Detroit Property Tax

Welcome to this comprehensive guide on understanding and navigating the world of Detroit property taxes. As a knowledgeable expert in the field, I will take you through the ins and outs of this complex topic, providing an in-depth analysis and practical insights. Detroit, a city rich in history and culture, presents unique challenges and opportunities when it comes to property taxes. From the assessment process to payment options, we will explore every aspect to ensure you have a clear understanding of your obligations and rights as a property owner in the Motor City.

The Detroit Property Tax Landscape: An Overview

Detroit’s property tax system is a vital component of the city’s financial infrastructure, contributing significantly to its economic stability and development. It is a complex system, with various factors influencing the assessment and collection of taxes, making it essential for property owners to stay informed and engaged.

The property tax landscape in Detroit is shaped by several key elements. Firstly, the city's unique history, marked by industrial prowess and cultural vibrancy, has led to a diverse property market with a range of assessments and values. Secondly, Detroit's ongoing revitalization efforts, coupled with its urban regeneration projects, create a dynamic environment where property values can fluctuate significantly.

Additionally, the city's tax policies and regulations play a crucial role in determining the property tax obligations of its residents and businesses. Understanding these policies is key to ensuring compliance and optimizing one's financial position.

Key Takeaways:

- Detroit’s property tax system is intricate, reflecting the city’s diverse history and ongoing development.

- Property values can vary widely due to the city’s unique market dynamics and revitalization efforts.

- Staying informed about tax policies is essential for compliance and financial optimization.

Understanding Property Assessments in Detroit

Property assessments form the foundation of the Detroit property tax system. These assessments determine the value of a property, which directly influences the amount of tax owed. The assessment process in Detroit is meticulous, involving a series of steps to ensure fairness and accuracy.

The city employs a team of professional assessors who utilize various methods to determine property values. These methods include analyzing recent sales data, considering the property's location and features, and assessing its overall condition. The goal is to assign a fair market value to each property, ensuring that tax obligations are proportionate to the property's worth.

Property owners have the right to review their assessments and, if necessary, appeal them. This process ensures transparency and allows for adjustments to be made if the initial assessment is found to be inaccurate. It is crucial for property owners to stay informed about their assessment status and understand their rights during this process.

Key Insights:

- Property assessments in Detroit are comprehensive and involve a detailed analysis of various factors.

- Professional assessors employ multiple methods to determine fair market values.

- Property owners have the right to review and appeal their assessments, promoting transparency and accuracy.

Navigating the Property Tax Payment Process

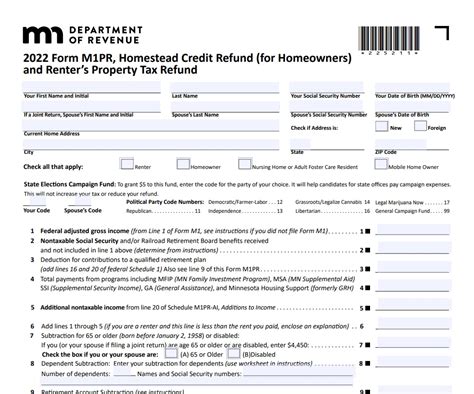

Once a property’s assessment is finalized, the tax payment process comes into play. Detroit offers a range of options to make property tax payments, catering to different preferences and needs. Understanding these options is crucial to ensure timely and efficient payments.

Property owners can choose from traditional methods such as mailing checks or paying in person at designated locations. These methods provide a sense of familiarity and security for those who prefer more tangible transactions. However, Detroit also embraces modern payment options, allowing taxpayers to utilize online platforms and mobile applications for a more convenient and efficient experience.

Additionally, the city provides resources and support to assist property owners with the payment process. This includes clear guidelines, payment schedules, and even installment plans for those who may require more flexible arrangements. By offering a variety of options and support, Detroit aims to make the tax payment process as seamless as possible for its residents and businesses.

Key Considerations:

- Detroit offers a range of payment methods, including traditional and digital options, to cater to diverse preferences.

- Resources and support are available to guide property owners through the payment process.

- Installment plans provide flexibility for those who require alternative payment arrangements.

Exploring Tax Relief and Incentives

Detroit recognizes the importance of supporting its residents and businesses, especially in the context of property taxes. As such, the city offers a range of tax relief programs and incentives to ease the financial burden and promote growth.

These initiatives include tax credits, abatements, and exemptions, each designed to benefit specific groups or situations. For instance, senior citizens and individuals with disabilities may be eligible for reduced tax obligations, providing much-needed financial relief. Similarly, businesses investing in Detroit's economic development may qualify for incentives that encourage growth and job creation.

Furthermore, Detroit actively promotes its tax relief programs to ensure that eligible residents and businesses are aware of their options. This includes outreach efforts, educational campaigns, and easy-to-access resources, ensuring that no one misses out on these valuable opportunities.

Key Benefits:

- Detroit offers a range of tax relief programs and incentives to support residents and businesses.

- These initiatives provide financial relief and encourage economic development.

- Outreach and educational efforts ensure that eligible parties are aware of their options.

The Future of Detroit Property Taxes

As Detroit continues its journey of revitalization and growth, the property tax system is likely to evolve alongside it. The city’s ongoing efforts to streamline processes, enhance transparency, and promote fairness will shape the future of property taxes.

Looking ahead, Detroit aims to leverage technology to further improve the tax assessment and payment processes. This includes implementing advanced data analytics to refine assessments and exploring digital payment options to enhance convenience and security. Additionally, the city plans to continue its commitment to providing support and resources to ensure that property owners have the tools they need to navigate the tax landscape effectively.

Moreover, Detroit's future tax policies will likely continue to support its residents and businesses, fostering an environment conducive to growth and prosperity. By staying adaptable and responsive to the needs of its community, Detroit can ensure that its property tax system remains a catalyst for positive change.

Key Projections:

- Detroit’s property tax system will continue to evolve, driven by technological advancements and a commitment to fairness.

- The city’s focus on support and resources will ensure property owners have the guidance they need.

- Future tax policies will likely continue to promote growth and prosperity for Detroit’s residents and businesses.

| Key Tax Relief Programs | Eligibility |

|---|---|

| Senior Citizen Tax Exemption | Individuals aged 65 and above with limited income |

| Homestead Property Tax Credit | Primary residence owners |

| Business Tax Incentives | Businesses investing in Detroit's economic development |

How often are property assessments conducted in Detroit?

+

Property assessments in Detroit are typically conducted every other year. However, the city reserves the right to conduct additional assessments if there are significant changes to a property or if it is deemed necessary for accuracy.

What happens if I disagree with my property assessment?

+

If you believe your property assessment is inaccurate, you have the right to appeal. The process involves submitting documentation and evidence to support your case. The city’s assessment board will review your appeal and make a decision.

Are there any online resources to assist with property tax payments in Detroit?

+

Yes, Detroit provides an online portal for property tax payments. You can access this portal through the city’s official website, where you can make payments, view your account details, and manage your tax obligations digitally.