Santa Barbara Property Tax

Welcome to an in-depth exploration of the fascinating world of property taxes in the vibrant city of Santa Barbara, California. This article aims to provide a comprehensive understanding of the property tax landscape, offering valuable insights for both residents and investors alike. Santa Barbara, known for its stunning scenery, rich cultural heritage, and high quality of life, presents a unique set of circumstances when it comes to property taxes.

With a diverse range of residential and commercial properties, from picturesque beachfront villas to historic downtown establishments, the property tax system in Santa Barbara is intricate and ever-evolving. As one of the most sought-after destinations in California, the city's real estate market is dynamic, and so are the tax implications. This guide will navigate through the complexities, shedding light on the assessment process, tax rates, exemptions, and strategies to manage these financial obligations effectively.

Whether you're a long-time resident looking to optimize your tax payments or a prospective buyer curious about the financial aspects of Santa Barbara living, this article will serve as your trusted companion. By the end of this journey, you'll possess a deeper understanding of the property tax landscape, empowering you to make informed decisions and navigate the tax waters with confidence.

Understanding Property Tax Assessment in Santa Barbara

At the heart of the property tax system in Santa Barbara lies the assessment process, a critical component that determines the value of each property and, subsequently, the tax liability. The County Assessor’s Office plays a pivotal role in this process, tasked with the responsibility of assessing all real property within the county, including residential, commercial, and agricultural lands.

The assessment methodology employed in Santa Barbara is primarily based on the market value approach, which takes into account recent sales of comparable properties, current market trends, and other relevant factors. This ensures that property taxes are fair and reflective of the property's actual worth. The Assessor's Office employs a team of professionals who conduct thorough research, utilizing a range of tools and resources to determine accurate property values.

For residential properties, the assessment process considers not only the physical attributes of the home but also its location, amenities, and the overall real estate market. Commercial properties, on the other hand, are assessed based on their income-generating potential, with factors such as rental income, occupancy rates, and market demand playing a crucial role. Agricultural lands are evaluated based on their productivity and potential for farming or other agricultural uses.

It's important to note that the assessment process is not static. The Assessor's Office conducts regular reviews to ensure that property values remain up-to-date. This includes revaluations every few years, as well as annual adjustments to account for market fluctuations. This dynamic approach ensures that property taxes remain fair and equitable, reflecting the true value of each property.

For homeowners and property owners in Santa Barbara, understanding the assessment process is crucial. It provides insight into how their property tax bill is calculated and allows them to verify the accuracy of their assessment. If a property owner believes their assessment is incorrect, they have the right to appeal, a process that involves providing evidence to support their claim. This could include recent sales of similar properties or other relevant data.

Key Takeaways from the Assessment Process

- The County Assessor’s Office is responsible for assessing all real property in Santa Barbara County.

- The market value approach is the primary methodology used, considering recent sales and market trends.

- Residential, commercial, and agricultural properties are assessed differently, taking into account unique factors for each category.

- Regular reviews and revaluations ensure that property values remain current and accurate.

- Property owners have the right to appeal their assessment if they believe it is incorrect.

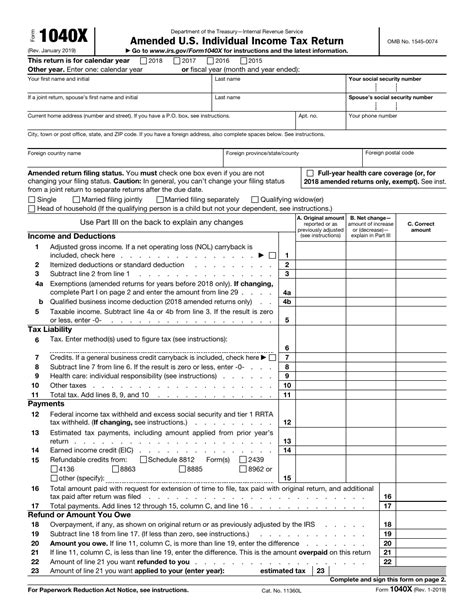

Exploring Property Tax Rates and Calculations

The property tax rate in Santa Barbara is a critical factor that directly impacts the tax liability for property owners. This rate is determined by the local government and is applied to the assessed value of the property to calculate the annual tax bill. In Santa Barbara, the property tax rate is set by the County Board of Supervisors, who consider a range of factors when establishing this rate.

The property tax rate is expressed as a percentage, and it can vary significantly depending on the location within the county. For instance, properties in more urban areas, such as the city of Santa Barbara itself, may have a higher tax rate compared to those in more rural regions. This is due to the differences in the cost of providing services and the varying levels of infrastructure and amenities available in each area.

