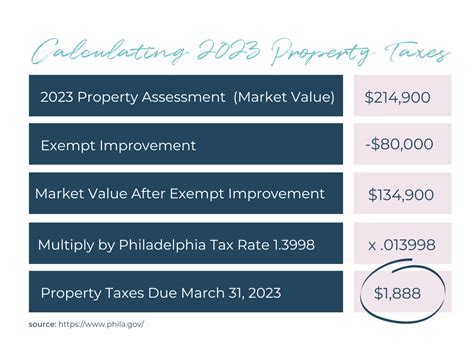

Property taxes play a significant role in funding essential services and infrastructure in Waterbury. The city assesses property values based on factors such as location, size, and condition. Here’s a breakdown of the key aspects:

- Assessment Process: The city conducts regular property assessments to determine the taxable value of each property. These assessments are crucial for calculating fair and equitable taxes.

- Tax Rates: Waterbury’s tax rates are determined by the city’s budget and the need to fund various services. The rates are typically expressed in mills, where one mill represents 1 of tax for every 1,000 of assessed property value.

- Exemptions and Deductions: The city offers certain exemptions and deductions to eligible homeowners. These include homestead exemptions, senior citizen tax abatements, and veterans’ exemptions. Understanding these provisions can significantly impact your tax liability.

- Appeal Process: If you believe your property assessment is inaccurate, Waterbury provides a formal appeal process. This allows property owners to challenge their assessed value and potentially reduce their tax burden.

To illustrate, consider the case of Mr. Johnson, a homeowner in Waterbury. His property was recently assessed at $250,000. With a tax rate of 35 mills, Mr. Johnson's annual property tax bill would amount to $8,750. However, by taking advantage of the available exemptions, he could potentially reduce this burden.

| Property Value | Tax Rate (Mills) | Annual Tax |

|---|---|---|

| $250,000 | 35 | $8,750 |

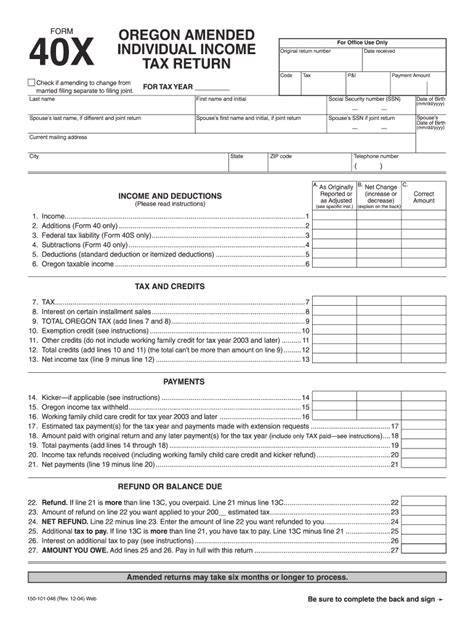

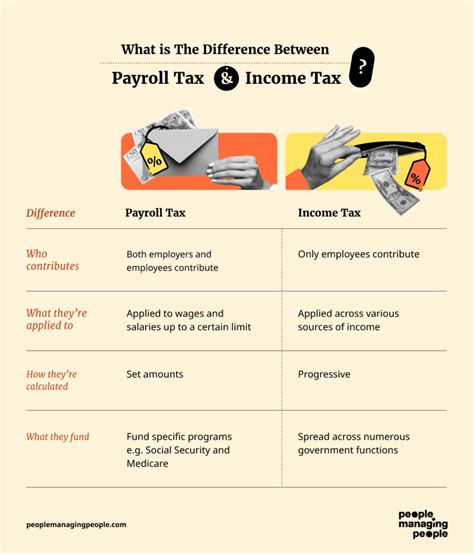

Income Taxes: Navigating the State and Local Landscape

Waterbury, like the rest of Connecticut, follows a progressive income tax structure. This means that as your income increases, so does your tax rate. Here’s a simplified breakdown:

- State Income Tax: Connecticut imposes state income taxes, with rates ranging from 3% to 6.99%. The exact rate depends on your taxable income bracket.

