Montgomery County Property Tax Bill

Property taxes are an essential part of local government revenue, funding various services and infrastructure in a community. Understanding your Montgomery County property tax bill is crucial for homeowners and investors alike. This article aims to provide a comprehensive guide, shedding light on the components, calculations, and strategies related to Montgomery County property taxes.

The Anatomy of a Montgomery County Property Tax Bill

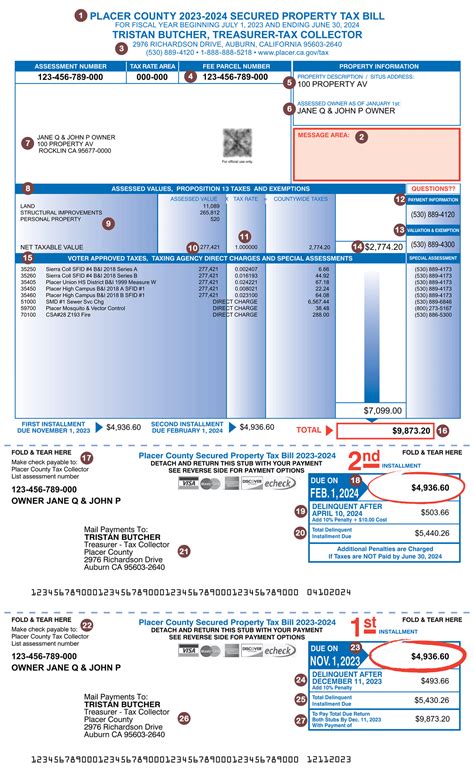

The Montgomery County property tax bill is a comprehensive document that outlines the taxes owed on a property for a specific fiscal year. It is typically sent to property owners in the late spring or early summer, with the due date falling in the subsequent autumn. Let’s delve into the key elements of this bill to gain a clearer understanding.

Assessed Value

The assessed value is the first crucial piece of information on your tax bill. This value is determined by the Montgomery County Assessor’s Office, which appraises properties based on various factors such as location, size, recent sales of similar properties, and improvements made to the property. The assessed value is not the same as the market value, as it is calculated using specific formulas and guidelines set by the county.

For instance, consider a residential property in Montgomery County with a market value of $500,000. The assessor might determine its assessed value to be $450,000, which is the basis for calculating the property taxes.

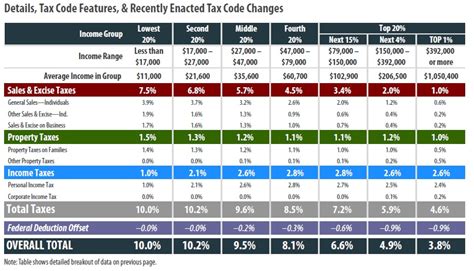

Tax Rate

The tax rate is a percentage applied to the assessed value of your property. This rate is set by local governments, including the county, city, school district, and other special districts. It is used to determine the amount of tax owed and is often expressed as a millage rate, which represents the amount of tax per $1,000 of assessed value.

Continuing with our example, if the Montgomery County tax rate is 2.5%, the property owner would calculate their tax liability as follows: $450,000 (assessed value) x 0.025 (tax rate) = $11,250 in property taxes.

Taxes Due

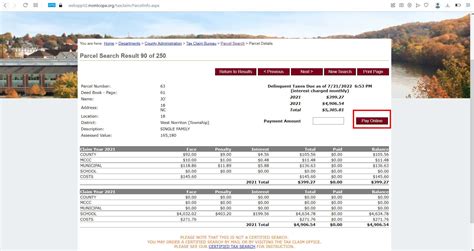

The taxes due section of your bill outlines the total amount of property taxes owed for the current fiscal year. This amount is calculated by multiplying the assessed value by the tax rate, as illustrated in the previous section. It is important to note that this amount may vary from year to year due to changes in the assessed value or tax rates.

| Assessed Value | Tax Rate | Taxes Due |

|---|---|---|

| $450,000 | 2.5% | $11,250 |

Payment Options and Due Dates

The Montgomery County property tax bill provides information on various payment options and their respective due dates. Property owners can typically choose to pay their taxes in full or opt for installment payments. The due date for the first installment is usually in the late summer or early autumn, with a second installment due a few months later.

