Mastering the Contractor Tax Form for Seamless Tax Filing

Tax season often triggers a mix of anticipation and anxiety among contractors navigating a complex web of financial obligations and regulatory forms. Among these, the contractor-specific tax form—commonly called the Schedule C or Form 1099-NEC—can pose significant challenges, especially for those unfamiliar with the intricacies of self-employment taxation and IRS requirements. Despite widespread misconceptions, mastering the subtleties of the contractor tax form is not only achievable but essential for ensuring compliance, maximizing deductions, and avoiding costly penalties. This comprehensive analysis aims to demystify the process, bust myths, and provide expert insights for contractors seeking a seamless tax filing experience.

Debunking Common Myths About Contractor Tax Forms

Before diving into the technicalities, it’s vital to address prevalent misconceptions that can lead to confusion, overlooked deductions, or even legal repercussions. Misunderstandings abound, partly fueled by oversimplified advice or outdated information from non-expert sources.

Myth 1: Filing as a contractor is inherently more complicated than salaried employment

This belief persists because contractors must often handle their own taxes, including quarterly estimates and deductions. However, complexity depends significantly on preparation and understanding. With proper record-keeping, the process can become routine. Technical tools like accounting software and professional consultation substantially reduce the perceived difficulty, rendering the process manageable rather than burdensome.

Myth 2: The contractor tax form is just a simplified version of the employee W-2 form

While the W-2 reports employee wages, contractors primarily use Schedule C (Profit or Loss from Business) attached to their Form 1040. The Schedule C encompasses income, expenses, and deductions pertinent to self-employed work—certainly more detailed, but essential for capturing the full scope of a contractor’s financial activities.

Myth 3: Paying estimated taxes is optional for contractors

Ignoring estimated tax payments can lead to penalties and interest. The IRS requires self-employed individuals to make quarterly payments if they expect to owe more than $1,000 in taxes annually. Foregoing this step jeopardizes compliance and can cause unwelcome surprises during tax season.

Understanding the Contractor Tax Form: Components and Significance

Effectively mastering the contractor tax filing process hinges on a thorough comprehension of the key forms and their roles. While many focus solely on Schedule C, several auxiliary forms and considerations are integral to a seamless process. Here, we explore each component’s purpose, common pitfalls, and best practices based on authoritative IRS guidelines and industry standards.

Schedule C (Form 1040): The centerpiece of contractor tax reporting

At the core of contractor tax documentation lies Schedule C, which reports profit or loss from a sole proprietorship or single-member LLC. Key sections include income reporting, business expenses, vehicle deductions, and home office allocations. Recognizing and categorizing deductible expenses—such as supplies, equipment, and professional services—can significantly lower taxable income.

| Component | Details |

|---|---|

| Gross Income | Total payments received, including cash, checks, and electronic transfers. |

| Expenses | Allowable costs related to the business, categorized into specific categories like supplies, travel, meals, and utilities. |

| Net Profit or Loss | The calculated margin after deducting expenses, which determines self-employment tax obligations. |

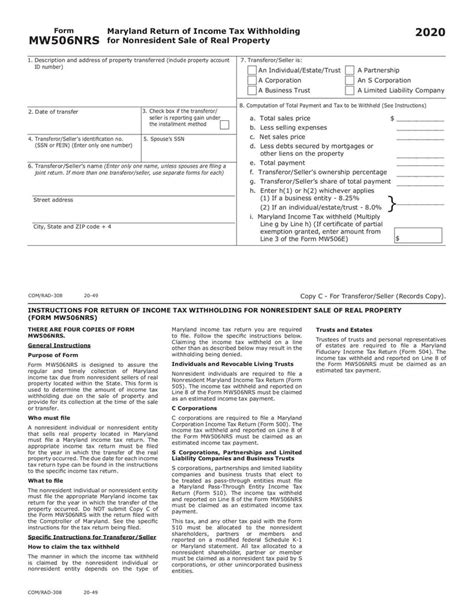

Form 1099-NEC and Record-Keeping

Contractors typically receive Form 1099-NEC from clients if earnings exceed $600 per job. It acts as an independent verification of income reported for tax purposes. Consistent, meticulous record-keeping ensures accurate reporting, prevents discrepancies with IRS records, and facilitates audit defense if necessary. Poor documentation remains a top reason for audit triggers and penalties among self-employed individuals.

Tax Deductions and Credits: Busting Myths for Optimal Savings

Overestimating or misunderstanding deductions forms another common pitfall among contractors. Many rely on outdated beliefs or guesswork, often leaving potential savings unclaimed and taxes unnecessarily high. A myth-busting approach clarifies what is genuinely deductible, backed by current tax laws and professional consensus.

