Roseville Ca Sales Tax

Sales tax is an essential component of the revenue system in the United States, and it plays a significant role in shaping the economic landscape of each state and locality. In the vibrant city of Roseville, California, understanding the sales tax structure is crucial for both businesses and consumers. This article delves into the intricacies of Roseville's sales tax, providing a comprehensive guide to help navigate this complex yet vital aspect of the local economy.

The Sales Tax Landscape in Roseville, California

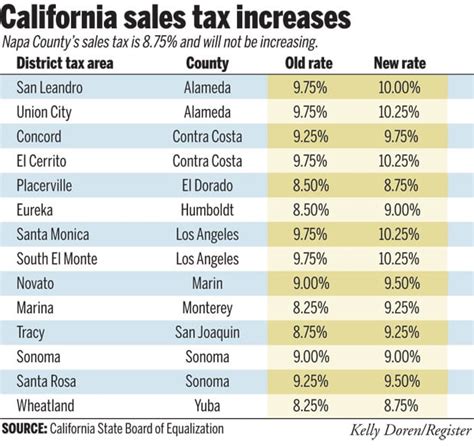

Roseville, nestled in the heart of California’s Gold Country, boasts a thriving business community and a vibrant consumer market. The city’s sales tax rates are a combination of state, county, and city taxes, each contributing to the overall tax burden. Delving into these rates provides a clear picture of the economic environment in this bustling metropolis.

State Sales Tax

The California state sales tax stands at 7.25%, a rate set by the state government. This tax applies to a wide range of goods and services, forming a significant portion of the overall sales tax rate in Roseville.

County Sales Tax

Placer County, where Roseville is located, imposes an additional sales tax. This county sales tax is set at 0.25%, bringing the total sales tax to 7.5% at the county level. This supplementary tax is crucial for funding county-wide initiatives and services.

City Sales Tax

The city of Roseville itself levies a city sales tax of 1.25%. This tax is dedicated to supporting city projects and maintaining the city’s infrastructure. When combined with the state and county taxes, the total sales tax in Roseville amounts to 8.75%.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| County Sales Tax | 0.25% |

| City Sales Tax | 1.25% |

| Total Sales Tax in Roseville | 8.75% |

Sales Tax Exemptions and Special Considerations

While the standard sales tax rate applies to most goods and services, certain items and situations enjoy exemptions or special considerations. These exemptions are crucial for businesses and consumers to understand, as they can significantly impact financial planning and decision-making.

Exemptions for Specific Goods

California, and by extension Roseville, offers exemptions for certain types of goods. These exemptions are designed to encourage specific behaviors or support certain industries. For instance, groceries are generally exempt from sales tax, providing a relief for households and promoting food security.

Additionally, medicines and prescription drugs are also exempt from sales tax, ensuring that healthcare is more accessible to the public. Other exempt items include certain clothing and footwear (up to a specific value), newspaper subscriptions, and educational materials like textbooks.

Special Considerations for Online Sales

In the digital age, online sales have become a significant portion of the retail market. California, including Roseville, imposes a use tax on online purchases. This tax is similar to sales tax but applies when items are purchased from out-of-state vendors and shipped into California. It ensures that consumers pay their fair share of taxes, regardless of the origin of their purchases.

Businesses that sell online must comply with these use tax regulations, often requiring them to collect and remit the tax on behalf of the consumer. This ensures a level playing field for local businesses and maintains a fair tax environment.

Tax Holidays and Special Events

Roseville, like many other cities, occasionally participates in tax holidays or special sales events. During these periods, certain items or purchases may be exempt from sales tax, encouraging consumer spending and supporting local businesses. These events are usually announced in advance and are a great opportunity for consumers to save on their purchases.

The Impact of Sales Tax on Local Economy

Sales tax is a critical component of Roseville’s economic ecosystem, influencing both consumer behavior and business strategies. Understanding the implications of sales tax can provide valuable insights into the local economy’s health and potential areas for growth.