The calculation of the property tax bill involves multiplying the assessed value of the property by the applicable tax rate. For example, if a property is assessed at $500,000 and the tax rate is 1.25%, the annual property tax bill would be $6,250. This calculation is straightforward but can become more complex when considering additional factors such as exemptions, discounts, or penalties.

It's important to note that the property tax rate is not the only component that influences the tax bill. Other factors, such as the presence of special assessment districts or bond measures, can also impact the final amount. These additional charges are often used to fund specific projects or services, such as infrastructure improvements or school district initiatives.

Property owners in Santa Barbara have the opportunity to review their tax bills and understand the breakdown of charges. This transparency allows for a better understanding of how their tax dollars are being utilized and provides an opportunity to question any discrepancies or unexpected increases.

Understanding the Components of Property Tax Bills

- The property tax rate is set by the County Board of Supervisors and can vary by location.

- The tax rate is applied to the assessed value of the property to calculate the annual tax bill.

- Additional charges, such as special assessment districts or bond measures, may also be included in the tax bill.

- Property owners can review their tax bills to understand the breakdown of charges and question any discrepancies.

Strategies for Managing Property Taxes in Santa Barbara

Managing property taxes in Santa Barbara can be a complex task, but with the right strategies, it’s possible to optimize your financial obligations. This section will explore a range of approaches to help property owners navigate the tax landscape effectively, from understanding exemptions and deductions to exploring financing options and tax planning.

Exemptions and Deductions

One of the most effective ways to reduce your property tax bill is by taking advantage of the various exemptions and deductions offered by the state and local governments. In Santa Barbara, property owners may qualify for a range of tax relief programs, including the Homeowners’ Property Tax Exemption, which provides a significant reduction in property taxes for primary residences. Other exemptions, such as those for seniors, veterans, and disabled individuals, can also offer substantial savings.

Additionally, property owners can explore deductions, such as the Mortgage Interest Deduction, which allows them to deduct the interest paid on their mortgage loans from their taxable income. This deduction, coupled with other federal and state tax benefits, can significantly reduce the overall tax burden.

It's important to note that exemptions and deductions are not automatic. Property owners must apply for these benefits and provide the necessary documentation to prove their eligibility. Staying informed about the various programs and ensuring timely application can lead to substantial tax savings.

Financing Options and Tax Planning

Another strategy for managing property taxes is to carefully consider your financing options and implement effective tax planning strategies. When purchasing a property, the choice of mortgage type and the timing of the purchase can impact the tax implications. For instance, a fixed-rate mortgage may provide more stability and predictability in terms of tax payments, while adjustable-rate mortgages may offer lower initial rates but carry more risk.

Tax planning involves looking at the bigger picture and considering the tax consequences of various financial decisions. This includes understanding the tax implications of property improvements, such as renovations or additions, which may increase the assessed value of the property and, subsequently, the tax liability. It also involves staying updated on tax law changes and taking advantage of any opportunities to reduce tax obligations legally.

Consulting with tax professionals or financial advisors can be invaluable in this process. They can provide tailored advice based on your specific circumstances, helping you make informed decisions that align with your financial goals and minimize your tax burden.

Key Strategies for Managing Property Taxes

- Explore exemptions and deductions to reduce your tax bill, such as the Homeowners’ Property Tax Exemption and deductions for mortgage interest.

- Stay informed about tax relief programs and ensure timely application to maximize savings.

- Consider financing options and tax planning strategies, such as choosing the right mortgage type and understanding the tax implications of property improvements.

- Consult with tax professionals or financial advisors for tailored advice and guidance.

The Impact of Property Taxes on Real Estate Transactions

Property taxes play a significant role in real estate transactions, influencing both the buying and selling process. For buyers, understanding the property tax obligations is crucial when considering a purchase, as these taxes can significantly impact the overall cost of ownership. Sellers, on the other hand, must consider the potential tax implications of a sale, including capital gains taxes and the impact on their future tax obligations.

Property Taxes and the Buying Process

When buying a property in Santa Barbara, prospective buyers should carefully review the property tax obligations. This includes understanding the current tax rate, any special assessments, and the potential for future tax increases. This information is crucial for budgeting and financial planning, as property taxes are a recurring expense that can vary significantly from year to year.

Additionally, buyers should be aware of the potential for reassessments, especially if the property has undergone significant improvements or renovations. These reassessments can lead to an increase in the property's assessed value, resulting in higher property taxes. Understanding this process and its potential impact is essential for making an informed purchase decision.

During the due diligence phase of the buying process, buyers should request a copy of the seller's most recent tax bill and review it carefully. This provides insight into the current tax obligations and any potential future liabilities. It's also an opportunity to identify any discrepancies or issues that may require further investigation.

