Understanding Property Car Tax VA: A Simple Guide

When it comes to owning a vehicle in Virginia, understanding property car tax is essential for responsible fiscal planning and compliance. Despite its straightforward appearance, this form of taxation unfolds as a complex tapestry woven with historical roots, legislative nuances, and practical implications that can influence car owners' financial health. As vehicle ownership continues to grow alongside the state’s expanding economy, grasping the intricacies of VA property car tax becomes increasingly vital for residents, tax professionals, and policymakers alike.

Origins and Evolution of Property Car Tax in Virginia

The genesis of property tax on vehicles in Virginia dates back to the early 20th century, aligning with broader trends in state and local taxation policies aimed at funding infrastructure and public services. Unlike traditional real estate taxes that focus on immovable property, property car tax emerged as a mechanism to treat personal mobility assets as contributory entities within the tax base. Over the decades, legislative amendments have refined how these taxes are calculated, appraised, and enforced, reflecting shifts in economic priorities and technological advancements.

Initially, vehicle taxes in VA were relatively lenient, often based on flat rates or crude valuations. As vehicle technology evolved—introducing hybrid, electric, and autonomous vehicles—the valuation frameworks expanded, incorporating more dynamic parameters. This evolution signified a move toward a more equitable taxation system that considers vehicle depreciation, usage, and environmental impact, aligning fiscal policies with contemporary transportation trends.

Fundamentals of Property Car Tax in Virginia

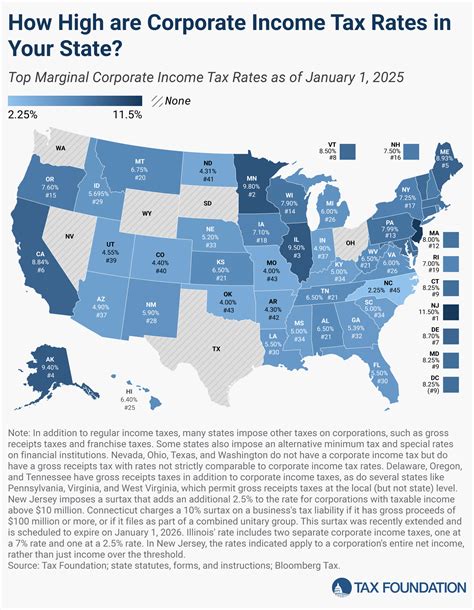

Virginia’s property tax on vehicles functions as an ad valorem tax, meaning it is based on the assessed value of the vehicle rather than a flat fee. This approach aligns with the broader tax philosophy of equitability, ensuring that owners of more valuable cars contribute proportionally more to local revenues. The tax is typically assessed annually, with the Department of Motor Vehicles (DMV) and local assessors working conjointly to determine current vehicle valuations.

Assessment Process and Valuation Methodologies

The assessment process incorporates multiple methodologies, primarily focusing on either fair market value or a standardized depreciation schedule. Local assessors may use private vehicle valuation databases, such as Kelley Blue Book and NADA Guides, to estimate the current market value. Additionally, vehicle-specific factors—such as make, model, year, mileage, condition, and modifications—are analyzed to refine the valuation. Some jurisdictions also apply a tiered tax rate depending on vehicle categories, like passenger cars, trucks, or specialized vehicles.

| Relevant Category | Substantive Data |

|---|---|

| Average Vehicle Valuation | $15,000 to $25,000 based on market data |

| Tax Rate Range | $0.40 to $4.00 per $100 of assessed value depending on locality |

Local Variations and Jurisdictional Specifics

Virginia’s property car tax is administered at the local level, resulting in a patchwork of regulations, rates, and exemptions. Each county or municipality holds authority to set their own assessment schedules and tax rates within state legal frameworks. For instance, Fairfax County’s tax rate might differ slightly from Arlington or Loudoun County, reflecting regional economic conditions and budgetary needs.

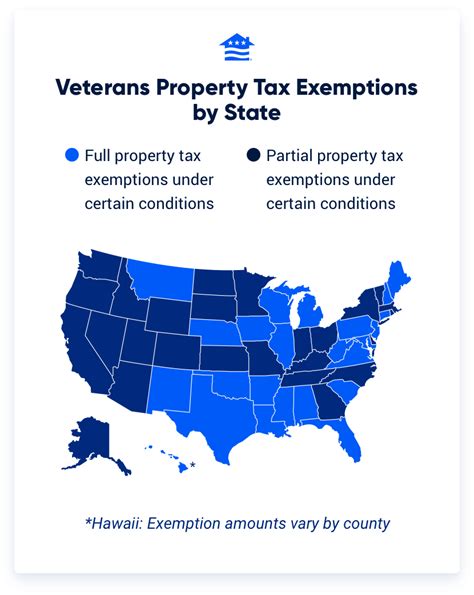

Tax Exemptions and Special Considerations

Despite its broad application, certain vehicles or owner categories qualify for exemptions or reductions. Common exemptions include vehicles owned by disabled persons, veterans, or nonprofit organizations. Additionally, specific vehicle types—such as historic cars, certain agricultural vehicles, or those used solely for farm work—may receive partial or complete relief.

| Relevant Category | Substantive Data |

|---|---|

| Exemption Types | Veterans, disabled persons, nonprofit vehicles |

| Exemption Value | Varies; often full exemption for qualifying vehicles |

| Application Process | Submission of documentation to local assessor’s office annually |

Calculating and Paying Vehicle Property Tax in Virginia

Calculating the property tax involves multiplying the assessed value of the vehicle by the local tax rate and applying any available exemptions. The process is simplified by online portals maintained by county offices, which often provide estimation tools. Most billings are sent out in the first quarter, with due dates typically between April and June.

