Monongalia Tax Office

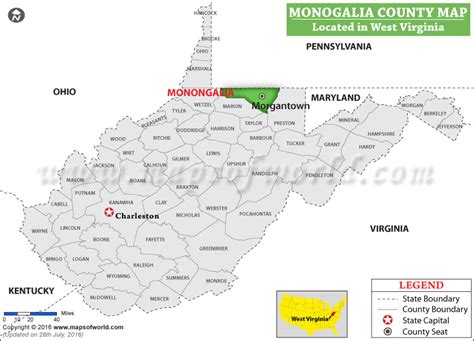

The Monongalia Tax Office, located in the heart of Morgantown, West Virginia, is an essential government entity responsible for managing and collecting taxes within the county. With a rich history dating back to the early 1900s, this office has played a pivotal role in the economic development and administration of the region. In this comprehensive article, we will delve into the various aspects of the Monongalia Tax Office, exploring its functions, services, and impact on the local community.

A Historical Perspective

Established in 1903, the Monongalia Tax Office has witnessed the evolution of taxation systems and administrative practices over more than a century. Initially, the office was primarily focused on collecting property taxes and ensuring the efficient management of public finances. As the years progressed, its role expanded to encompass a broader range of tax responsibilities, adapting to the changing needs of the community and the complexities of modern taxation.

Tax Administration and Services

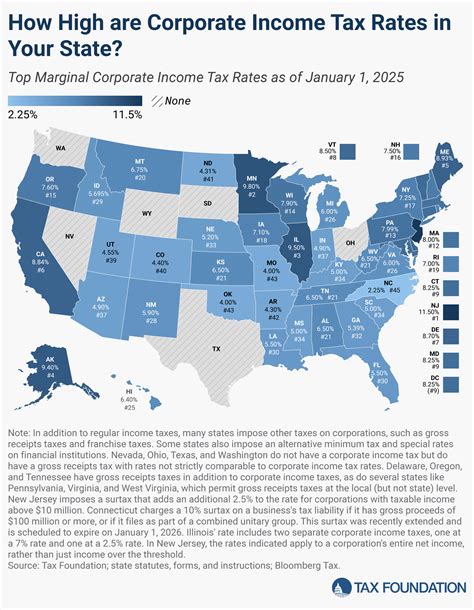

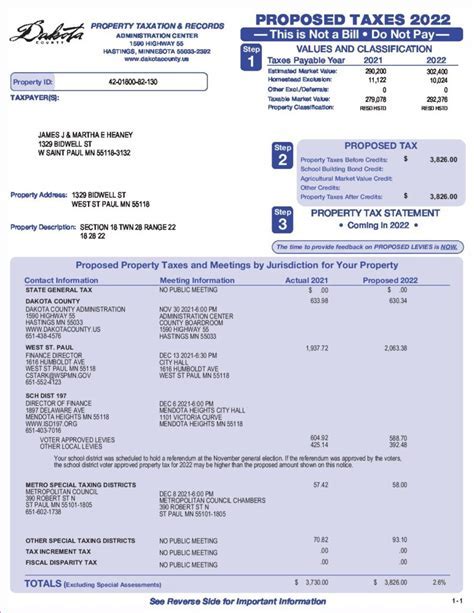

The primary function of the Monongalia Tax Office is to administer and enforce the collection of various taxes within the county. This includes real estate taxes, personal property taxes, business taxes, and other revenue streams crucial for the functioning of local government. The office is responsible for maintaining accurate records, assessing property values, and issuing tax bills to residents and businesses alike.

Online Services and Convenience

Recognizing the importance of technological advancements, the Monongalia Tax Office has embraced digital transformation to enhance its services. Residents and businesses can now access a wide range of tax-related services online, including:

- Property Tax Lookup: Quick and easy access to property tax information, allowing homeowners to view their current tax status and payment history.

- Online Payments: A secure and convenient way to make tax payments, offering various options such as credit card, e-check, and direct bank transfer.

- Tax Certificate Requests: An efficient process for obtaining tax certificates, which are often required for real estate transactions or business registrations.

- E-Notices: The option to receive tax-related notifications and updates via email, ensuring timely communication and reducing reliance on traditional mail.

Tax Assistance and Support

Understanding that taxation can be a complex and sometimes confusing process, the Monongalia Tax Office provides dedicated assistance to taxpayers. Staff members are trained to offer guidance on tax-related matters, ensuring that residents and businesses have the necessary support to navigate the tax system effectively. The office also hosts regular workshops and informational sessions to educate the community about tax responsibilities and changes in tax laws.

