Property Taxes By County Pa

Welcome to a comprehensive guide exploring the intricate world of property taxes in Pennsylvania. This article aims to provide an in-depth analysis of the property tax landscape, offering valuable insights into how these taxes are calculated, the variations across different counties, and their impact on homeowners and the state's economy. With a focus on accuracy and relevance, we delve into the specifics, shedding light on the factors that influence property tax rates and the strategies employed by counties to manage their tax bases.

Understanding Property Taxes in Pennsylvania

Property taxes in Pennsylvania play a pivotal role in funding essential public services and infrastructure. These taxes are levied on real estate properties, including residential, commercial, and industrial properties, with the revenue generated used to support local governments, schools, and various community initiatives.

The state's property tax system is notably decentralized, with each county responsible for assessing property values and setting tax rates. This approach allows for localized control and the ability to tailor tax policies to meet the unique needs and challenges of each county. However, it also leads to significant variations in tax rates and assessment practices, which can have a substantial impact on homeowners and businesses.

Understanding the nuances of property taxes is crucial for homeowners, as it directly affects their financial planning and overall cost of living. For instance, a higher property tax rate can influence a homeowner's decision to sell, rent, or improve their property. It can also impact the local housing market, influencing property values and investment opportunities.

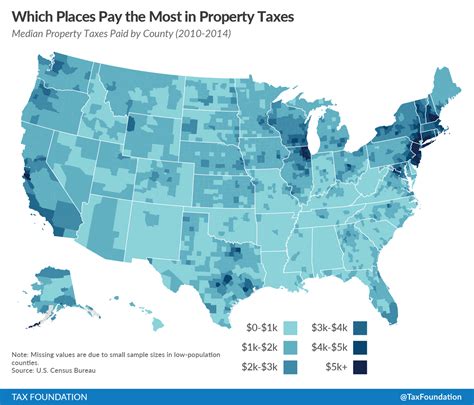

Property Tax Rates and Assessments Across Counties

Pennsylvania’s diverse geography and varying economic conditions result in a wide range of property tax rates across its 67 counties. These rates are expressed as millage rates, where one mill equals one-tenth of a cent. To illustrate, a millage rate of 10 mills corresponds to 1 in property tax for every 1,000 of assessed property value.

Let's take a closer look at some specific counties and their property tax rates:

Philadelphia County

Philadelphia County, home to the state’s largest city, boasts a robust economy and diverse real estate market. Its property tax rate stands at 14.23 mills, making it one of the higher rates in the state. This rate is primarily used to fund the city’s extensive public school system and other municipal services.

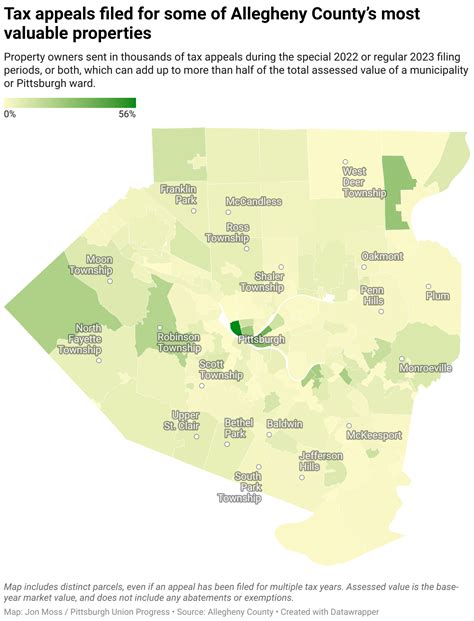

Allegheny County

Allegheny County, which includes the city of Pittsburgh, has a slightly lower property tax rate of 11.87 mills. Despite this, the county generates substantial revenue due to its large population and the presence of major industries. The tax revenue is allocated towards maintaining the county’s infrastructure and supporting its thriving cultural and educational institutions.

Montgomery County

Montgomery County, a suburban county neighboring Philadelphia, has a property tax rate of 13.42 mills. This rate reflects the county’s focus on providing high-quality public services, including an excellent school system, while also maintaining a competitive business environment.

Lehigh County

Lehigh County, known for its vibrant industrial sector and beautiful landscapes, has a property tax rate of 10.89 mills. The county’s assessment practices prioritize fairness and accuracy, ensuring that property owners are taxed based on the true value of their properties.

York County

York County, a thriving agricultural and manufacturing hub, maintains a relatively low property tax rate of 7.75 mills. This rate is a result of the county’s commitment to keeping taxes affordable while still providing essential services and supporting local businesses.

| County | Property Tax Rate (Mills) |

|---|---|

| Philadelphia | 14.23 |

| Allegheny | 11.87 |

| Montgomery | 13.42 |

| Lehigh | 10.89 |

| York | 7.75 |

Factors Influencing Property Tax Rates

Property tax rates in Pennsylvania are influenced by a multitude of factors, each playing a critical role in shaping the tax landscape.

Property Values and Assessments

The assessed value of a property is a key determinant of the property taxes owed. Counties employ different assessment methods, which can range from periodic reassessments to annual adjustments based on market trends. The accuracy and fairness of these assessments are crucial to ensuring that property owners pay their fair share of taxes.

