Property Tax Sacramento

Understanding property taxes is essential for homeowners and prospective buyers alike, as these taxes can significantly impact your financial planning and overall cost of living. In Sacramento, California, property taxes play a crucial role in funding local services and infrastructure, making them an integral part of the community's economic ecosystem. This article aims to provide a comprehensive guide to property taxes in Sacramento, shedding light on the factors that influence tax rates, the assessment process, payment options, and strategies for effective management.

Demystifying Property Taxes in Sacramento

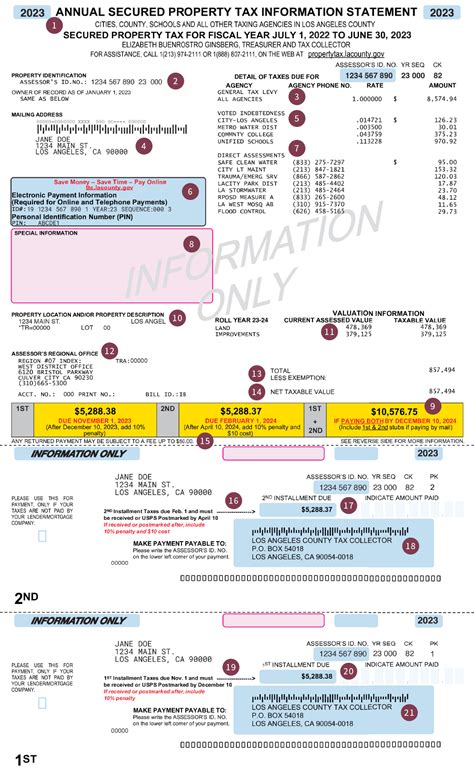

Property taxes in Sacramento are calculated based on the assessed value of a property and the applicable tax rate set by local governing bodies. The assessed value is determined through a meticulous process, taking into account various factors such as the property’s location, size, improvements, and market conditions. This assessment, conducted by the Sacramento County Assessor’s Office, serves as the foundation for calculating the annual property tax liability.

One of the unique aspects of property taxation in California, and Sacramento specifically, is the Proposition 13 rule. Enacted in 1978, Proposition 13 limits the annual increase in the assessed value of real property to no more than 2% or the inflation rate, whichever is lower. This means that even if your property's market value increases significantly, your assessed value (and consequently, your property taxes) will only rise modestly each year. This provision provides a degree of stability and predictability for Sacramento homeowners.

The Role of Assessment Districts

Sacramento County is divided into Assessment Districts, each with its own unique characteristics and tax rates. These districts are typically aligned with school districts, as a significant portion of property taxes funds public education. The tax rate within each district is determined by the local taxing authorities, including the county, city, and special districts, and it includes not only the basic 1% rate set by Proposition 13 but also any additional levies approved by voters.

For instance, the Sacramento City Unified School District has an assessment district that covers a portion of the city and some unincorporated areas. This district, along with others, contributes to the overall property tax burden in Sacramento. Understanding the specific assessment district your property falls into is crucial, as it directly impacts your tax liability.

| Assessment District | Tax Rate | Funding Purpose |

|---|---|---|

| Sacramento City Unified School District | 1.1259% | Public Education |

| Folsom Cordova Unified School District | 1.2247% | School Operations and Construction |

| Elk Grove Unified School District | 1.1576% | Educational Programs and Services |

Assessment Appeals

If you believe your property’s assessed value is inaccurate, you have the right to appeal. The Sacramento County Assessment Appeals Board allows property owners to challenge their assessed values based on factors such as errors in the assessment, changes in property conditions, or discrepancies with similar properties. It’s important to note that appeals based solely on market value fluctuations are generally not successful, as Proposition 13 limits annual assessed value increases.

The appeal process involves submitting an application, providing supporting documentation, and potentially attending a hearing. It's advisable to consult with a tax professional or legal expert to navigate this process effectively and increase your chances of a successful appeal.

Property Tax Payment Options and Strategies

Understanding your payment options and developing effective strategies can help streamline the property tax process and ensure timely payments without incurring penalties. Sacramento County offers several convenient methods for property tax payment, each with its own advantages and considerations.

Payment Methods

- Online Payment: The Sacramento County Treasurer-Tax Collector’s Office provides an online platform where taxpayers can securely make payments using a credit or debit card. This method offers convenience and the ability to track payment status.

- Phone Payment: Taxpayers can also make payments over the phone using a credit or debit card. This option is ideal for those who prefer a more personal interaction or have limited access to online services.

- In-Person Payment: The traditional method of paying in person at the Treasurer-Tax Collector’s Office is still available. This option allows for immediate confirmation of payment and is suitable for those who prefer face-to-face interactions.

- Mail-In Payment: Taxpayers can mail their payments to the Treasurer-Tax Collector’s Office. While this method may take longer to process, it provides a convenient option for those who prefer a more traditional approach or live far from the office.

Payment Strategies

Developing a payment strategy can help manage your property tax obligations effectively. Here are some strategies to consider:

- Budgeting: Incorporate property taxes into your annual budget. Given the predictable nature of property taxes in Sacramento, you can estimate your liability based on the assessed value and tax rate. This allows you to allocate funds accordingly and ensure timely payments.