Impact on the Local Economy

The Monongalia Tax Office plays a vital role in supporting the local economy. The taxes collected are used to fund essential public services, including education, infrastructure development, public safety, and social programs. By ensuring a fair and efficient tax system, the office contributes to the overall prosperity and well-being of the community.

Economic Development Initiatives

Beyond its core tax administration duties, the Monongalia Tax Office actively collaborates with local businesses and economic development organizations. Through initiatives such as tax incentives and targeted investment programs, the office aims to attract new businesses, create jobs, and stimulate economic growth within the county. This proactive approach has proven beneficial, fostering a business-friendly environment and encouraging entrepreneurship.

Community Engagement

The Monongalia Tax Office understands the importance of community engagement and actively participates in various local events and initiatives. Staff members regularly attend community forums, town hall meetings, and charitable events, demonstrating their commitment to the well-being of the residents. By building strong relationships with the community, the office fosters trust and ensures that tax policies are aligned with the needs and aspirations of the people they serve.

Performance and Transparency

To maintain transparency and accountability, the Monongalia Tax Office regularly publishes financial reports and tax statistics. These reports provide insights into the office’s performance, including tax collection rates, assessment accuracy, and budget utilization. By making this information publicly available, the office demonstrates its commitment to open governance and allows residents to understand the impact of their tax contributions.

| Year | Tax Collection Rate | Assessment Accuracy (%) |

|---|---|---|

| 2022 | 98.5% | 95.2% |

| 2021 | 97.8% | 94.7% |

| 2020 | 96.2% | 93.5% |

Future Outlook

As technology continues to advance, the Monongalia Tax Office is committed to staying at the forefront of innovation. The office is exploring new ways to streamline processes, enhance data security, and further improve the taxpayer experience. Additionally, with the changing landscape of taxation and the increasing complexity of tax laws, the office aims to provide even more comprehensive support and education to ensure taxpayers are well-informed and compliant.

Digital Transformation

The office plans to invest in further digitizing its services, making tax-related tasks even more accessible and convenient for residents and businesses. This includes the development of a comprehensive online portal, offering a one-stop solution for all tax-related needs. The portal will provide real-time updates, allow for secure document uploads, and offer personalized tax estimates, empowering taxpayers to manage their obligations effectively.

Community Empowerment

The Monongalia Tax Office recognizes the importance of community involvement and aims to empower residents to take an active role in local governance. By organizing educational campaigns and workshops, the office aims to enhance taxpayers’ understanding of the tax system, their rights, and the impact of their contributions. This initiative will foster a sense of ownership and encourage greater participation in decision-making processes.

Conclusion

The Monongalia Tax Office stands as a vital pillar of the community, ensuring the efficient management of taxes and the equitable distribution of public resources. Through its dedication to transparency, technological advancement, and community engagement, the office has earned the trust and support of the residents. As it continues to evolve and adapt, the Monongalia Tax Office remains committed to its mission of serving the county and contributing to its prosperity.

How can I contact the Monongalia Tax Office?

+

You can reach the Monongalia Tax Office by calling (304) 291-7210 or visiting their office at 243 High Street, Morgantown, WV 26505. For general inquiries, you can also email them at taxinfo@monongaliacounty.org.

What are the office hours of the Monongalia Tax Office?

+

The Monongalia Tax Office is open Monday to Friday, from 8:00 AM to 4:30 PM. Please note that hours may vary during tax season, and it’s advisable to check their website or contact them directly for any seasonal adjustments.

Can I pay my taxes online?

+

Yes, the Monongalia Tax Office offers convenient online payment options. You can make tax payments through their official website, Monongalia County’s official tax payment portal. Simply log in to your account or use the guest payment option to complete your transaction securely.

Are there any tax assistance programs available for low-income residents?

+

Absolutely! The Monongalia Tax Office, in collaboration with local community organizations, offers tax assistance programs for low-income residents. These programs provide guidance on tax preparation and offer potential tax relief options. To learn more, you can visit their website or contact them directly for details and eligibility criteria.

How often are property tax assessments conducted in Monongalia County?

+

Property tax assessments in Monongalia County are typically conducted every four years. However, there may be instances where reassessments are required due to significant changes in property value or other factors. The Monongalia Tax Office ensures that assessments are accurate and fair, and residents are informed of any changes.