Sales Tax Santa Rosa Ca

Sales tax is an essential component of the revenue generation system in many states, and California is no exception. Santa Rosa, a vibrant city in Sonoma County, plays a significant role in the state's economy, contributing to the overall sales tax collection. Understanding the sales tax landscape in Santa Rosa is crucial for businesses, consumers, and anyone interested in the financial dynamics of the region.

Sales Tax Structure in Santa Rosa, California

Sales tax in California, including Santa Rosa, is governed by a complex yet well-defined system. It is a cumulative tax, meaning that it is collected at each stage of a product’s sale, from the manufacturer to the retailer, and finally to the end consumer. This structure ensures that the tax burden is shared across the supply chain.

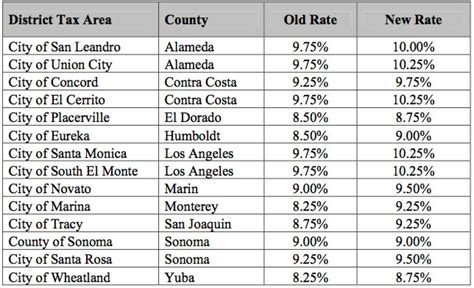

The sales tax rate in Santa Rosa consists of several components: the state sales tax rate, county sales tax rate, and potential city or district tax rates. As of my last update in January 2023, the state sales tax rate in California is 7.25%, which is among the highest in the nation. Sonoma County, where Santa Rosa is located, levies an additional 0.25% sales tax, bringing the total countywide rate to 7.50%.

However, the sales tax rate can vary within Santa Rosa itself. The city of Santa Rosa imposes an extra 0.25% sales tax, which is dedicated to transportation improvements. This additional tax brings the total sales tax rate within the city limits to 7.75%. Additionally, there are special tax districts within the city, such as the Santa Rosa Downtown Redevelopment Area, which may have their own unique sales tax rates to fund specific community projects.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of California | 7.25% |

| Sonoma County | 0.25% |

| City of Santa Rosa | 0.25% |

| Total (Santa Rosa) | 7.75% |

It's important to note that while the sales tax rate in Santa Rosa may seem high, it is not uncommon for California cities to have rates above 7%. This is due to the state's reliance on sales tax as a significant revenue source and the various local needs and projects that sales tax funds support.

How Sales Tax is Applied in Santa Rosa

Sales tax in Santa Rosa, as in the rest of California, applies to most tangible personal property and some services. This includes items like clothing, electronics, furniture, and groceries. However, there are certain exemptions, such as most non-prepared food items, prescription medications, and certain medical devices.

The sales tax is typically calculated by the retailer at the point of sale and included in the final price displayed to the consumer. This point-of-sale tax system ensures that consumers are aware of the tax they are paying and that retailers are collecting the correct amount. Retailers are then responsible for remitting the collected sales tax to the appropriate tax authorities, typically on a monthly or quarterly basis.

Impact of Sales Tax on Santa Rosa’s Economy

Sales tax is a critical revenue stream for Santa Rosa, contributing significantly to the city’s financial health and ability to fund essential services and infrastructure projects. The city’s sales tax revenue supports various public services, including public safety, healthcare, education, and transportation. For instance, the additional 0.25% sales tax dedicated to transportation improvements helps fund road maintenance, public transit, and other transportation-related initiatives.

The sales tax structure also influences consumer behavior and business strategies in Santa Rosa. Businesses must carefully consider the impact of sales tax on their pricing strategies, as competitive pricing can be a significant factor in attracting customers. On the other hand, consumers may choose to shop in areas with lower sales tax rates, especially for large purchases, which can impact local businesses.

Sales Tax Exemptions and Special Considerations

While most retail sales in Santa Rosa are subject to sales tax, there are specific exemptions and special considerations to be aware of. For instance, certain types of businesses, such as nonprofit organizations and government entities, may be exempt from paying sales tax on their purchases. Additionally, there are special tax rates and regulations for specific industries, such as the hospitality industry, which often has unique tax considerations due to its focus on tourism and entertainment.

Another critical aspect is the treatment of online sales. With the growth of e-commerce, the sales tax landscape has become more complex. Santa Rosa, like other cities, must navigate the challenges of collecting sales tax from online retailers, especially those that do not have a physical presence in the city. This is a dynamic area of sales tax regulation, with ongoing discussions and legislative changes at both the state and federal levels.

