Property Tax Miami Dade County

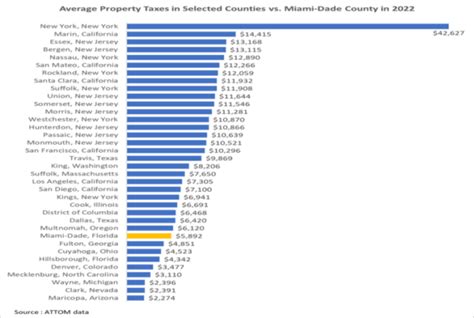

Property taxes are an essential component of the financial landscape in any county, and Miami-Dade County, Florida, is no exception. This comprehensive guide will delve into the intricacies of property taxes in Miami-Dade County, providing an in-depth analysis of the rates, assessment processes, payment methods, and the overall impact on homeowners and businesses. By understanding the property tax system, residents and investors can make informed decisions and effectively manage their financial obligations.

Understanding Property Tax in Miami-Dade County

Property tax, also known as ad valorem tax, is a significant source of revenue for local governments, including Miami-Dade County. It is calculated based on the assessed value of real estate properties, which includes land and improvements such as buildings, within the county. The revenue generated from property taxes is utilized to fund essential public services, including schools, law enforcement, fire protection, infrastructure, and more.

Assessment Process

The Miami-Dade County Property Appraiser's Office is responsible for the annual assessment of properties within the county. This process involves determining the fair market value of each property, which serves as the basis for calculating property taxes. The appraiser's office utilizes various methods, including sales comparison, cost approach, and income approach, to assess property values accurately.

Property owners receive a Notice of Proposed Property Taxes (TRIM Notice) annually, which outlines the assessed value, proposed taxes, and any exemptions or discounts applied. This notice serves as an opportunity for property owners to review the assessment and, if necessary, dispute the proposed value.

| Assessment Category | Description |

|---|---|

| Homestead Properties | Residences occupied as the primary residence are classified as homestead properties and are eligible for additional exemptions. |

| Non-Homestead Properties | Properties owned by individuals or entities but not occupied as a primary residence. |

| Commercial Properties | Businesses, office spaces, and other income-generating properties fall under this category. |

| Agricultural Properties | Land used for agricultural purposes may be assessed at a lower rate. |

Tax Rates and Calculations

Property taxes in Miami-Dade County are determined by applying a millage rate to the assessed value of the property. The millage rate is the tax rate expressed in mills, where one mill equals one-tenth of a cent or $0.001. This rate is set by various taxing authorities, including the county government, school districts, and special districts, and can vary from one area to another within the county.

The formula for calculating property taxes is as follows:

Property Tax = Assessed Value x Millage Rate

For example, if a property has an assessed value of $300,000 and the combined millage rate is 10 mills, the property tax would be calculated as:

Property Tax = $300,000 x 0.010 = $3,000

Tax Exemptions and Discounts

Miami-Dade County offers various exemptions and discounts to eligible property owners, which can significantly reduce their tax burden. These incentives are designed to promote homeownership, support seniors, and encourage investment in certain industries.

Homestead Exemption

The Homestead Exemption is one of the most significant tax benefits available to Florida residents. It provides a reduction in the assessed value of a property for homeowners who occupy their residence as their primary home. To qualify for the Homestead Exemption, homeowners must meet certain residency and ownership requirements and file an application with the Property Appraiser's Office.

The Homestead Exemption provides a $25,000 reduction in the assessed value, which translates to a substantial savings on property taxes. Additionally, Florida offers a "Save Our Homes" cap, which limits the annual increase in the assessed value of homestead properties to 3% or the Consumer Price Index (CPI), whichever is less.

Other Exemptions and Discounts

Miami-Dade County offers a range of other exemptions and discounts, including:

- Senior Exemption: Seniors aged 65 and older may qualify for an additional exemption, reducing their taxable value further.

