Income Tax In Ohio Calculators

Ohio's income tax system, though seemingly straightforward, can present unique complexities for residents and businesses alike. With a flat tax rate, the state's income tax system may appear simple on the surface, but delving deeper reveals a range of factors that can influence your tax obligations.

This comprehensive guide aims to demystify the income tax landscape in Ohio, offering an in-depth analysis of tax rates, deductions, and credits available to individuals and businesses. By understanding these nuances, taxpayers can make more informed decisions and potentially minimize their tax liabilities.

Understanding Ohio’s Income Tax Rates and Brackets

Ohio operates on a flat income tax rate, which means all taxpayers, regardless of their income level, are subject to the same rate. As of the 2023 tax year, the flat rate stands at 2.8% for both residents and non-residents. This rate applies to all taxable income earned or received in the state.

While a flat tax rate simplifies calculations, it's important to note that Ohio also imposes a School District Income Tax (SDIT). This tax varies by school district and can range from 0% to 3.375%, with the average rate being around 1.2%. SDIT is levied on top of the state's flat rate, making the effective tax rate for some taxpayers higher than the standard 2.8%.

The table below provides an overview of Ohio's tax rates and brackets for the current tax year.

| Tax Rate | Taxable Income Range |

|---|---|

| 2.8% | $0 - $10,000,000 |

For taxpayers with income exceeding $10 million, the tax rate remains the same, but the income is taxed at a higher rate due to the progressive nature of the tax system. This means that as your income increases, you pay a higher effective tax rate, despite the flat tax rate structure.

Income Tax Brackets for Ohio Residents

Ohio uses a single income tax bracket for all taxpayers, which simplifies the tax calculation process. However, it’s worth noting that the tax brackets can change annually based on legislative decisions and economic factors. It’s always advisable to refer to the Ohio Department of Taxation’s official website for the most up-to-date information on tax rates and brackets.

The flat tax rate of 2.8% applies to all income earned or received in Ohio, including wages, salaries, bonuses, tips, commissions, and most types of self-employment income. However, certain types of income, such as certain types of public assistance and military combat pay, are exempt from Ohio income tax.

Ohio’s Taxable Income and Deductions

When calculating your Ohio income tax liability, it’s crucial to understand what constitutes taxable income in the state. Taxable income includes all income from various sources, such as wages, salaries, bonuses, tips, commissions, and self-employment income. However, Ohio provides several deductions and exemptions that can reduce your taxable income and potentially lower your tax liability.

Common Deductions and Exemptions in Ohio

- Standard Deduction: Ohio offers a standard deduction of 5,600</strong> for single filers and <strong>11,200 for married couples filing jointly for the 2023 tax year. This deduction reduces your taxable income, lowering your overall tax liability.

- Itemized Deductions: Taxpayers have the option to claim itemized deductions instead of the standard deduction if their total itemized expenses exceed the standard deduction amount. Common itemized deductions include medical expenses, charitable contributions, state and local taxes, and mortgage interest.

- Retirement Savings Deductions: Ohio allows taxpayers to deduct contributions to certain retirement plans, such as 401(k)s and IRAs, from their taxable income. This can provide significant tax savings for those saving for retirement.

- Exemptions: Ohio provides personal exemptions for taxpayers and their dependents. For the 2023 tax year, the personal exemption amount is $1,200 per person. This exemption further reduces your taxable income, benefiting taxpayers with multiple dependents.

It's important to note that Ohio's tax laws can change annually, so it's advisable to consult the latest tax guides and resources provided by the Ohio Department of Taxation to ensure you're taking advantage of all available deductions and exemptions.

Ohio’s Tax Credits and Incentives

In addition to deductions, Ohio offers a range of tax credits that can further reduce your tax liability. These credits are designed to encourage specific behaviors or support certain groups of taxpayers. Some of the key tax credits available in Ohio include:

Tax Credits for Individuals and Families

- Earned Income Tax Credit (EITC): The EITC is a refundable federal tax credit for low- to moderate-income working individuals and families. Ohio has its own version of the EITC, which provides a state-level credit for eligible taxpayers. This credit can significantly reduce your tax liability or even result in a refund.

- Child and Dependent Care Tax Credit: Ohio offers a tax credit for childcare expenses incurred to allow parents to work or attend school. This credit can offset some of the costs associated with childcare, providing financial relief to working families.

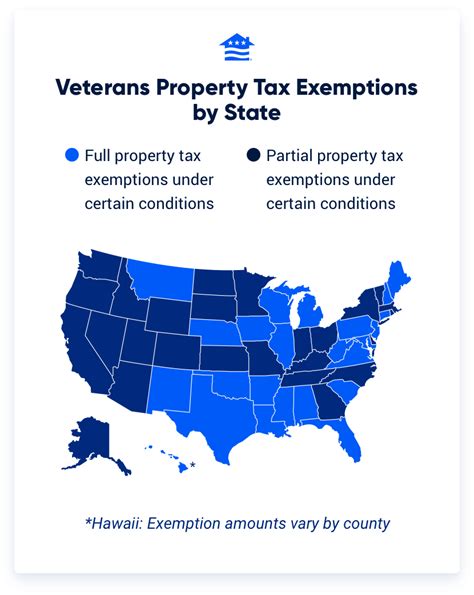

- Homestead Exemption: Ohio provides a tax exemption for homeowners aged 65 and older, disabled veterans, and surviving spouses of disabled veterans. This exemption reduces the taxable value of the homeowner’s property, resulting in lower property taxes.

