Hawaii State Taxes

The beautiful islands of Hawaii, with their stunning natural landscapes and vibrant culture, are a popular destination for tourists and a desirable place to call home. When it comes to state taxes, Hawaii has its own unique system that residents and businesses must navigate. Understanding the intricacies of Hawaii's tax landscape is crucial for anyone considering a move to this tropical paradise or for those already residing there. This comprehensive guide will delve into the specifics of Hawaii's state taxes, providing an in-depth analysis of the various taxes levied, their rates, and the impact they have on individuals and businesses.

Hawaii’s State Tax Structure: A Comprehensive Overview

Hawaii’s tax system is designed to support the state’s unique needs and challenges, which include a limited land area, a remote geographic location, and a diverse population. The state relies on a combination of taxes to generate revenue, including income taxes, general excise taxes, property taxes, and various other fees and assessments. Let’s explore each of these tax categories in detail to gain a comprehensive understanding of Hawaii’s tax landscape.

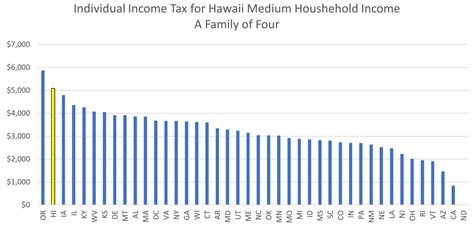

Income Taxes: Navigating Hawaii’s Progressive Tax System

Hawaii imposes an individual income tax on residents and non-residents earning income within the state. The state’s income tax system is progressive, meaning that higher income levels are taxed at increasingly higher rates. As of the 2023 tax year, Hawaii has four income tax brackets, each with its own tax rate:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $3,600 | 1.4% |

| $3,600.01 - $11,300 | 3.2% |

| $11,300.01 - $36,900 | 5.6% |

| Over $36,900 | 11% |

These tax brackets apply to single, married filing separately, and head of household filers. For married couples filing jointly, the tax brackets are doubled. It's important to note that Hawaii's income tax rates are among the highest in the nation, which can significantly impact individuals with higher incomes.

General Excise Tax: A Key Revenue Source for Hawaii

The General Excise Tax (GET) is a critical component of Hawaii’s tax system, serving as a major source of revenue for the state. GET is a gross receipts tax, meaning it is levied on the total amount of money a business receives from selling goods or services, regardless of profit. The standard GET rate is 4%, which applies to most transactions. However, there are certain industries and activities that are subject to surcharges, increasing the effective tax rate.

For example, the accommodation industry, which includes hotels and vacation rentals, is subject to an additional 10.25% transient accommodations tax on top of the standard GET rate. This tax is commonly referred to as the TA tax and is included in the displayed room rates for tourists. Additionally, certain food and beverage establishments, such as restaurants and bars, may be subject to a 0.5% surcharge on top of the standard GET rate.

The General Excise Tax is levied on both residents and visitors, making it a significant contributor to Hawaii's revenue stream. Businesses must carefully navigate the GET requirements to ensure compliance and avoid penalties.

Property Taxes: Assessing Hawaii’s Real Estate

Hawaii imposes a property tax on real estate within the state, which provides a substantial source of revenue for county governments. The property tax rate in Hawaii varies by county, with rates ranging from approximately 0.25% to 0.45% of the assessed value of the property. The assessed value is typically a percentage of the fair market value of the property, and it is determined by the county assessor’s office.

Property taxes are an essential part of Hawaii's tax system, as they help fund vital public services such as education, infrastructure, and public safety. Homeowners and businesses must be aware of their property tax obligations and ensure timely payments to avoid penalties and interest charges.

Other Taxes and Fees: A Range of Assessments

In addition to the taxes mentioned above, Hawaii levies a variety of other taxes and fees to generate revenue and support specific programs and services. These include:

- Motor Vehicle Weight Tax: A tax imposed on vehicles based on their weight, ranging from $30 to $300.

- Conveyance Tax: A tax on the transfer of real property, typically 0.5% of the purchase price or the fair market value.

