Fairfax County Real Estate Taxes

Understanding real estate taxes is crucial for homeowners, especially in dynamic areas like Fairfax County, Virginia. These taxes play a significant role in property ownership and can significantly impact an individual's financial planning. This article aims to provide an in-depth analysis of Fairfax County's real estate tax system, offering insights into how it works, its impact on homeowners, and the strategies to manage these taxes effectively.

The Fundamentals of Fairfax County Real Estate Taxes

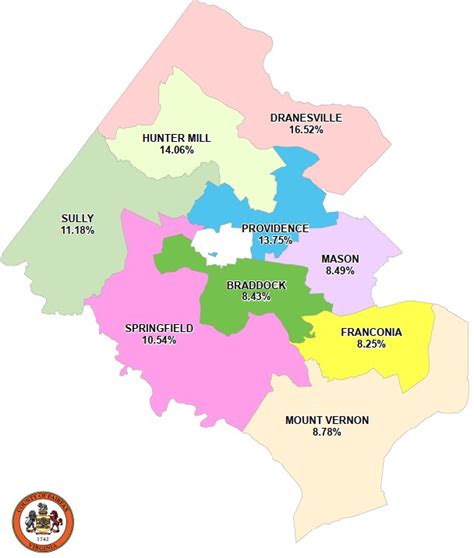

Fairfax County, known for its vibrant communities and diverse neighborhoods, employs a straightforward yet comprehensive real estate tax system. The tax, levied annually, is calculated based on the assessed value of a property, ensuring that homeowners contribute to the county’s overall development and maintenance.

The assessment process is conducted by the Fairfax County Department of Tax Administration (DTA), which determines the Fair Market Value (FMV) of each property. This value is then subjected to a uniform assessment ratio to arrive at the Assessed Value, which forms the basis for calculating the real estate tax.

Assessment Process and Timing

Fairfax County follows a well-defined schedule for property assessments. The DTA conducts a comprehensive reassessment every four years, with the next reassessment slated for 2024. During these reassessments, the DTA analyzes market trends, property sales, and other relevant factors to ensure that the assessed values accurately reflect the current real estate market.

In the interim years, the DTA conducts an annual adjustment to account for any significant changes in property values that may occur. This process ensures that the assessed values remain up-to-date and fair, providing stability for both homeowners and the county's revenue stream.

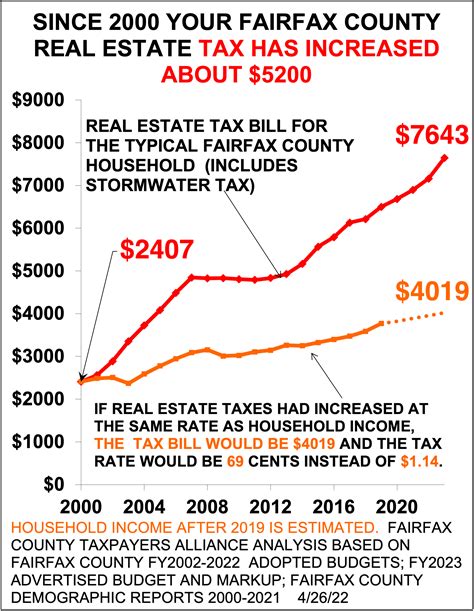

Real Estate Tax Rates

The real estate tax rate in Fairfax County is established by the Fairfax County Board of Supervisors. This rate is expressed in dollars per hundred dollars of assessed value and is applied uniformly across the county. For the fiscal year 2023-2024, the general real estate tax rate is set at 1.15</strong>, while the special real estate tax rate for schools stands at <strong>0.116. This means that for every 100 of assessed value, homeowners pay 1.266 in real estate taxes.

| Tax Category | Rate ($/100 of Assessed Value) |

|---|---|

| General Real Estate Tax | $1.15 |

| Special Real Estate Tax (Schools) | $0.116 |

Understanding the Impact of Real Estate Taxes

Real estate taxes can significantly influence a homeowner’s financial outlook and planning. Here’s a breakdown of their impact:

Financial Considerations

For homeowners, real estate taxes are a significant annual expense. The amount can vary widely depending on the property’s assessed value, with higher-value properties incurring higher taxes. This expense must be factored into a homeowner’s budget, especially for those on a fixed income.