Business Tax Credits and Incentives

- Research and Development Tax Credit: Ohio encourages businesses to invest in research and development by offering a tax credit for qualified research expenses. This credit can significantly reduce a company’s tax liability and encourage innovation.

- Job Creation Tax Credit: To attract and retain businesses, Ohio offers a tax credit for job creation. This credit provides a tax incentive to companies that create new jobs in the state, helping to stimulate the economy and promote job growth.

- Film Production Tax Credit: Ohio aims to boost its film industry by offering a tax credit for qualified film and digital media production expenses. This credit can cover a portion of the production costs, making Ohio an attractive location for film productions.

Ohio's tax credits and incentives are regularly updated to align with the state's economic goals and priorities. It's crucial for taxpayers, especially businesses, to stay informed about these incentives to maximize their tax savings and support Ohio's economic growth.

Calculating Your Ohio Income Tax

Calculating your Ohio income tax liability involves a straightforward process, given the state’s flat tax rate. However, it’s important to account for any applicable deductions, exemptions, and tax credits to ensure an accurate calculation.

Step-by-Step Guide to Calculating Ohio Income Tax

- Determine Taxable Income: Start by calculating your total taxable income for the year. This includes all income sources, such as wages, salaries, self-employment income, and any other taxable income. Subtract any applicable deductions and exemptions to arrive at your taxable income.

- Apply Tax Rate: Multiply your taxable income by Ohio’s flat tax rate of 2.8% to calculate your base tax liability. This calculation provides a starting point for your tax obligation.

- Consider School District Income Tax (SDIT): Remember that SDIT is levied in addition to the state’s flat rate. You’ll need to determine the SDIT rate for your specific school district and add it to your base tax liability to arrive at your total Ohio income tax liability.

- Apply Tax Credits: Finally, subtract any applicable tax credits from your total tax liability. Ohio offers various tax credits, such as the Earned Income Tax Credit, Child and Dependent Care Tax Credit, and others, which can significantly reduce your tax bill.

It's crucial to consult the official Ohio income tax forms and guidelines for the most accurate and up-to-date information on calculating your income tax. The Ohio Department of Taxation provides detailed instructions and resources to ensure taxpayers can navigate the process smoothly.

Frequently Asked Questions (FAQ)

How often do Ohio’s tax rates and brackets change?

+Ohio’s tax rates and brackets can change annually, typically as a result of legislative decisions or economic factors. It’s advisable to refer to the Ohio Department of Taxation’s official website for the most current information.

Are there any income thresholds for the standard deduction in Ohio?

+No, Ohio’s standard deduction is available to all taxpayers, regardless of their income level. However, if your total itemized deductions exceed the standard deduction amount, you may opt for itemized deductions instead.

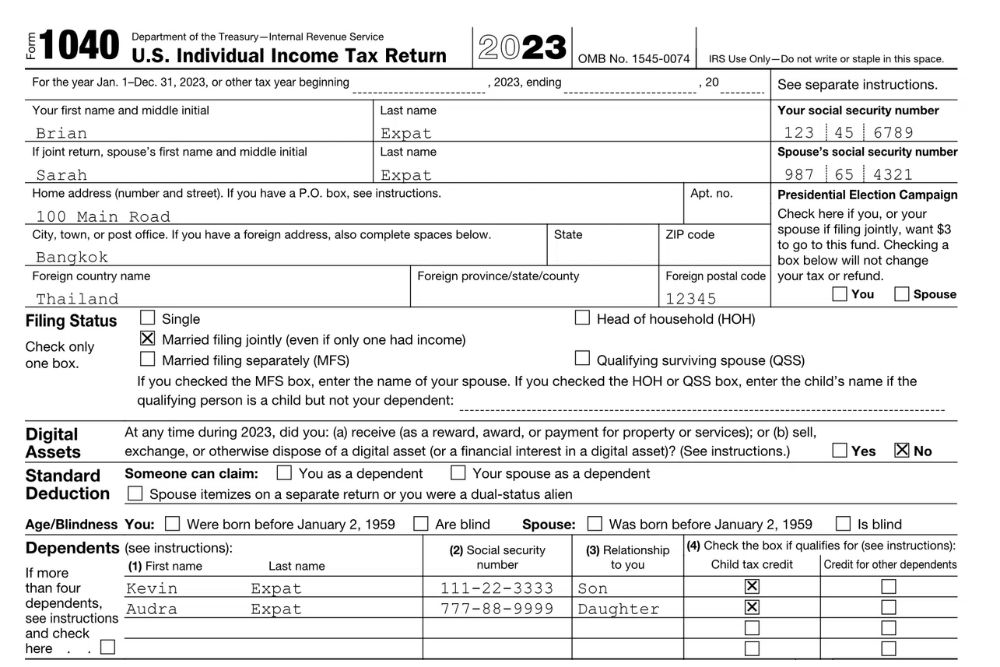

Can non-residents who work in Ohio claim tax credits or deductions?

+Non-residents who earn income in Ohio are subject to Ohio income tax. They can claim the same deductions and credits as residents, provided they meet the eligibility criteria. However, they may also need to file a non-resident tax return in their home state.

How can I maximize my tax savings in Ohio?

+To maximize tax savings, it’s important to understand all the deductions, exemptions, and credits available to you. Consult a tax professional or use tax preparation software to ensure you’re taking advantage of every opportunity to reduce your tax liability.

Ohio's income tax system, while relatively straightforward, offers a range of deductions, exemptions, and credits that can significantly impact your tax liability. By understanding these nuances and staying informed about tax law changes, you can make the most of your tax obligations and potentially reduce your tax burden.