- Local Income Tax: Waterbury also collects a local income tax to support city operations. This tax is typically a percentage of your state taxable income and varies based on your residency status within the city.

- Filing Requirements: Residents of Waterbury are required to file both state and local income tax returns. It’s crucial to stay compliant with these filing obligations to avoid penalties.

For instance, let's consider Ms. Smith, a resident of Waterbury with an annual income of $75,000. With a state income tax rate of 5.5% and a local income tax rate of 1.5%, her total income tax obligation would be approximately $4,875. This includes both state and local taxes.

| Income | State Tax Rate | Local Tax Rate | Total Income Tax |

|---|---|---|---|

| $75,000 | 5.5% | 1.5% | $4,875 |

Sales and Use Taxes: Understanding Consumption Taxes

Sales and use taxes are another important aspect of Waterbury’s tax landscape. These taxes are levied on the sale of goods and services and play a significant role in generating revenue for the city and state.

- Sales Tax: Waterbury, like the rest of Connecticut, imposes a sales tax on most retail transactions. The current sales tax rate is 6.35%, which includes both the state and local components.

- Use Tax: The use tax is applicable when goods or services are purchased from out-of-state vendors and brought into Connecticut for use. This tax ensures fairness and prevents tax evasion.

- Exemptions and Discounts: Certain items, such as groceries and prescription drugs, are exempt from sales tax. Additionally, Waterbury offers special discounts for specific events or initiatives, promoting economic development.

- Compliance and Reporting: Businesses operating in Waterbury must comply with sales tax regulations and accurately report and remit sales taxes. Failure to do so can result in penalties and legal consequences.

Imagine you own a retail store in Waterbury and make a sale of $1,000 worth of goods. With a sales tax rate of 6.35%, the customer would pay an additional $63.50 in taxes, bringing the total purchase amount to $1,063.50. As a business owner, you are responsible for collecting and remitting this tax to the appropriate tax authorities.

| Sale Amount | Sales Tax Rate | Tax Amount | Total Amount |

|---|---|---|---|

| $1,000 | 6.35% | $63.50 | $1,063.50 |

Conclusion: Navigating Waterbury’s Tax Landscape

Understanding the tax landscape in Waterbury is crucial for individuals and businesses to make informed financial decisions. From property taxes to income taxes and sales taxes, each aspect has unique considerations and implications. By staying informed, seeking professional guidance when needed, and leveraging available resources, residents and businesses can navigate the tax landscape effectively.

Waterbury's tax structure, while comprehensive, is designed to support the city's growth and development. By contributing to the tax base, residents and businesses play a vital role in shaping the city's future. As the city continues to evolve, so too will its tax policies, making it essential to stay abreast of any changes and adapt financial strategies accordingly.

Frequently Asked Questions

What is the current property tax rate in Waterbury?

+

The current property tax rate in Waterbury is 35 mills, which means 35 of tax is levied for every 1,000 of assessed property value.

Are there any property tax exemptions available in Waterbury?

+

Yes, Waterbury offers various property tax exemptions, including homestead exemptions, senior citizen tax abatements, and veterans’ exemptions. These exemptions can significantly reduce your tax burden.

How often are property assessments conducted in Waterbury?

+

Property assessments in Waterbury are typically conducted every few years to ensure accurate valuation. However, you can request a revaluation if you believe your property’s value has significantly changed.

What is the income tax rate for residents of Waterbury?

+

The income tax rate for residents of Waterbury varies based on your income bracket. The state income tax rates range from 3% to 6.99%, and there is an additional local income tax rate on top of that.

Are there any tax incentives or programs for businesses in Waterbury?

+

Yes, Waterbury offers various tax incentives and programs to attract and support businesses. These may include tax credits, abatements, or special economic development zones. It’s worth exploring these options when establishing or expanding your business in the city.