Jackson County Property Taxes

Welcome to a comprehensive guide on Jackson County property taxes, a topic that impacts many homeowners and investors in the region. This article aims to provide an in-depth analysis of the property tax system in Jackson County, shedding light on the processes, rates, and strategies to manage this significant financial obligation effectively.

Understanding Property Taxes in Jackson County

Property taxes are a vital source of revenue for local governments in the United States, including Jackson County, Oregon. These taxes fund essential services such as schools, emergency services, and infrastructure development. As a homeowner or property owner in Jackson County, it’s crucial to understand the property tax system to ensure compliance and manage your financial obligations efficiently.

The property tax system in Jackson County operates under a set of regulations and procedures outlined by the county's Assessor's Office. This office is responsible for assessing the value of all taxable properties within the county, ensuring fair and accurate evaluations that form the basis for property tax calculations.

Assessment Process

The property assessment process in Jackson County involves several key steps. First, the Assessor’s Office gathers information about each property, including its physical characteristics, location, and recent sales data. This data is used to estimate the property’s fair market value, which is the price it would likely sell for in an open market.

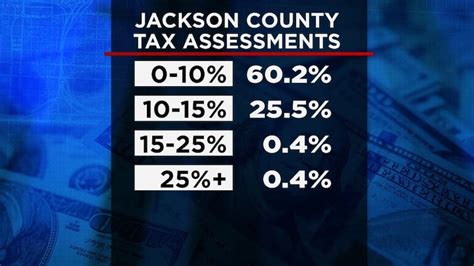

Once the fair market value is determined, it is multiplied by an assessment ratio to arrive at the assessed value. The assessment ratio is a percentage set by the county and ensures that property values are assessed uniformly. In Jackson County, the assessment ratio is typically around 90% of the fair market value.

For example, if a property has a fair market value of $500,000, the assessed value would be calculated as follows:

| Fair Market Value | Assessment Ratio | Assessed Value |

|---|---|---|

| $500,000 | 90% | $450,000 |

Property Tax Rates

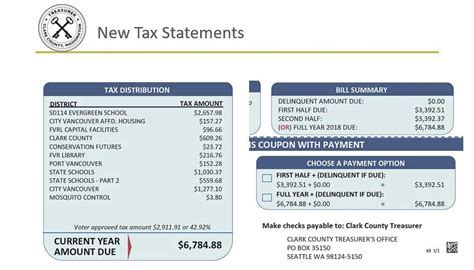

The assessed value of a property forms the basis for calculating property taxes. Jackson County, like many other jurisdictions, applies a tax rate to the assessed value to determine the annual property tax bill. This tax rate is expressed as a percentage and is set by the local government bodies, such as the county commissioners and school districts.

The tax rate in Jackson County is typically determined based on the budget requirements of various taxing districts within the county. These districts include the county itself, cities, school districts, and special districts like fire protection or sanitation services. Each district has its own tax rate, which is combined to form the overall tax rate for a property.

For instance, consider a property with an assessed value of $450,000 located in a taxing district with an overall tax rate of 1.5%. The property tax bill for this property would be calculated as follows:

| Assessed Value | Tax Rate | Annual Property Tax |

|---|---|---|

| $450,000 | 1.5% | $6,750 |

In this example, the property owner would be responsible for paying an annual property tax of $6,750 to the relevant taxing districts.

Strategies for Managing Property Taxes

Managing property taxes effectively is crucial for homeowners and property owners in Jackson County. Here are some strategies to consider:

Understanding Tax Bills

Property tax bills can be complex, with various components and line items. Take the time to understand your tax bill, including the assessed value, tax rates, and any applicable exemptions or deductions. This knowledge can help you identify potential errors or areas for improvement.

Stay Informed about Tax Rates

Tax rates can change annually, so it’s important to stay informed about any proposed changes or adjustments. Attend local government meetings, follow news sources, and engage with your elected officials to understand the budget process and potential impacts on your property taxes.

Appealing Assessments

If you believe your property’s assessed value is inaccurate, you have the right to appeal. The assessment appeal process in Jackson County involves submitting documentation and evidence to support your case. Common reasons for appeals include recent changes to your property, such as damage or renovations, or discrepancies in the assessed value compared to similar properties.

It's essential to gather evidence, such as recent sales data of comparable properties or professional appraisals, to support your appeal. Consult with a tax professional or an attorney specializing in property tax appeals to ensure your case is presented effectively.

Exemptions and Deductions

Jackson County, like many other jurisdictions, offers various exemptions and deductions to reduce the property tax burden for eligible homeowners. These may include homestead exemptions, veteran’s exemptions, senior citizen deductions, or special assessments for agricultural properties.

Research and understand the specific exemptions and deductions available in Jackson County. Consult with the Assessor's Office or a tax professional to determine if you qualify for any of these benefits and ensure you take advantage of them to lower your property tax liability.

Payment Options and Assistance

Jackson County provides various payment options and assistance programs to help property owners manage their tax obligations. These may include installment plans, online payment portals, or deferred payment programs for eligible seniors or disabled individuals.

Explore the payment options and assistance programs available in Jackson County to find the most suitable method for your circumstances. Take advantage of these resources to ensure timely payments and avoid penalties or late fees.

Conclusion

Understanding and managing property taxes in Jackson County is a crucial aspect of homeownership and property investment. By familiarizing yourself with the assessment process, tax rates, and available strategies, you can effectively navigate the property tax landscape and ensure compliance with your financial obligations.

Stay informed, utilize available resources, and consider seeking professional advice when needed. With a proactive approach, you can manage your property taxes efficiently and maintain a positive relationship with the local taxing authorities.

How often are property assessments conducted in Jackson County?

+Property assessments in Jackson County are typically conducted every two years. However, certain changes to a property, such as new construction or significant renovations, may trigger a reassessment outside of this cycle.

Can I estimate my property tax bill before receiving the official notice?

+Yes, you can estimate your property tax bill by multiplying your property’s assessed value by the current tax rate. However, it’s important to note that tax rates can change annually, so this estimate may not be entirely accurate.

What happens if I don’t pay my property taxes on time?

+Late payment of property taxes can result in penalties, interest charges, and potential legal consequences. It’s important to pay your taxes on time to avoid these additional costs and maintain a positive standing with the taxing authorities.

Are there any resources available to help me understand my tax bill in more detail?

+Yes, the Jackson County Assessor’s Office provides resources and guides to help property owners understand their tax bills. These resources often include explanations of the assessment process, tax rates, and any applicable exemptions or deductions. Reach out to the Assessor’s Office for assistance if needed.