Home Office Deduction

One of the most exploited yet misunderstood deductions. The IRS allows a proportionate expense deduction if a dedicated space is used exclusively for business. The myth that any home or corner qualifies is false; the space must be used regularly and exclusively for work. Proper calculation involves dividing actual expenses—utilities, rent, depreciation—by the square footage of the dedicated office area.

Vehicle Expenses

Many contractors believe they can deduct all vehicle costs. The IRS permits two methods: the standard mileage rate or actual expenses. Accurate mileage logs and detailed records are critical; estimated or lump-sum claims can trigger audits or disqualification of deductions.

| Relevant Category | Substantive Data |

|---|---|

| Standard Mileage Rate | 58.5 cents per mile (2023), applicable from January to June; 62.5 cents from July onward. |

| Actual Expenses | Includes fuel, repairs, insurance, depreciation, and leasing costs, apportioned by miles driven for business. |

Quarterly Estimated Tax Payments: Myth vs. Reality

The misconception that scheduling estimated payments is optional or can be deferred often leads to penalty liabilities. The IRS mandates quarterly payments if total tax liability exceeds certain thresholds, primarily to distribute tax collection across the year and reduce lump-sum burdens.

Calculating and Timing Payments

Estimated payments are based on expected income, deductions, and credits. The IRS expects payments in four installments: April, June, September, and January of the following year. Many contractors underestimate income or overlook deductible expenses, resulting in underpayment penalties. Employing tools like IRS Form 1040-ES helps in making accurate estimations.

| Relevant Metric | Details |

|---|---|

| Penalty Threshold | Underpayment penalty applies if taxes owed exceed $1,000 after withholding and credits. |

| Average Penalty Rate | Typically about 0.5% per month on underpaid tax amounts, compounded monthly. |

Ensuring Compliance and Avoiding Audit Triggers

Despite the best efforts, audits can happen. Recognizing and mitigating common causes prevents penalties and maintains trustworthiness in financial reporting. Standard audit triggers include misclassification, inconsistent income reporting, and unsubstantiated deductions.

Best Practices for Accurate Reporting

To avoid raising IRS flags, contractors should adhere to strict documentation routines: retain receipts, categorize expenses systematically, reconcile bank statements regularly, and maintain a transparent trail for all entries. Engaging with tax professionals for periodic reviews enhances accuracy and compliance clarity.

Strategic Year-Round Planning to Master Contractor Tax Filing

Mastery extends beyond annual filing; it benefits from continuous strategic planning. Proactive financial management, targeted expense tracking, and education about evolving tax laws foster seamless tax seasons with minimal surprises.

Building a Year-Round Financial System

This systematic approach involves scheduling quarterly reviews, leveraging accounting software, and staying informed about IRS updates. Additionally, considering retirement accounts such as SEP IRAs or Solo 401(k)s offers both tax advantages and retirement security.

| Key Strategy | Impact |

|---|---|

| Regular Reconciliation | Ensures data integrity, minimization of errors at tax time. |

| Tax Law Updates | Maintaining current knowledge ensures claims are valid and deductions maximized. |

| Retirement Contributions | Reduces taxable income while setting aside for future needs. |

Implementing a Tailored Approach for Different Contractor Types

Different contracting fields—from freelance creatives to construction workers—face unique tax considerations. Recognizing these nuances elevates compliance and maximizes financial benefit. For example, a freelance graphic designer’s deductions may focus on software and hardware, whereas a construction contractor’s expenses include heavy equipment and safety compliance costs.

Special Considerations for Industry-Specific Contractors

In-depth understanding of industry standards, allowable expenses, and regulatory requirements is vital. Professional associations and industry-specific guidelines serve as valuable references for ensuring claims align with sector norms and legal boundaries.

Conclusion: Elevating Contractor Tax Management to Expert Level

Achieving mastery over the contractor tax form and process involves dispelling myths, cultivating meticulous record-keeping habits, leveraging industry knowledge, and engaging strategic planning. Through continuous education and adopting best practices, contractors can enjoy a seamless, compliant, and financially optimized tax experience, transforming a traditionally daunting task into a strategic advantage. Remember, the key lies in understanding, preparing, and proactively managing every aspect of your financial footprint, ensuring that the journey from income to filing is smooth, predictable, and aligned with best practices.

What is the most common mistake contractors make when filing their taxes?

+The most frequent error is failing to keep detailed, organized records of income and expenses throughout the year, leading to inaccuracies or missed deductions during filing.

Can I deduct my home office if I work from a corner of my living room?

+No, the IRS requires exclusive use of a dedicated space for the home office deduction to qualify—simply working in a corner doesn’t meet the criteria.

Are estimated tax payments actually necessary every quarter?

+Yes, if you expect to owe more than $1,000 in taxes after withholding and credits, quarterly estimated payments prevent penalties and interest from underpayment.

What documentation should I retain to support my deductions?

+Receipts, bank statements, mileage logs, contracts, and detailed expense records are essential for substantiating deductions during audits.