Tax Deed Sales Texas

In the realm of real estate and investment opportunities, Tax Deed Sales are an intriguing concept that often sparks curiosity and raises questions for prospective investors. These sales, which are conducted by local governments to recoup unpaid property taxes, offer a unique pathway to acquiring property. This article aims to provide an in-depth exploration of Tax Deed Sales in Texas, shedding light on the process, benefits, and considerations for potential participants.

Understanding Tax Deed Sales in Texas

Texas, with its vibrant real estate market and diverse landscape, provides an ideal setting to delve into the intricacies of Tax Deed Sales. These sales are a mechanism employed by county tax offices to enforce the collection of delinquent property taxes. When a property owner fails to pay their taxes for a specified period, usually two years in Texas, the county has the authority to seize the property and sell it through a public auction.

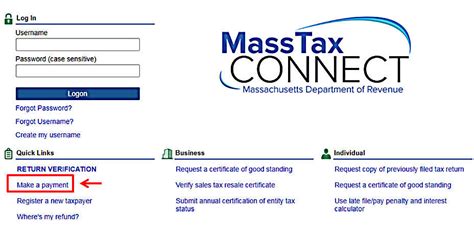

The Texas Property Tax Code outlines the procedures for conducting Tax Deed Sales, ensuring transparency and fairness in the process. The code stipulates that these sales must be advertised publicly, allowing interested buyers to research and bid on properties. This public notice is a critical aspect, ensuring that potential buyers have access to information about the property's history, tax obligations, and any potential liabilities.

The Auction Process

Tax Deed Sales in Texas are typically conducted through live auctions, where bidders gather to compete for properties. These auctions are often high-energy events, with bidders strategically placing their offers to secure the best deals. The bidding process can be intense, with experienced investors and first-time buyers alike vying for desirable properties.

Before the auction, prospective buyers have the opportunity to inspect the properties and conduct their due diligence. This includes researching the property's condition, any existing liens or encumbrances, and the potential for environmental hazards. It's crucial for buyers to understand the full scope of the property and its associated risks before placing a bid.

| Auction Date | Property Location | Minimum Bid |

|---|---|---|

| July 12, 2024 | Dallas County | $20,000 |

| August 16, 2024 | Harris County | $35,000 |

| September 27, 2024 | Travis County | $18,500 |

Benefits of Tax Deed Sales

Tax Deed Sales offer a range of advantages for savvy investors. Firstly, they present an opportunity to acquire properties at potentially below-market prices. With properties being sold due to tax delinquency, the starting bids are often lower than what one would expect in a traditional real estate market. This can be particularly attractive for investors seeking properties with good equity potential.

Secondly, Tax Deed Sales provide a streamlined process for acquiring property. Unlike traditional real estate transactions, which can involve lengthy negotiations and multiple intermediaries, Tax Deed Sales are more straightforward. Once a bid is accepted, the buyer typically has a set timeframe to complete the purchase, simplifying the acquisition process.

Lastly, these sales offer a diversification opportunity for investors. By participating in Tax Deed Sales, investors can access a wider range of properties, including residential, commercial, and even vacant land. This diversification can help mitigate risk and open up new avenues for investment growth.

Success Stories

Many investors have found success through Tax Deed Sales in Texas. One notable example is investor John D., who acquired a commercial property in Austin through a tax deed auction. The property, which had been vacant for several years due to tax delinquency, was purchased for a fraction of its market value. After some renovations and strategic marketing, John was able to lease the space to a thriving local business, generating a significant return on his investment.

Similarly, investor Sarah L. found success in the residential market through Tax Deed Sales. She acquired a foreclosed home in Houston, which she renovated and converted into a stylish rental property. By carefully selecting the property and managing the renovation process, Sarah was able to create a high-demand rental, maximizing her return on investment.

Considerations and Potential Risks

While Tax Deed Sales present exciting opportunities, they also come with certain considerations and risks. One of the primary concerns is the potential for hidden liabilities. Properties sold through tax deed auctions may have undisclosed liens, environmental issues, or other legal complications. It’s essential for buyers to conduct thorough due diligence to mitigate these risks.

Another consideration is the timeframe for purchase completion. Buyers typically have a limited window, often 30-60 days, to finalize the purchase after winning the bid. This can be a challenge for those who require financing, as it may not always align with traditional loan timelines. Buyers should ensure they have the necessary funds or financing options in place before participating in the auction.

Research and Due Diligence

Research is a critical component of a successful Tax Deed Sale investment strategy. Prospective buyers should thoroughly investigate the properties they are interested in, including their location, condition, and any associated liabilities. This research should involve examining public records, conducting site visits, and consulting with professionals such as real estate agents, lawyers, and environmental specialists.

Additionally, it's important to understand the local market dynamics and the potential for property appreciation. Factors such as neighborhood development plans, infrastructure improvements, and local economic trends can significantly impact a property's value over time. By staying informed about these aspects, investors can make more informed decisions when bidding on properties.

Conclusion

Tax Deed Sales in Texas offer a unique and potentially lucrative avenue for real estate investment. With the right strategy, research, and due diligence, investors can acquire properties at attractive prices and realize significant returns. However, it’s crucial to approach these sales with caution, understanding the potential risks and complexities involved. By staying informed and proactive, investors can navigate the Tax Deed Sale process successfully and unlock the benefits of this dynamic investment opportunity.

Frequently Asked Questions

What is the average success rate for investors in Tax Deed Sales in Texas?

+The success rate can vary widely depending on various factors such as market conditions, property type, and investor strategy. On average, experienced investors who conduct thorough research and due diligence can expect a success rate of around 70% in Tax Deed Sales.

Are there any restrictions on who can participate in Tax Deed Sales?

+Generally, Tax Deed Sales are open to the public, including individuals, partnerships, and corporations. However, there may be specific requirements or restrictions set by the county conducting the sale. It’s advisable to review the auction guidelines and consult with the county tax office for any specific eligibility criteria.

Can properties acquired through Tax Deed Sales be immediately occupied or rented out?

+The answer to this question depends on the specific circumstances of the property. In some cases, properties may be vacant and ready for immediate occupancy or rental. However, there may be instances where the previous owner or tenants remain on the property, requiring a legal eviction process before the new owner can take possession. It’s essential to clarify the occupancy status during the due diligence phase.

What happens if the winning bidder fails to complete the purchase within the specified timeframe?

+If a winning bidder fails to complete the purchase within the agreed-upon timeframe, they may forfeit their deposit and any additional funds paid towards the purchase. In some cases, the county may re-auction the property, potentially resulting in a higher sale price. It’s crucial for bidders to ensure they have the necessary funds and financing in place to avoid such scenarios.

Are there any online resources or platforms for researching Tax Deed Sales in Texas?

+Yes, there are several online platforms and resources that provide information on Tax Deed Sales in Texas. These include county tax office websites, real estate auction platforms, and specialized websites dedicated to tax deed investment. These resources often provide auction schedules, property details, and additional information to assist potential buyers.