Does Texas Have A State Income Tax

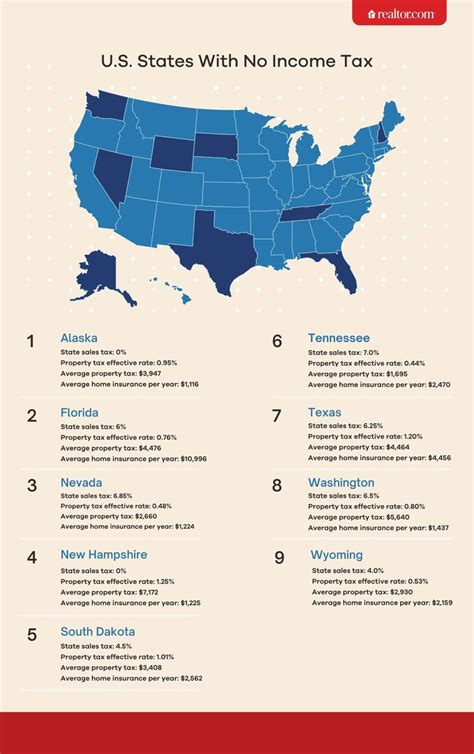

The tax landscape in the United States varies significantly from state to state, with each jurisdiction possessing the authority to establish its own unique tax regulations. One notable aspect of Texas' tax system is the absence of a state-level income tax, making it one of the few states in the nation to operate without this form of taxation.

Texas’ Income Tax Policy

Texas stands out among US states for its no-income-tax policy, which has been a cornerstone of its economic strategy for decades. This policy has had a profound impact on the state’s fiscal landscape and has been a key factor in shaping its economic trajectory.

The decision to forgo a state income tax has attracted significant attention and debate. Advocates argue that it fosters economic growth, attracts businesses, and simplifies the tax system. On the other hand, critics contend that it may lead to a reliance on other forms of taxation, potentially burdening certain sectors of the population.

Economic Implications

The absence of a state income tax in Texas has undoubtedly influenced its economic development. The state has witnessed a steady influx of businesses and individuals seeking a tax-friendly environment. This has contributed to a robust job market and a thriving economy. However, the long-term sustainability of this model is a topic of ongoing discussion among economists and policymakers.

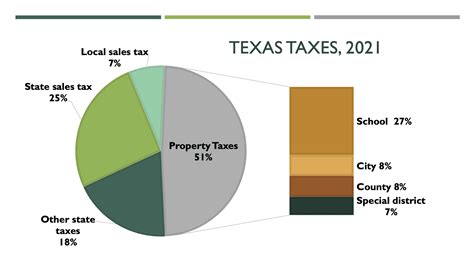

While the lack of an income tax may be advantageous for businesses and high-income earners, it can place a heavier tax burden on other segments of the population, such as low- and middle-income households. This is because Texas relies more heavily on sales and property taxes, which can disproportionately affect those with lower incomes.

| Tax Type | Texas Tax Rate |

|---|---|

| Sales Tax | 6.25% |

| Property Tax | Varies by County (average 1.85%) |

Comparison with Other States

When compared to states that impose income taxes, Texas offers a significantly different tax environment. For instance, California, a state with a robust income tax system, can levy rates as high as 13.3% on certain income brackets. This contrast highlights the diversity in tax policies across the US.

Potential Future Changes

Despite the longstanding absence of a state income tax, discussions about its potential introduction are not unheard of. However, any such proposal would likely face significant opposition from a variety of stakeholders, making it a complex and controversial issue.

In conclusion, Texas' decision to operate without a state income tax has had far-reaching implications for its economy and tax structure. While it has undoubtedly attracted businesses and fostered economic growth, it has also sparked debates about tax fairness and the distribution of public resources.

How does Texas fund public services without an income tax?

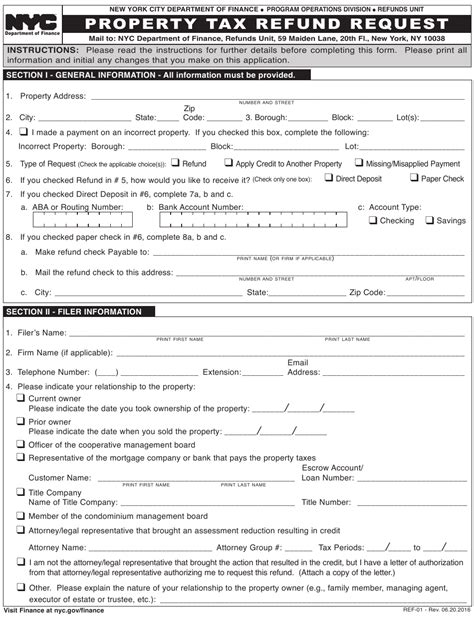

+Texas relies on a combination of sales tax, property tax, and various other fees and charges to fund public services. The state’s robust economy also contributes significantly to its revenue stream.

What are the advantages of a state without an income tax like Texas?

+The absence of an income tax can attract businesses and individuals seeking tax advantages. It can also simplify the tax system and reduce administrative burdens.

Are there any states with lower income tax rates than Texas?

+Yes, several states, including Florida, Nevada, and South Dakota, have no income tax. Other states like Washington and Wyoming have lower income tax rates compared to many other states.