Property Taxes and the Selling Process

For sellers, the property tax implications of a sale can be complex. One of the primary considerations is capital gains tax, which is levied on the profit made from the sale of the property. The amount of capital gains tax owed depends on a range of factors, including the length of ownership, the property’s appreciation, and the seller’s tax bracket.

Another important aspect is the impact of the sale on the seller's future tax obligations. Selling a property can trigger a reassessment, which may result in a higher assessed value and, subsequently, higher property taxes on any new property the seller purchases. This is particularly relevant for those considering a downsize or move to a different area.

To navigate these complexities, sellers often benefit from the guidance of real estate professionals and tax advisors. These experts can provide valuable insights into the potential tax implications of a sale, helping sellers make informed decisions and implement strategies to minimize their tax burden.

Key Considerations for Real Estate Transactions

- Buyers should carefully review property tax obligations, including current rates, special assessments, and potential future increases.

- Be aware of the potential for reassessments, especially after significant property improvements.

- Request and review the seller’s tax bill during the due diligence phase.

- Sellers should consider capital gains tax and the potential impact of the sale on their future tax obligations.

- Seek guidance from real estate professionals and tax advisors to navigate the tax implications of a sale.

Future Outlook and Implications for Property Taxes in Santa Barbara

As Santa Barbara continues to evolve, so too will its property tax landscape. The future outlook for property taxes in the city is shaped by a range of factors, from economic trends and real estate market dynamics to changes in local and state policies. Understanding these potential shifts is crucial for property owners and investors, as it allows for better financial planning and strategic decision-making.

Economic and Market Factors

The economic health of Santa Barbara, driven by factors such as employment rates, income levels, and consumer spending, will have a direct impact on the real estate market and, subsequently, property taxes. A robust economy can lead to increased demand for properties, driving up prices and potentially leading to higher assessments and tax revenues. Conversely, economic downturns can result in lower property values and reduced tax income.

Market dynamics, including supply and demand, will also play a significant role. If the supply of available properties decreases while demand remains high, it can drive up prices and assessments, resulting in higher property taxes. Conversely, an oversupply of properties can lead to a softening of the market and lower assessments.

Policy and Regulatory Changes

Changes in local and state policies can significantly impact property taxes. For instance, modifications to the tax assessment process, such as changes in the methodology or frequency of assessments, can have a direct impact on property tax bills. Similarly, alterations to tax rates or the introduction of new tax measures can affect the overall tax burden.

At the state level, changes to tax laws and regulations, such as the introduction or modification of tax relief programs, can offer new opportunities for property owners to reduce their tax obligations. These changes can be complex and may require careful analysis to understand their full implications.

Preparing for the Future

To navigate the evolving property tax landscape in Santa Barbara, property owners and investors should stay informed about economic and market trends, as well as potential policy changes. This includes regularly reviewing real estate market data, monitoring local and state legislative activities, and staying in touch with industry professionals who can provide insights and guidance.

Additionally, it's beneficial to develop a long-term financial plan that takes into account the potential impact of property taxes. This plan should be flexible and adaptable, allowing for adjustments as new information becomes available. Regular reviews and updates to the plan can ensure that it remains relevant and effective in the face of changing circumstances.

Key Points for the Future Outlook

- Economic and market factors, such as employment rates and supply-demand dynamics, will influence the real estate market and property taxes.

- Policy and regulatory changes at the local and state levels can significantly impact tax assessment processes and rates.

- Stay informed about economic and market trends, and monitor policy changes to navigate the evolving property tax landscape.

- Develop a flexible financial plan that considers the potential impact of property taxes and allows for adjustments as needed.

Conclusion

Understanding the property tax landscape in Santa Barbara is crucial for both residents and investors. From the assessment process to tax rates and strategies for management, this article has provided a comprehensive guide to navigating the complex world of property taxes in this vibrant city. By staying informed and proactive, property owners can effectively manage their tax obligations and make informed decisions about their real estate investments.

As the future unfolds, with its inherent uncertainties and opportunities, staying adaptable and prepared is key. The ever-changing nature of the property tax system underscores the importance of continuous learning and strategic planning. By embracing these principles, property owners can thrive in the dynamic environment of Santa Barbara's real estate market, ensuring their financial success and peace of mind.

How often are property assessments conducted in Santa Barbara?

+Property assessments in Santa Barbara are conducted annually. The County Assessor’s Office reviews and adjusts property values to ensure they reflect current market conditions.

Are there any online tools to estimate my property taxes in Santa Barbara?

+Yes, the County Assessor’s Office provides an online Property Tax Estimator tool. This tool allows property owners to estimate their taxes based on various scenarios and helps in financial planning.

What is the deadline for paying property taxes in Santa Barbara?

+Property taxes in Santa Barbara are due in two installments. The first installment is due on November 1st, and the second on February 1st of the following year. Late payments incur penalties.