Understanding Las Vegas Sales Tax: What You Need to Know

In the dazzling heart of Nevada, Las Vegas isn't just a paradise for entertainment and tourism; it also presents a unique landscape for retail entrepreneurs, residents, and visitors alike in terms of sales tax. While many tourists might focus solely on the neon lights and world-class shows, understanding the intricacies of Las Vegas sales tax is fundamental for compliance, financial planning, and maximizing purchasing power within the city's bustling economy. Unlike many other jurisdictions, Nevada’s tax structure blends state, local, and special district levies, creating a layered system that demands clarity and strategic awareness from anyone engaging in commerce there. This detailed exploration aims to clarify what you need to know about Las Vegas sales tax—debunking myths, dissecting rates, unveiling exemptions, and providing a comprehensive guide to navigate this complex yet critical aspect of doing business or shopping in Sin City.

Contextual Foundation of Nevada and Las Vegas Sales Tax System

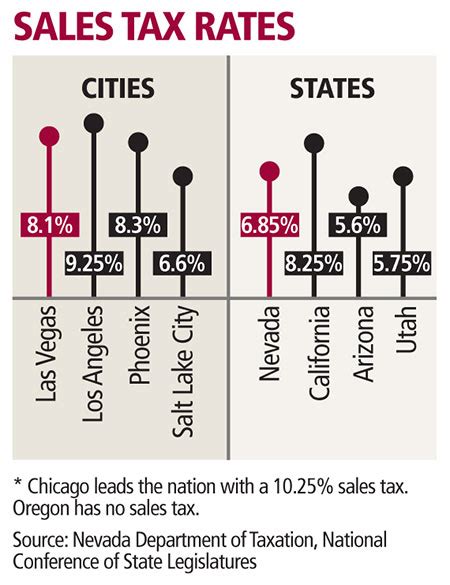

At the core of understanding Las Vegas sales tax lies a grasp of Nevada’s broader fiscal framework. Nevada operates under a relatively streamlined state sales tax system, but local governments—Clark County being the primary jurisdiction that encompasses Las Vegas—impose additional levies to fund regional infrastructure, public safety, and community projects. As of 2024, the state sets a base sales tax rate, which can then be augmented by county and district taxes, leading to variability across geographical boundaries. Nevada’s current state sales tax rate is 6.85%, but when factoring in Clark County’s local rates, the combined sales tax can escalate significantly, making it essential for consumers and merchants to consider location-specific rates.

Historically, Nevada’s sales tax has been regarded as a stable revenue generator, with the state continuously adjusting local rates in response to fiscal needs and voter-approved initiatives. Consequently, the sales tax environment in Las Vegas is dynamic but predictable, provided stakeholders are vigilant about rate changes and enforcement policies.

Detailed Breakdown of Las Vegas Sales Tax Composition

The total sales tax rate in Las Vegas varies depending on the precise location within Clark County. As of the latest fiscal report, the combined rate typically ranges between 8.375% and 8.375%, but certain districts and additional levies can raise this figure. The fundamental components include:

- State Rate (6.85%): Applied uniformly across Nevada, supporting core state functions.

- County Rate (typically 0.75%): Funds county-specific needs such as regional roads and public health initiatives.

- Regional Districts and Special Purpose Districts (up to 1.5%): These are program-specific taxes to finance transit, infrastructure, and economic development projects.

- Local Municipal Additions: Some areas within Clark County impose additional minor taxes for neighborhood or city-specific amenities.

| Component | Rate | Purpose |

|---|---|---|

| State | 6.85% | Funding statewide programs |

| County | 0.75% | County infrastructure and services |

| Districts | up to 1.5% | Transportation, public safety, redevelopment |

Implications for Consumers and Business Owners

Understanding the impact of sales tax extends beyond mere compliance; it influences purchasing decisions, store pricing, and revenue projections. For consumers, this means being aware that a 100 purchase may cost more depending on the specific local rate—an extra 8.38 at the top end of the typical range. Business owners, meanwhile, face the challenge of accurately collecting, reporting, and remitting these taxes, especially when operating across multiple districts or online platforms where tax rates may differ.

Taxability of Goods and Services in Las Vegas

Most tangible personal property is taxable in Las Vegas, but certain exemptions exist, such as food for home consumption, prescription medications, and utilities. However, digital goods, clothing, and entertainment services may be subject to varying degrees of tax depending on the specific laws enacted by local authorities. Additionally, Nevada has taken steps to clarify the taxability of remote sales following the Supreme Court’s decisions on marketplace fairness and interstate commerce.

| Taxable Items | Exemptions |

|---|---|

| Clothing, Electronics, Furniture | Most groceries, prescription meds |

| Entertainment services, Hotel stays | Some food items, educational services |

Special Considerations: Online Sales and Cross-Jurisdictional Challenges

The rise of e-commerce has complicated sales tax collection in Las Vegas. Sellers who operate online or have a physical presence in more than one jurisdiction must navigate complex nexus laws. Nevada’s marketplace facilitator law, enacted to simplify the process, requires online platforms to collect and remit sales tax for sales in the state, thus easing compliance burdens for individual businesses. Yet, variations still exist, especially considering remote and out-of-state vendors, making technology tools and legal counsel essential for accurate tax handling.

Moreover, some businesses leverage tax exemptions or special zones to reduce their effective tax rates, prompting the need for careful planning and transparency with consumers to maintain trust and compliance.

Strategic Insights: Navigating Sales Tax for Business Success in Las Vegas

For local businesses, mastering the sales tax landscape can significantly enhance competitiveness. Strategic pricing, transparent communication about tax components, and leveraging exemptions where permissible can improve customer satisfaction and margins. For large retailers and hospitality giants, integrating sophisticated POS systems and tax automation software ensures adherence to the fluctuating rate environment and mitigates audit risks.

Key Points

- Las Vegas sales tax rates vary significantly depending on exact location, with combined rates often exceeding 8.3%.

- Understanding district-specific levies is critical for accurate compliance and strategic pricing.

- Tax exemptions on certain goods and services can influence consumer behavior and business margins.

- E-commerce and remote sales laws are evolving rapidly, requiring ongoing legal and technological adaptation.

- Transparency and precise tax calculation foster customer trust and reduce audit risks.

Future Outlook and Policy Developments

The fiscal landscape in Las Vegas and Nevada at large is not static. Policy debates surrounding tax increases, district expansions, and digital sales regulation are ongoing. The state’s reliance on robust sales tax revenue means any significant policy shifts could alter the rate structure or exemption landscape, impacting consumers and retailers alike.

Emerging trends suggest a push toward integrating broader tax reforms, improving technological enforcement, and expanding the base to include digital transactions. With the federal government leaning into digital taxation strategies, Nevada’s adaptations will play a critical role in maintaining its fiscal health without stifling commerce.

How does Las Vegas sales tax compare to other major US cities?

+Las Vegas’s total sales tax generally ranks among the higher rates compared to other metropolitan areas, primarily due to additional district levies. Cities like Chicago or Los Angeles have comparable or higher combined rates, but the structure varies considerably, emphasizing the importance of local context.

Are there opportunities for businesses to reduce their sales tax liabilities?

+While direct avoidance is limited by law, strategic use of exemptions, tax planning, and location-specific operational structures can optimize tax liabilities. Consulting with tax professionals familiar with Nevada’s laws provides tailored strategies.

What future changes might impact Las Vegas sales tax rates?

+Potential increases in district levies, changes in state policy to diversify revenue sources, or federal legislation on digital sales could reshape the tax landscape. Staying informed through official channels and legal counsel is advised for all stakeholders.