Can I Still File My 2023 Taxes

The annual tax season is a critical time for individuals and businesses to fulfill their tax obligations and claim any eligible deductions or credits. As we progress through the year, many taxpayers find themselves wondering if they've missed the window to file their taxes for the previous year. In this article, we'll explore the key aspects of filing taxes for the 2023 tax year, including important deadlines, the potential for late filing, and the steps to take if you're considering an extension.

Understanding the 2023 Tax Filing Season

The Internal Revenue Service (IRS) typically designates a specific timeframe for taxpayers to file their annual tax returns. For the 2023 tax year, the official filing season commenced on January 22, 2024, marking the opening of the IRS’s processing systems for tax returns.

The traditional deadline for filing federal income tax returns is April 15, which aligns with the Tax Day observance in the United States. This deadline is a critical milestone for taxpayers, as it signifies the last day to file tax returns without incurring any penalties or interest charges. However, it's important to note that this deadline can be extended under certain circumstances, which we'll explore in more detail later in this article.

Late Filing Penalties

Filing your tax return after the designated deadline can result in penalties and interest charges. The IRS imposes a failure-to-file penalty, which accrues at a rate of 5% of the unpaid taxes for each month or part of a month that a return is late, up to a maximum of 25%. Additionally, a failure-to-pay penalty may also apply if you don’t pay your taxes by the due date. This penalty is 0.5% of the unpaid taxes for each month or part of a month, with a maximum of 25%.

To illustrate, if you owe $10,000 in taxes and your return is 60 days late, you could face a failure-to-file penalty of $500 (5% of $10,000 for two months) and a failure-to-pay penalty of $300 (0.5% of $10,000 for two months), for a total penalty of $800. Interest charges may also apply, further increasing the financial burden of late filing.

Extended Deadlines and Filing Extensions

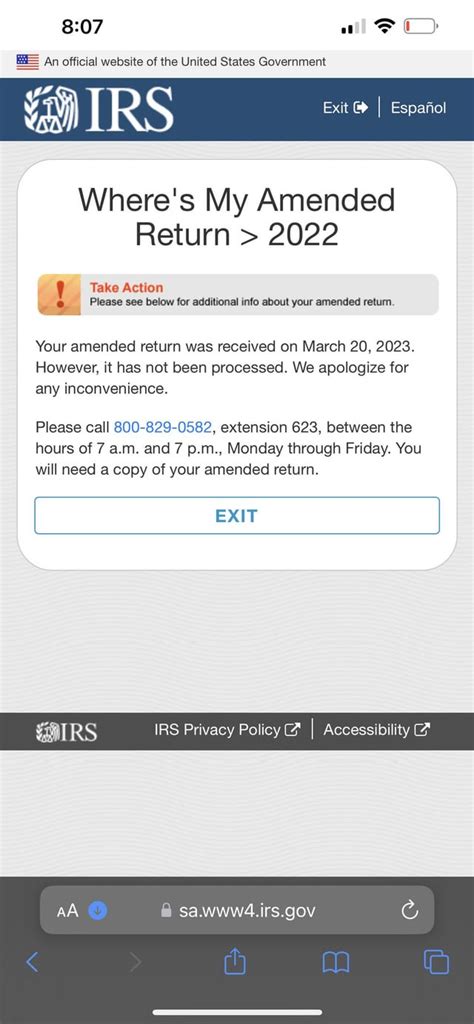

In certain situations, taxpayers may qualify for an extended deadline to file their tax returns. The most common scenario is when a taxpayer is granted an automatic extension of time to file, which provides an additional six months from the original due date. This extension is available to all taxpayers and doesn’t require any advance request or justification. To take advantage of this extension, taxpayers must simply file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, by the original due date.

By filing Form 4868, taxpayers gain an extension until October 15, 2024 to file their 2023 tax returns. It's important to note that this extension only applies to filing and doesn't provide additional time to pay any taxes owed. Therefore, if you anticipate owing taxes for the 2023 tax year, it's crucial to make estimated tax payments or request a payment extension to avoid late payment penalties and interest.

Steps to Take When Filing Late

If you’ve missed the original deadline and are considering filing your tax return late, it’s essential to take the necessary steps to minimize any potential penalties and ensure a smooth filing process. Here’s a step-by-step guide to help you navigate this situation:

- Determine the Reason for the Delay: Start by identifying the cause of the delay in filing your tax return. Common reasons include missing tax documents, complex tax situations, or simply forgetting the deadline. Understanding the reason can help you take appropriate actions and potentially avoid future delays.

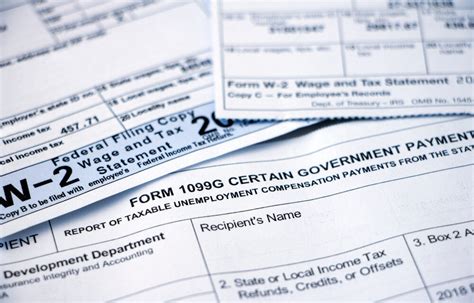

- Gather Necessary Documentation: Ensure you have all the required tax documents and forms to complete your return accurately. This may include W-2 forms, 1099 forms, expense receipts, and any other relevant financial records. If you're missing any documents, contact the issuer directly to obtain them promptly.

- File Electronically (e-File): The IRS encourages taxpayers to use electronic filing (e-file) whenever possible. E-filing offers several advantages, including faster processing, reduced errors, and the potential for quicker refunds. To e-file, you can use tax preparation software or engage the services of a tax professional.

- Consider Engaging a Tax Professional: If you're facing a complex tax situation or are uncertain about the late filing process, it may be beneficial to consult a tax professional. They can provide expert guidance, ensure your return is accurate, and help you navigate any potential issues or penalties.