Consumer Behavior and Spending Patterns

The sales tax rate directly impacts consumer spending habits. A higher tax rate can discourage spending, as consumers may opt to purchase goods from lower-tax jurisdictions or online. Conversely, tax holidays or special events can boost spending by offering tax savings.

Businesses in Roseville must carefully consider these consumer behaviors when setting their pricing strategies. Offering competitive pricing or running promotional campaigns during tax-free periods can attract more customers and boost sales.

Business Strategies and Tax Planning

For businesses operating in Roseville, understanding the sales tax landscape is crucial for effective tax planning. This includes ensuring compliance with tax regulations, as well as exploring potential tax incentives or exemptions that could benefit the business.

Additionally, businesses must consider the impact of sales tax on their pricing strategies. While passing the tax burden onto consumers is an option, it may affect competitiveness. Some businesses choose to absorb a portion of the tax to maintain attractive pricing, especially during periods of economic uncertainty.

Revenue Generation and Economic Development

The sales tax revenue generated in Roseville is a vital source of funding for the city’s infrastructure and services. It supports essential public services like education, healthcare, and public safety. This revenue also fuels economic development initiatives, attracting new businesses and creating job opportunities.

A healthy sales tax base indicates a thriving local economy, which in turn attracts more businesses and consumers. This positive feedback loop is crucial for the long-term sustainability and growth of Roseville's economy.

Future Trends and Potential Changes

The sales tax landscape in Roseville, like any other city, is subject to change. Economic shifts, political decisions, and technological advancements can all influence the tax system. Staying informed about potential changes is crucial for both businesses and consumers to adapt their strategies accordingly.

Economic Factors and Policy Changes

Economic downturns or recessions can prompt discussions about adjusting sales tax rates to stimulate the economy. Conversely, periods of strong economic growth may lead to considerations of lowering tax rates to maintain competitiveness.

Policy changes at the state or federal level can also impact Roseville's sales tax. For instance, changes in tax laws or regulations regarding online sales can affect how businesses operate and how consumers shop.

Technological Advancements and E-commerce

The rise of e-commerce and online shopping has already significantly impacted the sales tax system. As more businesses operate online, the collection and remittance of sales tax become more complex. Technological advancements in tax software and payment systems can help streamline this process, ensuring compliance and efficiency.

Potential Tax Reform and Exemptions

Discussions around tax reform are ongoing, with proposals for simplifying the tax system or introducing new exemptions. These changes could impact Roseville’s sales tax structure, potentially benefiting certain industries or consumer groups. Staying updated on these discussions is essential for understanding the future direction of the sales tax landscape.

Conclusion: Navigating Roseville’s Sales Tax Landscape

Understanding Roseville’s sales tax is crucial for both businesses and consumers. It influences pricing strategies, consumer behavior, and the overall economic health of the city. By staying informed about the sales tax rates, exemptions, and potential future changes, stakeholders can make informed decisions and adapt their strategies accordingly.

The sales tax system in Roseville is a dynamic and ever-evolving aspect of the local economy. By recognizing its impact and staying engaged with the latest developments, businesses and consumers can thrive in this vibrant city's economic landscape.

How often do sales tax rates change in Roseville?

+Sales tax rates can change annually or at irregular intervals, depending on economic conditions and policy decisions. It’s essential to stay updated with the latest rates to ensure compliance and accurate pricing.

Are there any online resources to help calculate sales tax in Roseville?

+Yes, several online tools and calculators can help compute sales tax. These tools consider the combined state, county, and city tax rates, making it easier for businesses and consumers to estimate their tax obligations.

What happens if a business doesn’t collect or remit sales tax correctly in Roseville?

+Businesses are legally obligated to collect and remit sales tax accurately. Failure to do so can result in penalties, fines, or even legal consequences. It’s crucial for businesses to understand their tax obligations and seek professional advice if needed.