Unrealized Capital Gain Tax

Welcome to a comprehensive guide on one of the most complex and often misunderstood aspects of financial planning: the Unrealized Capital Gain Tax. This topic is of paramount importance for investors and financial advisors alike, as it can significantly impact an individual's wealth and tax obligations. In this article, we will delve into the intricacies of this tax concept, exploring its definitions, implications, and strategies for optimization.

Understanding Unrealized Capital Gain Tax

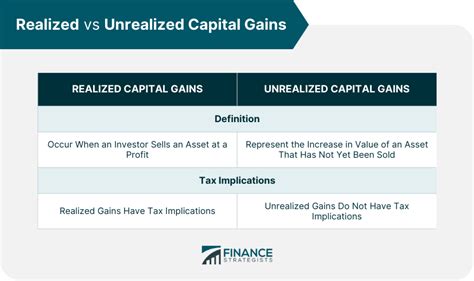

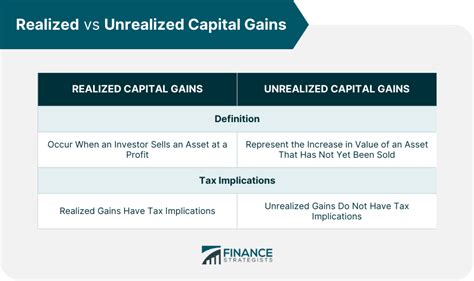

At its core, an unrealized capital gain represents the potential increase in value of an investment, be it stocks, bonds, real estate, or other assets, from the date of purchase to the current date. This gain remains “unrealized” until the asset is sold, at which point it becomes a “realized” capital gain, subject to taxation. However, the unrealized capital gain tax refers to the potential tax liability that arises from the appreciation of an asset’s value while it remains in the investor’s possession.

To illustrate, consider an investor who purchases a stock for $1000 and its value increases to $1500 over time. While the investor has yet to sell the stock and recognize the gain, the unrealized capital gain is $500. The tax liability associated with this gain is what we refer to as the unrealized capital gain tax.

It's important to note that not all countries or jurisdictions impose taxes on unrealized capital gains. For instance, the United States does not tax unrealized capital gains for individuals, but some jurisdictions, like Canada, do have provisions for taxing certain types of unrealized gains.

The Complexity of Unrealized Capital Gain Tax

The concept of unrealized capital gain tax adds a layer of complexity to financial planning, especially when considering the potential tax consequences of investment decisions. Investors must navigate the fine line between maximizing their investments’ growth and minimizing their tax liabilities. The challenge lies in understanding how changes in asset values can affect tax obligations, even before the assets are sold.

Impact on Investment Strategies

Unrealized capital gains can influence investment strategies in several ways. For instance, investors may choose to rebalance their portfolios to optimize tax efficiency, selling assets with high unrealized gains and shifting the proceeds to other investments. This strategy, often referred to as “tax-loss harvesting”, can help offset realized capital gains and reduce overall tax liabilities.

Additionally, the prospect of unrealized capital gain tax can encourage investors to explore tax-efficient investment vehicles such as retirement accounts or certain types of trusts, which may offer more favorable tax treatments for unrealized gains.

Potential Tax Liabilities

The tax implications of unrealized capital gains can be significant. For example, in jurisdictions that tax unrealized gains, investors may be required to pay taxes on the increased value of their assets annually, even if they have not sold them. This can lead to a situation where investors are paying taxes on gains they have not yet realized, which can impact their cash flow and overall financial planning.

Furthermore, the tax rates for unrealized capital gains can vary depending on the type of asset and the holding period. For instance, long-term capital gains, which are gains from assets held for over a certain period, often have lower tax rates compared to short-term gains.

| Asset Type | Holding Period | Tax Rate |

|---|---|---|

| Stocks | Long-term | 15% - 20% |

| Real Estate | Short-term | 25% - 35% |

| Bonds | Medium-term | 10% - 15% |

Strategies for Optimizing Unrealized Capital Gain Tax

Given the complexity and potential impact of unrealized capital gain tax, investors and financial advisors should consider a range of strategies to optimize their tax obligations.

Tax-Loss Harvesting

As mentioned earlier, tax-loss harvesting is a strategy that involves selling investments with losses to offset gains and reduce tax liabilities. By carefully managing their portfolios, investors can minimize their tax obligations while still maintaining their long-term investment goals.

Utilizing Tax-Efficient Accounts

Certain investment accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans, offer tax advantages that can help reduce the impact of unrealized capital gain tax. These accounts often allow for tax-free growth of investments or deferral of taxes until retirement, providing a significant advantage for long-term investors.

Estate Planning Considerations

Unrealized capital gains can also play a role in estate planning. When an asset is passed on to heirs, the tax basis of the asset is often “stepped up” to the fair market value at the time of the owner’s death. This can result in a significant reduction of unrealized capital gains and potential tax liabilities for the heirs.

Tax Strategies for Different Asset Types

The tax treatment of unrealized capital gains can vary depending on the type of asset. For instance, gains from the sale of a primary residence may be exempt from capital gains tax up to a certain amount, while gains from the sale of collectibles may be taxed at a higher rate.

Understanding the tax implications of different asset types can help investors make informed decisions about when to sell or hold onto their investments. It's essential to consult with a tax professional to ensure compliance with the relevant tax laws and regulations.

Conclusion: Navigating the Complex World of Unrealized Capital Gain Tax

The concept of unrealized capital gain tax is a critical aspect of financial planning that requires a deep understanding of tax laws and investment strategies. While it can be complex, the right strategies can help investors minimize their tax liabilities and maximize their wealth. Whether through tax-loss harvesting, utilizing tax-efficient accounts, or estate planning, there are numerous ways to optimize the impact of unrealized capital gain tax.

As always, it's crucial to consult with financial and tax professionals to ensure that your investment and tax strategies are aligned with your short-term and long-term financial goals. With the right guidance and a comprehensive understanding of unrealized capital gain tax, investors can navigate the complex world of finance with confidence and success.

What is the difference between realized and unrealized capital gains?

+

Realized capital gains refer to the profits made from selling an investment, whereas unrealized capital gains represent the potential increase in value of an investment that remains in the investor’s possession.

Do all countries tax unrealized capital gains?

+

No, not all countries tax unrealized capital gains. For instance, the United States does not tax unrealized gains for individuals, while other countries like Canada have provisions for taxing certain types of unrealized gains.

How can investors minimize their tax liabilities on unrealized capital gains?

+

Investors can minimize tax liabilities by employing strategies such as tax-loss harvesting, utilizing tax-efficient investment accounts, and carefully planning their estate to take advantage of potential stepped-up basis.

Are there any tax advantages for holding onto investments for the long term?

+

Yes, long-term capital gains often have lower tax rates compared to short-term gains. Additionally, certain tax-efficient accounts like IRAs and 401(k) plans offer tax advantages for long-term investments.

Can unrealized capital gains impact an investor’s cash flow?

+

Yes, in jurisdictions that tax unrealized gains, investors may be required to pay taxes on the increased value of their assets annually, which can impact their cash flow and financial planning.