Local Budgetary Needs

Counties must balance their budgets, and property taxes are a significant source of revenue. The level of services provided, such as police and fire protection, road maintenance, and education, directly impacts the tax rate. Counties with higher budgetary requirements may set higher tax rates to meet these needs.

Economic Conditions

The economic health of a county can significantly influence its property tax rates. Counties with strong economies, thriving businesses, and robust job markets may be able to set lower tax rates while still generating sufficient revenue. Conversely, counties facing economic challenges may need to increase tax rates to maintain essential services.

Population Density and Growth

Population density and growth rates can impact property tax rates. High-density areas with rapid population growth may require more significant investments in infrastructure and services, potentially leading to higher tax rates. Conversely, rural areas with slow growth may have lower tax rates due to reduced service demands.

Tax Base Stability

A stable tax base is crucial for counties to maintain consistent revenue streams. Counties with a diverse tax base, including a mix of residential, commercial, and industrial properties, are better equipped to weather economic fluctuations and maintain stable tax rates.

Strategies for Managing Property Tax Bases

Counties in Pennsylvania employ various strategies to manage their property tax bases effectively, ensuring a fair and sustainable tax system.

Assessment Practices

Accurate and fair assessments are fundamental to a well-managed property tax system. Counties utilize different assessment methods, including mass appraisals, computer-assisted valuation, and market-based approaches. These practices ensure that property values are determined consistently and equitably.

Tax Rate Adjustments

Counties may adjust tax rates periodically to account for changes in property values, economic conditions, or budgetary requirements. These adjustments can be made through formal reassessment processes or more incremental changes based on market trends.

Homestead and Senior Exemptions

Many counties offer exemptions or reduced tax rates for homesteads, which are primary residences. Additionally, some counties provide tax relief for senior citizens, recognizing their contributions to the community and potential financial challenges. These exemptions help to make property ownership more affordable and sustainable for certain segments of the population.

Tax Incentives for Economic Development

Counties may offer tax incentives, such as tax abatement or tax increment financing, to attract new businesses and promote economic development. These incentives can stimulate job growth and boost the local economy, ultimately enhancing the tax base over time.

Collaboration and Shared Services

Counties often collaborate and share services to optimize resources and reduce costs. By consolidating certain functions, such as emergency dispatch or solid waste management, counties can achieve efficiencies that lower the overall tax burden.

Impact of Property Taxes on Homeownership

Property taxes have a direct and significant impact on homeownership in Pennsylvania. For prospective homeowners, the property tax rate is a crucial factor in their decision-making process. A high property tax rate can increase the overall cost of homeownership, potentially making it less affordable for some individuals or families.

Existing homeowners are also affected by property taxes, as they must budget for these expenses annually. Changes in tax rates or property values can impact their financial planning, especially for those on fixed incomes or with limited financial flexibility. Moreover, property taxes can influence homeowners' decisions to improve or sell their properties, as the tax burden may impact their return on investment.

Future Implications and Potential Reforms

As Pennsylvania continues to evolve, the property tax system will likely undergo changes to address emerging challenges and opportunities. Here are some potential future implications and reforms:

-

Fair Assessment Practices: There is a growing emphasis on ensuring that assessment practices are fair and transparent. Counties may invest in advanced technologies and training to improve the accuracy and consistency of property assessments.

-

Tax Base Diversification: Counties may explore strategies to diversify their tax bases, attracting a mix of residential, commercial, and industrial properties. This approach can help stabilize revenue streams and reduce the reliance on any single sector.

-

Regional Collaboration: There may be increased collaboration between counties, especially in metropolitan areas, to address shared challenges and optimize resources. This could lead to more efficient service delivery and potentially lower tax burdens for residents.

-

Property Tax Reform: While property taxes are a critical revenue source, there are ongoing discussions about potential reforms to make the system more equitable and efficient. This could involve changes to assessment practices, tax rates, or the distribution of tax revenue.

Conclusion

Property taxes in Pennsylvania are a complex but essential component of the state’s fiscal landscape. The decentralized nature of the tax system allows for localized control and tailored approaches, but it also results in significant variations across counties. Understanding these variations and the factors influencing property tax rates is crucial for homeowners, businesses, and policymakers alike.

As Pennsylvania moves forward, the management of property tax bases will remain a critical focus. By implementing fair assessment practices, diversifying tax bases, and exploring collaborative opportunities, counties can work towards a more sustainable and equitable tax system. Ultimately, this will contribute to the overall economic health and well-being of the state's communities.

How often are property tax rates reassessed in Pennsylvania?

+Property tax rates in Pennsylvania are typically reassessed every year to account for changes in property values and market conditions. However, some counties may have specific schedules for reassessments, which can range from every few years to annually.

Can property owners appeal their assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The process for appeals varies by county, but generally involves submitting documentation to support the request for a reassessment.

What is the average property tax rate in Pennsylvania?

+The average property tax rate in Pennsylvania is approximately 1.48%, which is slightly lower than the national average. However, it’s important to note that this average can vary significantly across counties, with some counties having rates as low as 0.5% and others exceeding 2%.