Tax Identity Theft

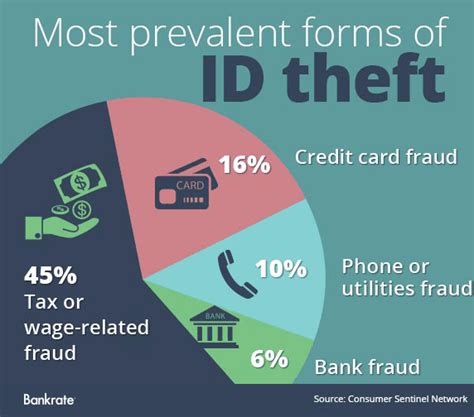

Tax identity theft is a serious and growing concern in the realm of financial crime, impacting individuals and businesses alike. This form of identity theft involves the misuse of personal information, such as Social Security numbers and birth dates, to file fraudulent tax returns and claim refunds. The implications of tax identity theft are far-reaching, causing financial losses, emotional distress, and significant challenges in resolving the aftermath.

In this comprehensive guide, we delve into the intricacies of tax identity theft, exploring its mechanisms, impact, and the measures individuals and organizations can take to protect themselves. Through real-world examples and expert insights, we aim to raise awareness, provide practical prevention strategies, and offer guidance on navigating the complex process of recovering from tax-related identity theft.

Understanding Tax Identity Theft: Mechanisms and Impact

Tax identity theft is a sophisticated crime that often goes unnoticed until the damage is done. Criminals employ various methods to obtain personal information, including phishing attacks, data breaches, and even old-fashioned stealing of mail or documents. Once they have the necessary details, they file tax returns under the victim’s name, often claiming large refunds by falsifying income and deductions.

The impact of tax identity theft can be devastating. Victims may face financial losses, legal issues, and significant challenges in clearing their names and restoring their creditworthiness. The process of resolving tax identity theft is complex and time-consuming, requiring extensive documentation and communication with tax authorities.

Real-World Example: The Smith Family’s Story

Imagine the Smith family, a hardworking couple with two children. One day, they receive a notice from the Internal Revenue Service (IRS) stating that they have a tax liability and must pay a substantial amount. Confused, they contact the IRS and discover that someone has filed a fraudulent tax return using their identities, claiming refunds for several years. The Smiths now face the daunting task of proving their innocence, rectifying their tax records, and potentially dealing with legal consequences.

| Year | Fraudulent Claims |

|---|---|

| 2022 | $15,000 |

| 2021 | $12,500 |

| 2020 | $8,000 |

This example highlights the real-life consequences of tax identity theft, where victims not only lose money but also endure emotional stress and the hassle of untangling the mess created by identity thieves.

Prevention Strategies: Fortifying Your Tax Data Security

Preventing tax identity theft requires a proactive approach and a comprehensive understanding of the risks. Here are some essential strategies to safeguard your tax-related information:

Secure Your Personal Information

Treat your personal information, especially Social Security numbers and birth dates, with utmost care. Avoid sharing sensitive details online or over the phone unless you are certain of the recipient’s identity and the security of the communication channel.

Protect Your Mail and Documents

Be vigilant about your mail. Consider using a locked mailbox or renting a P.O. box to ensure that important documents, such as tax forms and W-2s, are secure. Shred any documents containing personal information before discarding them.

Practice Safe Online Behavior

When filing taxes online, ensure you are using a secure connection and a reputable tax preparation software or service. Avoid public Wi-Fi for sensitive financial transactions. Regularly update your antivirus software and be cautious of phishing attempts, which are common methods used to steal personal data.

Monitor Your Tax Records

Stay informed about your tax situation. Regularly check your tax transcripts and monitor your credit report for any unusual activities. Early detection can be crucial in preventing further damage.

The Aftermath: Navigating Recovery from Tax Identity Theft

If you fall victim to tax identity theft, the road to recovery can be arduous. It requires patience, persistence, and a systematic approach to rectify the situation. Here’s a step-by-step guide to help you navigate the recovery process:

Report the Incident

Contact the IRS immediately if you suspect tax identity theft. They have dedicated resources to assist victims and can guide you through the necessary steps. You may need to file a report with your local law enforcement agency as well.

Freeze Your Credit

Consider placing a credit freeze on your accounts to prevent further fraudulent activities. This will restrict access to your credit report, making it more difficult for identity thieves to open new accounts in your name.

Document and Gather Evidence

Keep a detailed record of all communications and documents related to the incident. This will be crucial when working with the IRS and other authorities to resolve the issue. Gather as much evidence as possible to support your case.

Work with the IRS and Tax Authorities

Collaborate closely with the IRS and any relevant tax authorities to rectify your tax records. Provide all the necessary documentation and follow their instructions. It may be a lengthy process, but persistence is key.

Seek Legal Advice

In more complex cases, consider consulting a lawyer who specializes in identity theft and tax law. They can provide tailored guidance and represent your interests if legal proceedings are necessary.

Future Implications and Emerging Trends

Tax identity theft is an evolving threat, and criminals are constantly adapting their tactics. As technology advances, so do the methods used to steal personal information. Here are some emerging trends and future implications to consider:

Artificial Intelligence and Machine Learning

Criminals are leveraging AI and machine learning to automate their attacks, making them more efficient and harder to detect. This includes using AI to generate convincing phishing emails and customize attack strategies based on individual profiles.

Data Breaches and Dark Web Markets

The illegal trade of personal information on the dark web is a significant concern. Data breaches at large organizations can expose vast amounts of sensitive data, making it easier for identity thieves to acquire the information they need.

Pretexting and Social Engineering

Identity thieves are becoming more sophisticated in their social engineering tactics. They may use pretexting, a technique where they pose as someone else to gain access to personal information, such as calling your bank while pretending to be you.

Mobile and Cloud Security Risks

With the increasing use of mobile devices and cloud-based services for tax-related tasks, new vulnerabilities emerge. Ensuring the security of these platforms is crucial to prevent unauthorized access to tax data.

Conclusion: Empowering Protection and Recovery

Tax identity theft is a complex and challenging issue, but with the right knowledge and proactive measures, individuals and businesses can significantly reduce their risk of falling victim. By understanding the mechanisms, impact, and emerging trends, we can fortify our defenses and take control of our financial well-being.

Through this comprehensive guide, we hope to have provided valuable insights and practical strategies to protect against tax identity theft. Remember, awareness, vigilance, and a proactive approach are key to safeguarding your tax data and financial future.

How can I recognize if my tax information has been compromised?

+Signs of potential tax identity theft include receiving notices from the IRS about unpaid taxes or refunds you didn’t claim, unexpected changes in your filing status, or being unable to e-file due to a return already being submitted in your name.

What steps should I take if I suspect tax identity theft?

+If you suspect tax identity theft, contact the IRS immediately. They have a dedicated Identity Theft Central line to assist victims. Additionally, consider freezing your credit and monitoring your tax records for any unusual activities.

Can I recover my money if I become a victim of tax identity theft?

+Yes, you can recover your money if you become a victim of tax identity theft. The process involves working closely with the IRS and providing evidence to support your case. It may take time, but with persistence, you can reclaim your rightful refunds.