Sales Tax Compliance and Enforcement in Santa Rosa

Ensuring compliance with sales tax regulations is a critical aspect of doing business in Santa Rosa. The California Department of Tax and Fee Administration (CDTFA) is responsible for overseeing sales tax compliance throughout the state, including Santa Rosa. Businesses are required to register with the CDTFA, obtain a seller’s permit, and regularly report and remit sales tax collections.

The CDTFA has a range of enforcement tools at its disposal to ensure compliance. This includes conducting audits, imposing penalties for non-compliance, and even pursuing legal action in severe cases. For businesses, understanding and adhering to sales tax regulations is essential to avoid legal issues and maintain a positive relationship with the tax authorities.

For consumers, it's important to be aware of their rights and responsibilities regarding sales tax. While consumers are not directly responsible for reporting sales tax, they should be vigilant about ensuring that sales tax is correctly calculated and charged by retailers. If there are concerns or discrepancies, consumers can contact the CDTFA or the Better Business Bureau for guidance and assistance.

Resources and Support for Businesses and Consumers

Navigating the sales tax landscape in Santa Rosa can be complex, especially for new businesses or those unfamiliar with California’s tax system. Fortunately, there are several resources available to provide guidance and support.

The CDTFA website is an excellent starting point, offering a wealth of information on sales tax regulations, registration processes, and compliance guidelines. The website also provides tools and resources specifically tailored to small businesses, helping them understand their sales tax obligations and navigate the registration and reporting processes.

Additionally, the Santa Rosa Chamber of Commerce and other local business organizations can be valuable sources of information and support. These organizations often provide workshops, seminars, and one-on-one consultations to help businesses understand and comply with sales tax regulations. They can also provide insights into the local business climate and potential opportunities and challenges related to sales tax.

For consumers, the Better Business Bureau (BBB) can be a helpful resource for understanding their rights and responsibilities regarding sales tax. The BBB can provide guidance on identifying potential scams or fraudulent activities related to sales tax and offer advice on how to protect oneself as a consumer.

Future Outlook and Potential Changes

The sales tax landscape in Santa Rosa, like the rest of California, is subject to ongoing changes and evolution. As the state and local governments continue to assess their revenue needs and priorities, sales tax rates and regulations may undergo modifications.

One potential area of change is the treatment of online sales. With the rapid growth of e-commerce, there is ongoing discussion and debate about how to fairly and effectively collect sales tax from online retailers, especially those without a physical presence in the state. This could lead to new legislation or regulatory changes that impact sales tax collection in Santa Rosa and other cities.

Additionally, as the economy and consumer behaviors evolve, there may be shifts in the types of goods and services subject to sales tax. For instance, with the increasing popularity of digital products and services, there could be a greater focus on taxing these items, which currently have varying levels of taxation across different jurisdictions.

Lastly, the ongoing debate about state and local tax policies, including sales tax, is influenced by broader economic and political trends. As these trends evolve, they could lead to significant changes in the sales tax landscape, impacting businesses and consumers in Santa Rosa and throughout California.

How often do sales tax rates change in Santa Rosa, California?

+Sales tax rates in Santa Rosa, as in the rest of California, can change periodically. While the state sales tax rate has remained stable at 7.25% for several years, local jurisdictions like Sonoma County and the City of Santa Rosa can modify their tax rates to meet specific funding needs. These changes are typically made through legislative processes and can occur annually or in response to specific projects or budget shortfalls.

Are there any sales tax holidays in Santa Rosa, and if so, when are they?

+California does not observe statewide sales tax holidays, which are temporary periods when certain items are exempt from sales tax. However, some local jurisdictions, including Santa Rosa, may implement their own sales tax holidays to stimulate local economies and encourage shopping. These events are typically announced in advance and may coincide with specific holidays or seasons.

What happens if a business in Santa Rosa does not collect or remit sales tax correctly?

+Businesses in Santa Rosa are legally required to collect and remit sales tax on taxable goods and services. Failure to do so can result in significant penalties and legal consequences. The California Department of Tax and Fee Administration (CDTFA) has the authority to audit businesses, impose penalties for non-compliance, and even pursue legal action in severe cases. It’s crucial for businesses to understand their sales tax obligations and seek guidance if they have any concerns or questions.