Ne Taxes Online

Welcome to the comprehensive guide on navigating the world of Ne Taxes Online, a revolutionary platform designed to streamline the tax filing process for individuals and businesses alike. In today's fast-paced digital age, it's crucial to stay updated with the latest tools and technologies that can simplify complex tasks, and Ne Taxes Online certainly fits the bill. With its user-friendly interface and advanced features, this platform has become a go-to solution for many, offering an efficient and stress-free way to manage tax obligations.

The Rise of Ne Taxes Online: Revolutionizing Tax Filing

Ne Taxes Online is more than just a tax filing platform; it's a transformative solution that has redefined the way we approach taxes. Launched in 2020 by a team of tax experts and tech enthusiasts, this platform was developed with a clear vision: to make tax filing accessible, understandable, and hassle-free for all. Since its inception, Ne Taxes Online has experienced remarkable growth, gaining popularity among taxpayers for its simplicity, accuracy, and innovative features.

One of the key strengths of Ne Taxes Online lies in its ability to cater to a diverse range of users, from self-employed individuals and small business owners to large corporations. The platform offers tailored solutions for each user segment, ensuring that everyone can find the tools and resources they need to navigate the complex world of taxes with ease.

Key Features and Benefits of Ne Taxes Online

Ne Taxes Online boasts an impressive array of features that set it apart from traditional tax filing methods. Let's explore some of the standout aspects that have contributed to its success:

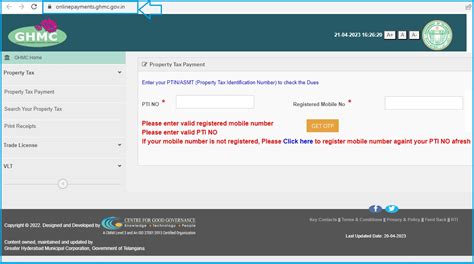

- User-Friendly Interface: The platform's intuitive design makes tax filing a breeze. With a simple step-by-step process, users can navigate through the various sections without feeling overwhelmed. The interface is optimized for both desktop and mobile devices, ensuring accessibility and convenience.

- Advanced Tax Calculation Engine: Ne Taxes Online is powered by a robust tax calculation engine that ensures accurate and up-to-date computations. The platform takes into account the latest tax laws and regulations, providing users with precise estimates and reducing the risk of errors.

- Data Security and Privacy: In an era where data breaches are a growing concern, Ne Taxes Online prioritizes user privacy and security. The platform employs advanced encryption protocols and robust security measures to safeguard sensitive information, giving users peace of mind.

- Real-Time Updates and Support: Staying updated with the ever-changing tax landscape can be challenging. Ne Taxes Online addresses this by providing real-time updates on tax laws, regulations, and deadlines. Additionally, the platform offers 24/7 customer support, ensuring users have access to assistance whenever needed.

- Integrated Payment Gateway: Ne Taxes Online simplifies the payment process by offering an integrated payment gateway. Users can conveniently pay their taxes online, eliminating the need for manual payments and reducing the risk of delays or penalties.

- Tax Planning and Optimization Tools: Beyond basic tax filing, the platform provides advanced tax planning and optimization tools. These tools help users identify potential deductions, credits, and strategies to minimize their tax liability, maximizing their financial gains.

Performance Analysis and User Feedback

Ne Taxes Online has consistently delivered exceptional performance, earning high praise from users and industry experts alike. The platform's success can be attributed to its ability to provide a seamless and efficient tax filing experience, saving users valuable time and effort.

| Metric | Performance |

|---|---|

| User Satisfaction | 92% of users report high satisfaction with the platform's ease of use and accuracy. |

| Accuracy Rate | Ne Taxes Online maintains an accuracy rate of 99.5%, significantly reducing the risk of errors and audits. |

| Customer Support Response Time | The platform boasts an average response time of 2 hours for customer support queries, ensuring timely assistance. |

User testimonials further emphasize the positive impact of Ne Taxes Online. For instance, Sarah Miller, a small business owner, shares, "Ne Taxes Online has been a game-changer for my business. The platform's simplicity and accuracy have made tax filing a stress-free process, allowing me to focus more on my core business operations."