- Escrow Accounts: Many homeowners choose to include property taxes in their monthly mortgage payments. Lenders typically set aside a portion of these payments into an escrow account, which is then used to cover property taxes and insurance. This strategy simplifies the payment process and ensures taxes are paid on time.

- Early Payment Discounts: Sacramento County offers a 2% discount for property taxes paid in full before the first installment deadline. Taking advantage of this discount can save you money and is particularly beneficial if you have the financial flexibility to make a lump-sum payment.

- Payment Plans: If you're facing financial challenges, the Treasurer-Tax Collector's Office may offer payment plans to help you manage your tax liability. These plans allow for more manageable payments over a specified period, ensuring you can maintain your property ownership.

The Impact of Property Taxes on Sacramento’s Real Estate Market

Property taxes play a significant role in shaping Sacramento’s real estate landscape. Buyers and investors carefully consider tax obligations when evaluating properties, as these costs directly affect the overall affordability and return on investment.

Buyer Considerations

When purchasing a property in Sacramento, buyers should carefully review the property’s tax history and assess its potential impact on their financial plans. Factors such as the assessed value, tax rate, and any potential reassessments should be considered. Buyers may also explore the possibility of tax breaks or incentives offered by the county or state, which can significantly reduce their tax burden.

For instance, the California Homeowner's Property Tax Exemption Program provides eligible homeowners with a $7,000 exemption from their property's taxable value, resulting in lower property taxes. Understanding these programs and their requirements can be advantageous for buyers, especially first-time homeowners.

Investor Strategies

Investors in Sacramento’s real estate market must also consider property taxes as a key factor in their investment decisions. Strategies such as purchasing properties with lower assessed values or in areas with favorable tax rates can help optimize investment returns. Additionally, investors may explore tax-efficient investment structures, such as real estate investment trusts (REITs) or limited liability companies (LLCs), which can offer certain tax advantages.

Furthermore, investors should be aware of potential reassessments that may occur when making significant improvements to a property. These reassessments can lead to higher property taxes, so careful planning and understanding of the assessment process are essential.

Future Outlook and Potential Changes

The landscape of property taxes in Sacramento is subject to change, influenced by economic trends, political decisions, and community needs. While Proposition 13 provides a stable framework, there have been ongoing discussions and proposals to modify or replace it.

Proposed Changes

Some proposals suggest modifying Proposition 13 to allow for reassessments based on market value rather than the 2% limit. This could lead to higher property taxes for homeowners, especially in areas with rapidly appreciating real estate values. However, such changes would require significant political support and may face resistance from homeowners who benefit from the current system.

Other proposals aim to address the issue of declining property tax revenues due to Proposition 13's limitations. These proposals often involve shifting the tax burden to commercial properties or implementing a split-roll system, where commercial and residential properties are taxed differently. While these ideas have gained traction, they have yet to be enacted into law.

Economic and Social Impact

Changes to Sacramento’s property tax system could have far-reaching implications. Higher property taxes may impact the affordability of housing, potentially pricing out lower-income families and first-time buyers. On the other hand, increased revenues could benefit the community by funding essential services, infrastructure improvements, and public education.

The balance between ensuring fair tax obligations for homeowners and generating sufficient revenue for public services is a delicate one. As such, any proposed changes to Sacramento's property tax system would need to carefully consider the economic and social implications to maintain a sustainable and equitable community.

Conclusion

Property taxes in Sacramento are a complex but integral part of the community’s economic and social fabric. Understanding the assessment process, payment options, and potential future changes is crucial for homeowners, buyers, and investors alike. By staying informed and developing effective strategies, individuals can manage their property tax obligations efficiently and contribute to the vibrant Sacramento community.

What is the average property tax rate in Sacramento County?

+The average property tax rate in Sacramento County is approximately 1.14%, which includes the base rate of 1% set by Proposition 13 and additional voter-approved levies. However, this rate can vary depending on the specific assessment district and the purpose of the levy.

How often are property taxes assessed in Sacramento?

+Property taxes in Sacramento are assessed annually. The Sacramento County Assessor’s Office conducts a physical reappraisal of each property every other year, with an annual adjustment to the assessed value limited to 2% or the inflation rate, whichever is lower.

Can I deduct property taxes from my federal income taxes in Sacramento?

+Yes, property taxes paid in Sacramento are generally deductible on your federal income tax return. However, there are limits and restrictions, so it’s advisable to consult with a tax professional to ensure you’re taking full advantage of available deductions.

What happens if I don’t pay my property taxes in Sacramento?

+Failure to pay property taxes in Sacramento can result in penalties, interest, and potential legal consequences. If taxes remain unpaid, the property may be subject to a tax sale, where the county sells the property to recover the unpaid taxes.

Are there any tax breaks or exemptions for senior citizens in Sacramento?

+Yes, Sacramento offers several tax breaks and exemptions for senior citizens. These include the Senior Citizen’s Homeowner’s Exemption, which provides a $7,000 exemption from the property’s taxable value for homeowners who are 65 or older and meet certain income requirements.