- Widow/Widower Exemption: Surviving spouses of homeowners who qualified for the Homestead Exemption may continue to receive the exemption.

- Disability Exemption: Property owners with permanent disabilities may be eligible for an exemption, reducing their taxable value.

- Veteran's Exemption: Florida offers various exemptions and discounts to honorably discharged veterans, depending on their level of disability and other factors.

- Agricultural Exemption: Properties used for bona fide agricultural purposes may qualify for a lower assessment rate.

Payment Options and Deadlines

Property taxes in Miami-Dade County are due twice a year, with payments typically due in March and September. However, homeowners have the option to pay their taxes in full by the first installment deadline or choose to make two equal payments. Late payments may incur penalties and interest.

The Miami-Dade County Tax Collector's Office provides several convenient payment methods, including online payments, mail-in payments, and in-person payments at designated locations. Property owners can also set up automatic payments to ensure timely payment without the risk of late fees.

Escrow Accounts

Many homeowners choose to include their property taxes in their monthly mortgage payments. Lenders often establish escrow accounts, where a portion of the monthly mortgage payment is set aside to cover property taxes and insurance. This ensures that homeowners have the funds available to pay their taxes when they are due.

Impact on Homeownership and Investment

Property taxes play a crucial role in shaping the real estate market and investment landscape in Miami-Dade County. They influence the affordability of homeownership, the attractiveness of investment opportunities, and the overall economic development of the region.

Homeownership

The Homestead Exemption and other tax incentives make homeownership more affordable for residents of Miami-Dade County. By reducing the taxable value of their properties, homeowners can save significantly on their annual property tax bills. This encourages long-term residency and fosters a sense of community.

Investment Opportunities

Miami-Dade County's diverse real estate market offers various investment opportunities, from residential properties to commercial ventures. The property tax system, combined with the availability of tax exemptions and discounts, can make investment properties more attractive. Investors can analyze the potential return on investment by considering the impact of property taxes on cash flow and overall profitability.

Economic Development

Property taxes are a vital source of revenue for Miami-Dade County, funding essential public services and infrastructure development. The tax system supports the growth and maintenance of schools, healthcare facilities, public safety, and other critical community assets. By investing in these areas, the county can attract businesses, create jobs, and enhance the overall quality of life for its residents.

Frequently Asked Questions

How can I estimate my property tax in Miami-Dade County?

+You can estimate your property tax by multiplying your property's assessed value by the current millage rate. The millage rate is set annually and may vary depending on your location within the county. You can find the current millage rate on the Miami-Dade County Property Appraiser's website.

<div class="faq-item">

<div class="faq-question">

<h3>What is the deadline for paying property taxes in Miami-Dade County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Property taxes in Miami-Dade County are due twice a year. The first installment is typically due in March, and the second installment is due in September. It's important to note that there are penalties for late payments, so it's advisable to pay on time or set up automatic payments to avoid any additional fees.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I appeal my property's assessed value?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you believe your property's assessed value is inaccurate, you have the right to appeal. The process involves submitting an appeal to the Property Appraiser's Office within a specified timeframe, typically after receiving your TRIM Notice. It's recommended to gather evidence, such as recent sales data or appraisals, to support your case. You can find more information on the appeal process on the Miami-Dade County website.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax exemptions available for seniors in Miami-Dade County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Miami-Dade County offers several tax exemptions for seniors. The Senior Exemption provides a reduction in the assessed value of the property for homeowners aged 65 and older. Additionally, there are other exemptions and discounts available for seniors with certain income levels or disabilities. It's advisable to consult with the Property Appraiser's Office or a tax professional to determine your eligibility.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I pay my property taxes online in Miami-Dade County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Miami-Dade County offers online payment options for property taxes. You can visit the Miami-Dade County Tax Collector's website and create an account to make secure online payments. This convenient option allows you to pay your taxes anytime, from the comfort of your home or office.</p>

</div>

</div>

</div>