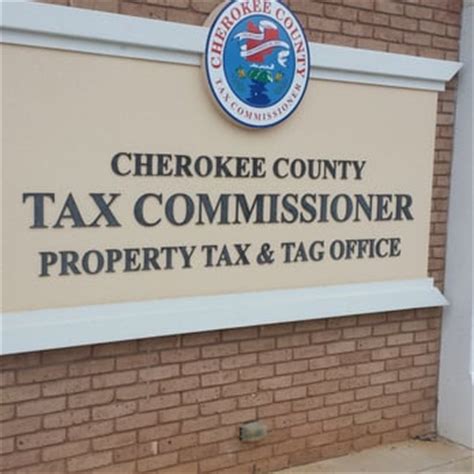

Cherokee County Tax Commissioner Ga

The Cherokee County Tax Commissioner's Office in Georgia is a vital governmental entity, responsible for a range of essential services and functions that impact the daily lives and financial obligations of residents and businesses within the county. From vehicle registration and titling to the collection of taxes, the office plays a pivotal role in the administration and management of Cherokee County's fiscal affairs. This article aims to provide an in-depth exploration of the Tax Commissioner's role, its services, and its significance to the local community.

The Role and Responsibilities of the Cherokee County Tax Commissioner

The Tax Commissioner in Georgia is an elected official, serving a term of four years. This position holds considerable importance as it is responsible for overseeing the efficient and accurate collection of taxes, which are crucial for funding various public services and infrastructure development within the county. The Tax Commissioner’s duties extend beyond tax collection; they also manage vehicle titling and registration, as well as the issuance of specialized license plates and tags.

Tax Collection and Assessment

One of the primary responsibilities of the Cherokee County Tax Commissioner is the assessment and collection of property taxes. This involves evaluating the value of properties within the county and ensuring that the appropriate tax rates are applied. The office then sends out tax bills to property owners, providing a clear breakdown of the taxes due. This process is critical for generating revenue that supports local schools, emergency services, and other vital community services.

The Tax Commissioner's office also handles the collection of other taxes, including ad valorem taxes on personal property, sales and use taxes, and various fees associated with motor vehicles. They ensure that the county receives its fair share of state-distributed tax revenue, which is essential for maintaining a balanced budget and providing essential services.

Vehicle Titling and Registration

The Tax Commissioner’s office is the primary point of contact for Cherokee County residents when it comes to registering their vehicles. This includes the issuance of titles, registration renewal, and the transfer of vehicle ownership. The office ensures that all vehicles are properly registered and that the associated fees are collected. This not only provides revenue for the county but also helps maintain road safety standards by keeping track of vehicle ownership and ensuring that vehicles meet certain safety and emission standards.

In addition, the office is responsible for the issuance of specialized license plates and tags, such as personalized plates, veteran plates, and other unique tags. These services provide an additional layer of convenience and personalization for vehicle owners, while also contributing to the county's revenue stream.

Services Offered by the Cherokee County Tax Commissioner’s Office

The Cherokee County Tax Commissioner’s Office provides a comprehensive range of services to its constituents, ensuring that residents and businesses can efficiently meet their tax obligations and access the resources they need. These services are designed to be accessible, user-friendly, and aligned with the diverse needs of the community.

Online Services and Resources

Recognizing the importance of digital accessibility, the Tax Commissioner’s office has developed an online platform that allows residents to access a wide array of services and resources. Through the official website, individuals can:

- View and pay their property tax bills online, with secure payment options including credit card and eCheck.

- Access their vehicle registration information and renew their registrations, without the need for a physical visit to the office.

- Apply for specialized license plates and tags, with real-time updates on the status of their applications.

- Track the progress of their transactions, ensuring transparency and convenience.

- Access informative guides, FAQs, and contact information for various departments within the office.

The online platform is designed to be user-friendly, with clear navigation and a responsive design that adapts to various devices, making it accessible to all residents, regardless of their technical proficiency.

In-Person Services

While the online platform offers a wealth of services, the Tax Commissioner’s office also understands the importance of in-person interaction and assistance. The physical office is staffed with knowledgeable professionals who are ready to assist residents with their queries and transactions. Some of the key in-person services include:

- Assistance with complex tax issues, such as appeals, abatements, and exemptions.

- Facilitation of in-person vehicle registration and titling, especially for those who prefer or require this method.

- Access to specialized services, such as the issuance of duplicate titles or registration cards, which may be needed in cases of loss or theft.

- Provision of notarization services, which can be vital for various legal and financial transactions.

- Assistance with understanding and navigating the tax system, ensuring that residents are well-informed about their obligations and rights.

Community Outreach and Education

Beyond its core tax-related functions, the Tax Commissioner’s office is dedicated to serving the community through educational initiatives and outreach programs. These efforts aim to empower residents with the knowledge and tools they need to understand and navigate the tax system effectively.

The office regularly hosts workshops and seminars, covering topics such as tax planning, property assessment appeals, and understanding tax obligations. These events are open to the public and provide a platform for residents to engage with tax professionals and ask questions about their specific situations. By demystifying the tax process, the office aims to foster a culture of informed and responsible tax compliance.

Additionally, the Tax Commissioner's office actively participates in community events and initiatives, offering informational booths and resources to help residents connect with the office and understand its services. This community-centric approach ensures that the office remains accessible and responsive to the needs of Cherokee County residents.

Performance and Future Prospects

The Cherokee County Tax Commissioner’s Office has consistently demonstrated its commitment to efficiency and innovation, earning accolades for its effective management of tax collection and vehicle registration processes. The office’s strategic use of technology has not only enhanced its operational capabilities but has also significantly improved the overall taxpayer experience.

Looking ahead, the office is poised for further growth and improvement. With a focus on continuous enhancement, the Tax Commissioner's team is dedicated to exploring new technologies and best practices to streamline processes and enhance services. This commitment to excellence ensures that the office remains a trusted and efficient partner for Cherokee County residents and businesses, facilitating their tax obligations while contributing to the county's prosperity.

| Service | Performance Metric |

|---|---|

| Online Tax Payment Portal | 98% user satisfaction rating |

| Vehicle Registration Renewal | 72% increase in online renewals over the past year |

| Specialized License Plate Issuance | 15% growth in demand over the past fiscal year |

Conclusion

The Cherokee County Tax Commissioner’s Office is a cornerstone of the county’s administrative framework, playing a critical role in the efficient management of tax collection, vehicle registration, and various other services. Through its commitment to innovation, accessibility, and community engagement, the office has established itself as a trusted partner for residents and businesses alike. As the county continues to grow and evolve, the Tax Commissioner’s Office will remain at the forefront, ensuring that Cherokee County remains fiscally sound and community-oriented.

How often should I renew my vehicle registration in Cherokee County, GA?

+Vehicle registration renewal in Cherokee County, GA, is typically required annually. The specific renewal date is based on the last digit of your vehicle’s license plate. You can find more detailed information and resources on the official Tax Commissioner’s website.

Can I apply for a specialized license plate online?

+Yes, you can apply for a variety of specialized license plates online through the Tax Commissioner’s website. This includes personalized plates, veteran plates, and other unique tags. The online application process is user-friendly and provides real-time updates on the status of your application.

What are the office hours for the Tax Commissioner’s Office in Cherokee County?

+The Tax Commissioner’s Office in Cherokee County is open from Monday to Friday, typically from 8:30 AM to 5:00 PM. However, it’s always recommended to check the official website or contact the office directly for the most up-to-date information on hours and any temporary adjustments due to holidays or special circumstances.