- Use Tax: A tax on the purchase of goods or services for use in Hawaii, similar to a sales tax. It is typically included in the price of goods and services.

- Gasoline Tax: A tax on gasoline and other motor fuels, currently set at $0.16 per gallon.

- Real Property Transfer Tax: A tax on the transfer of real property, which is paid by the seller and typically ranges from 0.5% to 1% of the purchase price.

These taxes and fees, while less prominent than income and excise taxes, play a crucial role in funding specific programs and initiatives in Hawaii.

Impact of Hawaii’s State Taxes on Residents and Businesses

Hawaii’s state tax system has a significant impact on both residents and businesses operating within the state. For individuals, the progressive income tax structure can result in a substantial tax burden, especially for those with higher incomes. The high income tax rates, coupled with the General Excise Tax, can make Hawaii a relatively expensive place to live and do business.

Businesses, particularly those in the tourism and hospitality industries, face unique challenges due to Hawaii's tax system. The GET, including surcharges for accommodations and food services, can increase the cost of doing business and impact profitability. Additionally, businesses must navigate the complexities of tax compliance, ensuring they properly collect and remit taxes to avoid penalties.

Future Implications and Potential Reforms

Hawaii’s state tax system is subject to ongoing discussions and potential reforms. As the state faces economic challenges and changing demographic trends, there is a growing recognition of the need for tax reforms to support long-term sustainability and economic growth.

One area of focus is the potential for tax relief for individuals and businesses. This could involve adjustments to income tax brackets, reductions in tax rates, or the introduction of tax credits and incentives. Such reforms could make Hawaii more competitive and attractive for businesses and individuals, potentially boosting economic growth and job creation.

Additionally, there is ongoing debate surrounding the General Excise Tax and its impact on the cost of living and doing business in Hawaii. Proposals for GET reform include the implementation of a value-added tax (VAT) or a destination-based sales tax, which could simplify the tax system and potentially reduce the tax burden on certain sectors.

As Hawaii's economy evolves and its needs change, the state's tax system will likely undergo further adjustments to remain competitive and support its unique challenges. Staying informed about potential tax reforms and their implications is essential for residents and businesses alike.

Conclusion

Hawaii’s state tax system is a complex and critical component of the state’s economy, funding vital public services and supporting its unique needs. From the progressive income tax structure to the General Excise Tax and property taxes, Hawaii’s tax landscape is designed to generate revenue and support the state’s diverse population. While the tax system can present challenges for residents and businesses, understanding its intricacies and staying informed about potential reforms is key to navigating Hawaii’s tax landscape successfully.

Frequently Asked Questions

What is the current income tax rate for residents in Hawaii?

+As of the 2023 tax year, Hawaii’s income tax rates range from 1.4% to 11%, depending on the income bracket. The brackets are adjusted periodically to account for inflation and economic changes.

How does Hawaii’s General Excise Tax (GET) work, and who pays it?

+The GET is a gross receipts tax levied on businesses. It is typically included in the price of goods and services, so both residents and visitors pay it indirectly. The standard rate is 4%, but certain industries, like accommodations and restaurants, have additional surcharges.

Are there any tax incentives or credits available in Hawaii for businesses or individuals?

+Yes, Hawaii offers a range of tax incentives and credits to attract businesses and support certain industries. These include tax credits for research and development, film and digital media production, and renewable energy projects. Additionally, there are tax incentives for low-income housing and historic preservation.

How does Hawaii’s property tax system work, and what is the average property tax rate?

+Hawaii’s property tax is assessed at the county level, with rates varying from approximately 0.25% to 0.45% of the assessed value of the property. The assessed value is typically a percentage of the fair market value. The average property tax rate in Hawaii is around 0.38%.

What are some potential tax reforms being discussed in Hawaii, and how could they impact residents and businesses?

+Potential tax reforms in Hawaii include adjusting income tax brackets, reducing tax rates, and implementing a value-added tax (VAT) or a destination-based sales tax. These reforms could provide tax relief for individuals and businesses, making Hawaii more competitive and potentially boosting economic growth.