- Pay Any Taxes Owed: If you anticipate owing taxes for the 2023 tax year, it's crucial to make the necessary payments to avoid late payment penalties and interest. You can make payments through various methods, including electronic funds transfer, direct debit, credit or debit card, or by mailing a check or money order.

- Request an Installment Agreement: If you're unable to pay the full amount owed by the due date, you can request an installment agreement with the IRS. This agreement allows you to make monthly payments towards your tax liability over a specified period. To request an installment agreement, you can use the Online Payment Agreement tool on the IRS website or complete Form 9465, Installment Agreement Request.

- Avoid Future Delays: To prevent future late filing situations, consider setting reminders for tax-related deadlines and creating a tax filing plan. This can help you stay organized and ensure you have all the necessary documents and information well in advance of the filing deadline.

Benefits of Filing on Time

While it’s understandable that circumstances may arise that prevent timely tax filing, there are several advantages to filing your tax return on time. Here are some key benefits to consider:

- Avoid Penalties and Interest: Filing on time helps you avoid late filing penalties and interest charges, which can significantly increase your tax liability.

- Quicker Refunds: If you're eligible for a tax refund, filing on time ensures you receive your refund sooner. The IRS typically processes refunds within 21 days for those who e-file and choose direct deposit.

- Peace of Mind: Filing on time provides peace of mind, knowing that you've fulfilled your tax obligations and can focus on other financial priorities without the stress of potential penalties or late payments.

- Accurate Recordkeeping: Timely filing ensures that you maintain accurate financial records and can easily access necessary tax information for future reference or audits.

Future Implications and Planning

For taxpayers who are late in filing their 2023 tax returns, it’s important to consider the potential implications and take proactive steps to improve tax compliance in the future. Here are some key considerations and strategies to enhance your tax planning:

Tax Record Retention

The IRS generally recommends retaining tax records for at least three years after the date you file your original tax return or two years after the date you paid the tax, whichever is later. This retention period allows you to have the necessary documentation to support your tax filings and respond to any IRS inquiries. By maintaining organized tax records, you can quickly retrieve information if needed and avoid potential penalties for missing documentation.

Estimating Tax Liability

To improve your tax planning and avoid surprises, it’s beneficial to estimate your tax liability for the current tax year as early as possible. This estimation can help you anticipate any taxes owed and plan for payments accordingly. The IRS provides a Tax Withholding Estimator tool on its website, which can assist you in determining if you’ve had enough tax withheld from your wages or if you need to make estimated tax payments.

Additionally, consider consulting a tax professional or using tax preparation software to estimate your tax liability accurately. This proactive approach can help you make informed decisions about tax payments and avoid potential late payment penalties.

Automated Tax Reminders

To stay on top of tax deadlines and avoid future delays, consider setting up automated tax reminders. Many tax preparation software programs and financial management apps offer the option to receive notifications and alerts for important tax-related dates. By utilizing these tools, you can ensure that you’re reminded well in advance of key deadlines, such as the tax filing deadline, estimated tax payment deadlines, and other critical tax milestones.

Staying organized and proactive in your tax planning can significantly reduce the stress and potential penalties associated with late filing. By implementing these strategies, you can improve your tax compliance and ensure a smoother tax filing experience in the future.

Frequently Asked Questions (FAQ)

What happens if I miss the tax filing deadline without a valid reason?

+

Missing the tax filing deadline without a valid reason can result in penalties and interest charges. The IRS imposes a failure-to-file penalty, which accrues at a rate of 5% of the unpaid taxes for each month or part of a month that a return is late, up to a maximum of 25%. Additionally, a failure-to-pay penalty may also apply if you don’t pay your taxes by the due date. To avoid these penalties, it’s important to file your tax return as soon as possible and make any necessary payments to reduce your tax liability.

Can I still file my taxes if I don’t have all the necessary documents?

+

It’s ideal to have all the necessary documents before filing your taxes, but if you’re missing some, you can still file an incomplete return and submit the missing information later. The IRS allows taxpayers to file an incomplete return, which indicates that the return is not complete and that you’ll provide additional information later. This option is available for federal tax returns and can be useful if you’re waiting for specific tax forms or documents. However, it’s important to note that you may still be subject to penalties and interest if you owe taxes and don’t make the necessary payments by the due date.

What are the consequences of filing my taxes late without an extension?

+

Filing your taxes late without an extension can result in penalties and interest charges. The IRS imposes a failure-to-file penalty, which accrues at a rate of 5% of the unpaid taxes for each month or part of a month that a return is late, up to a maximum of 25%. Additionally, a failure-to-pay penalty may apply if you don’t pay your taxes by the due date. These penalties can significantly increase your tax liability, so it’s important to file your tax return as soon as possible to minimize any potential penalties.

How long does the IRS typically take to process tax returns filed late without an extension?

+

The processing time for tax returns filed late without an extension can vary depending on several factors, including the complexity of the return and the IRS’s workload. Generally, the IRS aims to process tax returns within 6 to 8 weeks from the date of filing. However, it’s important to note that late-filed returns may take longer to process due to additional scrutiny and potential errors. To ensure a smoother processing experience, it’s advisable to file your tax return as soon as possible and provide accurate and complete information.

Are there any special considerations for self-employed individuals when filing taxes late without an extension?

+

Self-employed individuals, such as sole proprietors, partners in partnerships, and members of LLCs taxed as partnerships, have specific considerations when filing taxes late without an extension. These taxpayers must still file their tax returns by the due date to avoid penalties and interest charges. However, they may have additional requirements, such as estimating and paying their self-employment taxes throughout the year. It’s important for self-employed individuals to consult a tax professional or refer to IRS guidelines to ensure they’re complying with all applicable tax regulations.