Virginia State Property Tax Car

The topic of property taxes in Virginia, especially when it comes to vehicles, is an important one for residents and prospective homeowners to understand. Property taxes are a significant source of revenue for local governments, and they play a crucial role in funding various public services and infrastructure. In this comprehensive guide, we will delve into the intricacies of Virginia's property tax system as it pertains to cars and provide valuable insights to help you navigate this essential aspect of vehicle ownership.

Understanding Virginia’s Property Tax Structure

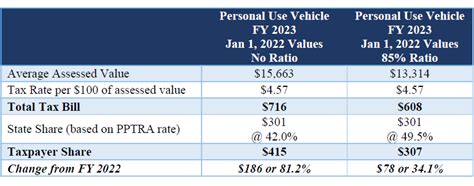

Virginia, like many other states, levies property taxes on both real estate and personal property. When it comes to vehicles, they are considered personal property and are subject to an annual ad valorem tax. This means that the amount of tax you pay is directly proportional to the value of your vehicle. The property tax rate, however, can vary depending on the locality in which you reside.

Virginia's property tax system is designed to ensure fairness and equity. The state has established a uniform assessment ratio, which is applied consistently across all localities. This assessment ratio determines the taxable value of a vehicle by multiplying its assessed value by a predetermined percentage. For instance, if the assessment ratio is set at 50%, a vehicle with an assessed value of $20,000 would have a taxable value of $10,000.

Calculating Your Vehicle’s Property Tax

Calculating the property tax on your vehicle involves a few key steps. First, you need to determine the assessed value of your car. This value is typically based on the fair market value of similar vehicles in your area. Local assessors consider factors such as the make, model, year, mileage, and condition of your vehicle when assessing its value.

Once the assessed value is established, it is multiplied by the assessment ratio to arrive at the taxable value. This taxable value is then multiplied by the property tax rate, which is set by your local government. The resulting amount is the property tax you owe for your vehicle for the year.

It's important to note that Virginia offers various exemptions and credits that can reduce the taxable value of your vehicle. For example, senior citizens and disabled individuals may be eligible for reduced assessments. Additionally, certain types of vehicles, such as hybrid or electric cars, may qualify for tax credits or exemptions as part of the state's efforts to promote environmentally friendly transportation options.

Payment and Due Dates

Property taxes on vehicles in Virginia are typically due on a yearly basis. The exact due date may vary depending on your locality, so it’s essential to stay informed about the specific deadlines in your area. Many localities offer convenient online payment options, allowing you to pay your taxes electronically. Some may also provide the option to pay in installments, making it more manageable for vehicle owners.

Failure to pay your property taxes on time can result in penalties and interest charges. It's crucial to stay on top of your payment schedule to avoid unnecessary financial burdens. Additionally, if you sell or dispose of your vehicle during the tax year, you may be eligible for a refund or a prorated tax amount, depending on the specific regulations in your locality.

Impact of Vehicle Age and Usage

The age and usage of your vehicle can also influence the property tax you pay. In Virginia, older vehicles generally have a lower assessed value compared to newer models. This means that as your vehicle ages, its taxable value decreases, resulting in a lower property tax bill over time. This is particularly beneficial for vehicle owners who keep their cars for extended periods.

Furthermore, the distance traveled by your vehicle can also impact its assessed value. Vehicles that are driven fewer miles each year may have a slightly lower assessed value compared to those with higher mileage. This consideration is especially relevant for individuals who primarily use their cars for short commutes or occasional travel.

Maintaining Accurate Vehicle Records

To ensure an accurate assessment of your vehicle’s value, it’s crucial to maintain comprehensive records. This includes keeping track of maintenance receipts, repair records, and any upgrades or modifications made to your car. By providing accurate and up-to-date information to the local assessor, you can help ensure that your vehicle’s value is assessed fairly and appropriately.

Additionally, staying informed about any changes in assessment procedures or tax rates in your locality is essential. Local governments may periodically adjust their assessment methods or tax rates to reflect market conditions or budgetary needs. By staying aware of these changes, you can better understand the impact on your property taxes and plan accordingly.

Appealing Your Vehicle’s Property Tax Assessment

If you believe that your vehicle’s assessed value or property tax calculation is inaccurate, you have the right to appeal the assessment. Virginia provides a formal process for taxpayers to challenge their property tax assessments. This typically involves submitting a written appeal to the local tax assessment board, providing supporting evidence, and attending a hearing to present your case.

It's important to carefully review the assessment and gather any relevant documentation that supports your claim. This may include recent sales data for similar vehicles, expert appraisals, or repair records that demonstrate a decrease in your vehicle's value. Seeking professional advice from tax consultants or attorneys who specialize in property tax matters can also be beneficial during the appeal process.

Conclusion: Navigating Virginia’s Vehicle Property Tax System

Understanding Virginia’s property tax system as it pertains to vehicles is crucial for vehicle owners in the state. By comprehending the assessment process, calculation methods, and potential exemptions, you can ensure that you are paying the correct amount of property tax on your vehicle. Staying informed about local regulations, maintaining accurate records, and being aware of your rights to appeal assessments are all essential aspects of navigating this complex tax landscape.

As Virginia continues to evolve and adapt its property tax system, it is crucial for vehicle owners to stay updated on any changes that may impact their financial obligations. By staying proactive and engaged, you can effectively manage your vehicle's property taxes and contribute to the funding of essential public services and infrastructure in your community.

How often do I need to pay property taxes on my vehicle in Virginia?

+Property taxes on vehicles in Virginia are typically due on an annual basis. The exact due date may vary depending on your locality, so it’s essential to check with your local government for specific deadlines.

Are there any exemptions or credits available for vehicle property taxes in Virginia?

+Yes, Virginia offers various exemptions and credits that can reduce the taxable value of your vehicle. Senior citizens, disabled individuals, and owners of hybrid or electric cars may be eligible for reduced assessments or tax credits. It’s advisable to check with your local tax office to determine your eligibility.

How can I appeal my vehicle’s property tax assessment in Virginia?

+If you believe your vehicle’s assessed value or property tax calculation is inaccurate, you have the right to appeal. The process involves submitting a written appeal, providing supporting evidence, and attending a hearing. It’s recommended to consult with tax professionals or legal experts for guidance.