Payment Methods and Penalties

Taxpayers can generally pay via online transfer, check, or in-person at local offices. Failure to pay on time incurs penalties—usually a percentage of the owed amount—and interest accrues on unpaid balances. Persistent delinquents risk vehicle registration holds or eventual lien placements, accentuating the importance of timely compliance.

| Relevant Metric | Actual Value with Context |

|---|---|

| Average Annual Property Tax | $150 to $600 depending on assessed value and local rate |

| Late Payment Penalty | 10% of overdue amount plus monthly interest of 1% |

Appeals and Dispute Resolution

When disagreements occur regarding valuation or exemption eligibility, vehicle owners can appeal through local assessments boards. Virginia law provides a clear procedural pathway: initial appeal to the local assessor, followed by a formal hearing if necessary, and finally a judicial review in circuit courts. Documentation supporting current market value or exemption criteria is crucial to successful appeals.

Case Studies of Notable Disputes

Recent cases reflect challenges in valuation accuracy, especially with high-end luxury vehicles or electric cars. In some instances, owners have argued for more reflective valuations based on recent sales data, resulting in adjusted assessments and lower tax bills. These disputes underline the importance of meticulous documentation and awareness of local valuation methodologies.

Future Trends and Policy Considerations

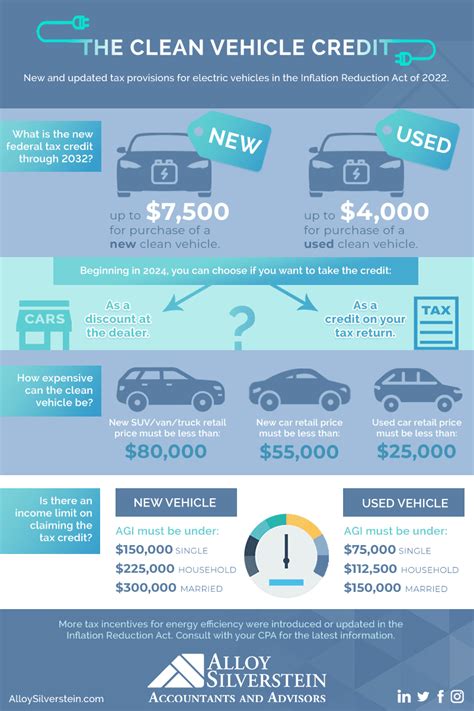

The landscape of property car tax in Virginia is poised for transformation as technological innovation and environmental policies reshape transportation. The rise of electric vehicles (EVs) and hybrid models prompts reevaluation of valuation metrics, as these vehicles often have higher initial costs but lower depreciation rates. Some jurisdictions are contemplating mileage-based taxes or green levies, adding layers of complexity to traditional property taxation.

Environmental Impact and Tax Policy Shifts

Incentivizing environmentally friendly vehicles through tax adjustments could include reduced assessments or credits for EV owners. Conversely, road maintenance costs associated with larger or heavier vehicles are scrutinized for equitable fiscal contribution. Policymakers are actively debating these models, striving for a balance between encouraging innovation and sustaining revenue streams.

| Relevant Policy | Potential Impact |

|---|---|

| Electric Vehicle Tax Adjustment | Potential reduction in assessed value; increased incentives for EV ownership |

| Weight-based Road Usage Fees | Supplemental revenue stream, especially for trucks and commercial vehicles |

Practical Guidance for Virginia Vehicle Owners

For vehicle owners navigating property tax responsibilities, a proactive approach is paramount. Regularly reviewing assessments, staying informed about local legislative changes, and engaging in community dialogues can prevent surprises during tax season. Investing in accurate valuation appraisals and leveraging online resources streamlines this process and minimizes disputes.

Best Practices for Managing Property Car Tax

First, verify the assessed value each year and maintain comprehensive vehicle records. Second, monitor local rate adjustments—these can fluctuate based on regional budgets or policy shifts. Third, consider consulting tax professionals or legal advisors for complex disputes or exemption applications. Lastly, participate in local tax forums or town hall meetings to stay ahead of upcoming policy changes.

Concluding Reflection

The landscape of property car tax in Virginia encapsulates a nuanced interplay between tradition and innovation, equity and practicality. While rooted in historical taxation principles, it adapts continually to address the evolving complexities of vehicle technologies, regional policies, and environmental priorities. Navigating this terrain requires awareness, strategic planning, and active engagement—tools that empower vehicle owners to fulfill their fiscal obligations while optimizing their financial health.

How is the assessed value of my vehicle determined in VA?

+The assessed value combines market data, vehicle condition, make, model, and depreciation schedules. Local assessors use databases like Kelley Blue Book or NADA Guides to establish a fair market value, which is then adjusted for regional factors and specific vehicle details.

Are there exemptions available for certain vehicle owners?

+Yes, exemptions are available for disabled individuals, veterans, nonprofit organizations, and specific vehicle types like historic or agricultural vehicles. Owners must submit documentation annually to qualify.

What should I do if I disagree with my vehicle’s valuation?

+Begin by reviewing your valuation, gather supporting sales data, and file an appeal with your local assessments board. If unresolved, escalate to a judicial review in circuit court, ensuring all documentation is comprehensive and timely.