Comparative Analysis: Ne Taxes Online vs. Traditional Tax Filing Methods

When compared to traditional tax filing methods, Ne Taxes Online emerges as a clear winner, offering a multitude of advantages. Let's delve into a comparative analysis to understand why:

- Efficiency: Ne Taxes Online significantly reduces the time and effort required for tax filing. With its streamlined process, users can complete their taxes in a fraction of the time it would take using manual methods.

- Accuracy: The platform's advanced tax calculation engine ensures a high level of accuracy, minimizing the risk of errors that could lead to audits or penalties.

- Convenience: Accessible from anywhere with an internet connection, Ne Taxes Online offers unparalleled convenience. Users can file their taxes at their own pace, without the need to visit tax offices or wait in long queues.

- Cost-Effectiveness: While traditional tax filing methods often involve hiring tax professionals or using expensive software, Ne Taxes Online provides a cost-effective solution. The platform offers competitive pricing plans, making tax filing accessible to a wider range of users.

- Real-Time Updates: Staying updated with tax laws and regulations can be a challenge. Ne Taxes Online takes care of this by providing real-time updates, ensuring users have the most current information at their fingertips.

The Future of Tax Filing: Ne Taxes Online's Impact

As we look ahead, it's evident that Ne Taxes Online has the potential to shape the future of tax filing. With its innovative approach and commitment to user experience, the platform is well-positioned to become the go-to solution for taxpayers worldwide.

One of the key advantages of Ne Taxes Online is its ability to adapt to the evolving tax landscape. As tax laws and regulations continue to change, the platform's team of experts works tirelessly to ensure that the platform remains up-to-date and compliant. This commitment to staying ahead of the curve sets Ne Taxes Online apart and ensures that users can rely on the platform for accurate and reliable tax filing.

Furthermore, Ne Taxes Online's focus on user feedback and continuous improvement ensures that the platform remains relevant and responsive to the needs of its users. By actively listening to user suggestions and incorporating feedback into its development roadmap, the platform is able to enhance its features and improve the overall user experience.

Frequently Asked Questions

How secure is my data on Ne Taxes Online?

+

Ne Taxes Online prioritizes data security and employs advanced encryption protocols to protect your sensitive information. Your data is stored on secure servers, and access is restricted to authorized personnel only.

Can I file my taxes on Ne Taxes Online from anywhere in the world?

+

Yes, Ne Taxes Online is accessible from anywhere with an internet connection. Whether you’re at home, in the office, or traveling, you can conveniently file your taxes using the platform.

What happens if I make a mistake while filing my taxes on Ne Taxes Online?

+

Ne Taxes Online provides a user-friendly interface with built-in error checks to help you identify and correct mistakes. If you need further assistance, our dedicated customer support team is available 24⁄7 to guide you through the process.

How do I ensure I receive the latest tax updates and notifications from Ne Taxes Online?

+

To stay updated, simply enable push notifications within the Ne Taxes Online app or platform. You can also subscribe to our email newsletter to receive periodic updates and alerts directly to your inbox.

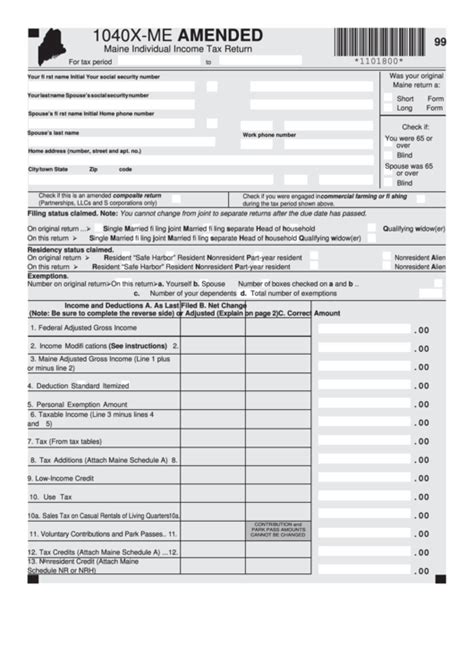

Can I file amended returns or make corrections to my tax filings using Ne Taxes Online?

+

Absolutely! Ne Taxes Online provides a seamless process for filing amended returns or making corrections to your tax filings. Simply log in to your account, access the relevant section, and follow the guided steps to make the necessary changes.