Home Equity and Value

Real estate taxes are directly linked to a property’s assessed value, which in turn influences its market value. A well-maintained property with a higher assessed value may result in increased taxes, but it also contributes to the overall home equity. Homeowners should view real estate taxes as an investment in their property’s long-term value.

Community Development and Services

Real estate taxes are a vital source of revenue for Fairfax County, funding essential services and infrastructure development. These taxes contribute to maintaining and improving public schools, parks, roads, and other amenities that enhance the quality of life for residents.

Strategies for Managing Real Estate Taxes

Understanding the real estate tax system is the first step; managing these taxes effectively is the next. Here are some strategies to consider:

Stay Informed

Keep abreast of changes in real estate tax rates and assessment processes. The Fairfax County DTA website provides valuable resources, including tax rates, assessment schedules, and information on tax relief programs. Being informed allows homeowners to budget effectively and plan for any potential increases.

Appeal the Assessment

Homeowners who believe their property’s assessed value is inaccurate can appeal to the Fairfax County Board of Equalization. This process involves providing evidence, such as recent sales data of comparable properties, to support the appeal. Successful appeals can result in a reduced assessed value and lower real estate taxes.

Utilize Tax Relief Programs

Fairfax County offers several tax relief programs to assist eligible homeowners. These programs include the Real Estate Tax Relief for the Elderly and Disabled, which provides a credit based on income and age, and the Homestead Exemption, which reduces the assessed value of a primary residence. Understanding these programs and their eligibility criteria can help homeowners save on real estate taxes.

Explore Tax Deductions

Real estate taxes are often deductible on federal and state tax returns. Consult with a tax professional to understand the potential deductions and how to maximize tax benefits associated with property ownership.

Conclusion: A Comprehensive Tax Strategy

Fairfax County’s real estate tax system is designed to be fair and transparent, ensuring that homeowners contribute equitably to the county’s development. By understanding the assessment process, tax rates, and their impact, homeowners can effectively manage their real estate taxes. The strategies outlined above provide a roadmap for homeowners to navigate the tax landscape, ensuring they can enjoy the benefits of homeownership while contributing to their community’s growth.

When are real estate tax bills issued in Fairfax County?

+

Real estate tax bills are typically issued twice a year in Fairfax County. The first half is due by March 1st, and the second half is due by September 15th. Late payments may incur interest and penalties.

How can I estimate my real estate taxes before receiving the official bill?

+

You can estimate your real estate taxes by multiplying your property’s assessed value by the current tax rate. For example, if your property’s assessed value is 300,000 and the tax rate is 1.266, your estimated tax would be $3,800.

Are there any exemptions or discounts available for real estate taxes in Fairfax County?

+

Yes, Fairfax County offers several tax relief programs, including the Real Estate Tax Relief for the Elderly and Disabled and the Homestead Exemption. These programs provide eligible homeowners with credits or reduced assessed values, resulting in lower real estate taxes. It’s important to review the eligibility criteria and apply accordingly.

Can I appeal my property’s assessed value if I believe it is inaccurate?

+

Absolutely. If you feel your property’s assessed value is incorrect, you have the right to appeal to the Fairfax County Board of Equalization. The appeal process requires you to provide evidence, such as recent sales data of comparable properties, to support your claim. A successful appeal can lead to a reduced assessed value and lower real estate taxes.

How often are properties reassessed for real estate tax purposes in Fairfax County?

+

Fairfax County conducts a comprehensive reassessment of all properties every four years. The next reassessment is scheduled for 2024. In the interim years, the county conducts annual adjustments to account for any significant changes in property values. This ensures that the assessed values remain fair and up-to-date.