For instance, the first installment might be due on October 1st, with a 5% discount if paid by that date. The second installment would then be due on January 1st, without the discount.

Strategies for Managing Montgomery County Property Taxes

Understanding your Montgomery County property tax bill is the first step in effectively managing your tax obligations. Here are some strategies to consider:

Appealing Your Assessment

If you believe your property’s assessed value is higher than it should be, you have the right to appeal. The Montgomery County Assessor’s Office provides a formal process for property owners to challenge their assessments. This process typically involves gathering evidence, such as recent sales of similar properties, to support your claim.

Tax Deductions and Exemptions

Explore the various tax deductions and exemptions offered by Montgomery County. These can include senior citizen exemptions, military service exemptions, and homestead exemptions. By qualifying for these deductions, you may be able to reduce your taxable assessed value, resulting in lower property taxes.

Timely Payments and Penalties

Make sure to pay your property taxes on time to avoid late fees and penalties. Montgomery County imposes penalties for late payments, which can quickly accumulate and add to your financial burden. Consider setting up automatic payments or reminders to ensure timely payments.

Understanding Tax Increases

Property tax rates in Montgomery County can change from year to year due to various factors, such as budget constraints or new infrastructure projects. Stay informed about these changes by attending local government meetings or following official announcements. Understanding the reasons behind tax increases can help you budget accordingly and plan for the future.

The Impact of Property Taxes on the Community

Property taxes play a vital role in funding essential services and infrastructure in Montgomery County. These taxes contribute to the maintenance and improvement of roads, schools, emergency services, parks, and other public amenities. By paying your property taxes, you are directly supporting the well-being and development of your community.

Community Development Projects

Property tax revenue is often invested in community development projects, such as constructing new schools, improving public transportation, and enhancing public safety measures. These initiatives aim to create a better quality of life for residents and attract businesses and investments to the area.

Economic Stability and Growth

Stable and predictable property taxes are crucial for the economic health of Montgomery County. They provide a reliable revenue stream for local governments, allowing them to plan and budget effectively. This stability attracts businesses, creates jobs, and fosters economic growth, ultimately benefiting all residents.

Future Outlook and Potential Changes

As Montgomery County continues to evolve and grow, property taxes are likely to undergo changes to adapt to the community’s needs. Here are some potential future developments:

Green Initiatives and Environmental Programs

Montgomery County may introduce tax incentives or programs to encourage sustainable practices and energy efficiency among property owners. These initiatives could include tax breaks for installing solar panels, implementing energy-efficient upgrades, or adopting eco-friendly landscaping practices.

Technology and Digital Services

The county might explore the use of technology to enhance the property tax assessment and payment processes. This could involve implementing online platforms for easier access to tax information, streamlined payment options, and improved communication between taxpayers and the Assessor’s Office.

Community Engagement and Transparency

There is a growing emphasis on community engagement and transparency in local government. Montgomery County may further develop its online presence and communication channels to provide residents with more accessible information about property taxes, assessment processes, and community development plans.

Conclusion

Understanding your Montgomery County property tax bill is essential for responsible property ownership. By familiarizing yourself with the assessed value, tax rate, and payment options, you can effectively manage your tax obligations and contribute to the growth and development of your community. Remember, property taxes are a vital investment in the future of Montgomery County, and staying informed and engaged is key to ensuring a prosperous and vibrant community.

How often are property taxes assessed in Montgomery County?

+Property taxes in Montgomery County are typically assessed annually, with the assessment reflecting the property’s value as of a specific date, usually January 1st of the current tax year.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline can result in late fees and penalties. It’s important to pay your taxes on time to avoid additional financial burdens.

Can I appeal my property’s assessed value if I disagree with it?

+Yes, you have the right to appeal your property’s assessed value if you believe it is incorrect or unfair. The Montgomery County Assessor’s Office provides a formal process for appealing assessments.