Ri Tax Refund

The Rhode Island (RI) tax refund process is a vital aspect of the state's fiscal policies, impacting both individuals and businesses. Understanding the ins and outs of RI tax refunds is essential for taxpayers to ensure they receive their entitled refunds promptly and accurately. This comprehensive guide aims to provide an in-depth analysis of the RI tax refund system, covering eligibility criteria, application processes, and potential challenges, along with offering practical tips and strategies to navigate the system effectively.

Understanding RI Tax Refunds

In Rhode Island, tax refunds are a mechanism to return overpaid taxes to taxpayers. These refunds occur when the total taxes paid exceed the actual tax liability for a given period. The state’s tax agency, the Rhode Island Division of Taxation, is responsible for processing and issuing these refunds, ensuring taxpayers receive their due amounts promptly.

The state offers various types of tax refunds, including income tax refunds, sales tax refunds, and property tax refunds. Each type of refund has its own set of rules and regulations, which taxpayers must understand to claim their refunds successfully.

Eligibility and Criteria

To be eligible for an RI tax refund, individuals must have overpaid their taxes. This overpayment can occur due to various reasons, such as:

- Withholding more taxes than necessary from wages or salaries.

- Overestimating tax liabilities during the filing process.

- Qualifying for tax credits or deductions after filing.

- Receiving certain types of income that are tax-exempt.

Businesses may also be eligible for tax refunds if they have overpaid their taxes, especially in cases where they have made advance tax payments or have had significant tax deductions or credits.

Application Process

The process of applying for an RI tax refund involves several steps. Taxpayers must first ensure they have all the necessary documentation, including tax returns, payment receipts, and any supporting documents for deductions or credits claimed.

Once ready, taxpayers can initiate the refund process by filing their tax returns. In Rhode Island, this typically involves using the state's electronic filing system or submitting paper returns. The state's tax agency provides clear guidelines on the filing process, including due dates and any specific requirements for different types of tax returns.

After filing, taxpayers should monitor their refund status. The state's tax agency provides online tools and resources to check the status of refunds, which can help taxpayers track the progress of their refund and identify any potential delays or issues.

| Tax Type | Average Refund Time |

|---|---|

| Income Tax | 4-6 weeks for electronic returns; 6-8 weeks for paper returns |

| Sales Tax | Varies based on the complexity of the claim |

| Property Tax | Generally within 30 days of filing |

Challenges and Potential Issues

While the RI tax refund process is designed to be straightforward, taxpayers may encounter challenges or issues. Common problems include errors in tax returns, missing or incorrect information, and delays in processing due to high volumes or complex refund claims.

In cases where taxpayers suspect an error or encounter a problem with their refund, it's essential to act promptly. Taxpayers should first review their tax returns and supporting documents to identify any potential issues. If an error is found, taxpayers should contact the Rhode Island Division of Taxation immediately to resolve the issue. The agency provides taxpayer assistance services to help resolve such problems.

Maximizing Your RI Tax Refund

Navigating the RI tax refund system effectively can result in significant financial benefits for taxpayers. Here are some strategies and tips to help maximize your RI tax refund:

Understanding Tax Credits and Deductions

Tax credits and deductions are crucial elements of the RI tax system, as they can significantly reduce your tax liability and increase your potential refund. It’s essential to understand the various tax credits and deductions available in Rhode Island and how they apply to your specific situation.

For instance, the state offers credits for various expenses, including education, child care, and property taxes. Additionally, deductions for certain types of income, such as retirement income, can help reduce your taxable income and increase your refund.

Keeping Accurate Records

Maintaining accurate and organized financial records is crucial for claiming tax refunds. This includes keeping track of all income, expenses, and deductions throughout the year. By doing so, you’ll have the necessary documentation to support your tax return and claim any eligible refunds.

Consider using digital tools or software to streamline your record-keeping process. These tools can help you categorize and track expenses, ensuring you don't miss out on any potential deductions or credits.

Filing Early and Accurately

Filing your tax return early can help ensure a smoother refund process. By filing early, you reduce the chances of errors or delays, as the tax agency can process your return promptly. Additionally, filing early gives you more time to review your return and make any necessary corrections before submitting it.

Accuracy is also key. Double-check your tax return for any errors or missing information. Even small mistakes can lead to delays or discrepancies in your refund amount. Consider using tax preparation software or seeking professional assistance to ensure your return is accurate and complete.

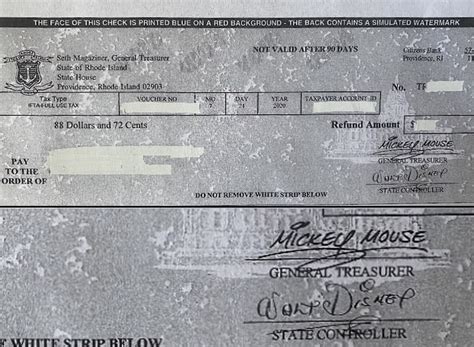

Using Direct Deposit

When it comes to receiving your tax refund, consider opting for direct deposit. This method is faster, safer, and more convenient than receiving a paper check. With direct deposit, your refund is deposited directly into your bank account, typically within a few days of processing.

To set up direct deposit, you'll need to provide your bank account information when filing your tax return. This information is usually requested on the tax form itself or can be provided separately through the state's tax agency website.

Conclusion: Navigating the RI Tax Refund System

The RI tax refund system, while comprehensive, can be navigated effectively with the right knowledge and strategies. By understanding the eligibility criteria, application process, and potential challenges, taxpayers can ensure they receive their entitled refunds promptly and accurately. Maximizing your RI tax refund involves a combination of understanding tax credits and deductions, maintaining accurate records, filing early and accurately, and opting for direct deposit.

Remember, the key to a successful RI tax refund is preparation and attention to detail. By staying informed and taking proactive steps, taxpayers can make the most of the state's tax refund system and ensure they receive their rightful refunds.

What is the average time it takes to receive an RI tax refund?

+The average time to receive an RI tax refund varies depending on the tax type. Income tax refunds typically take 4-6 weeks for electronic returns and 6-8 weeks for paper returns. Sales tax refunds can vary based on the complexity of the claim, while property tax refunds are generally processed within 30 days of filing.

How can I check the status of my RI tax refund?

+You can check the status of your RI tax refund online through the Rhode Island Division of Taxation’s website. They provide a refund status tool that allows you to track your refund progress and receive updates on any potential delays or issues.

What should I do if I receive an incorrect or no tax refund?

+If you believe your RI tax refund is incorrect or you haven’t received it, review your tax return and supporting documents to identify any potential errors. If an error is found, contact the Rhode Island Division of Taxation immediately to resolve the issue. They provide taxpayer assistance services to help address such problems.