Tax In Chicago

The city of Chicago, nestled in the state of Illinois, is renowned for its vibrant culture, architectural marvels, and a tax system that plays a significant role in shaping its economic landscape. Understanding the intricacies of taxation in Chicago is crucial for both residents and businesses alike. In this comprehensive guide, we will delve into the world of tax regulations and their impact on the Windy City.

Unraveling the Chicago Tax System

The tax structure in Chicago is a multifaceted system, encompassing various taxes that contribute to the city’s revenue. Let’s explore the key components and their implications.

Property Taxes: A Pillar of Revenue

Property taxes form the backbone of Chicago’s tax system. The city levies taxes on both residential and commercial properties, with rates varying based on property value and location. The Cook County Assessor’s Office plays a pivotal role in assessing property values, which directly influences the tax burden.

For instance, consider the case of Ms. Johnson, a homeowner in the bustling neighborhood of River North. Her property, assessed at 500,000, attracts a tax rate of 2.15%, resulting in an annual property tax bill of 10,750. This example illustrates how property taxes contribute significantly to Chicago’s revenue.

| Property Type | Assessment Value | Tax Rate | Annual Tax |

|---|---|---|---|

| Residential | $400,000 | 2.0% | $8,000 |

| Commercial | $1,200,000 | 2.5% | $30,000 |

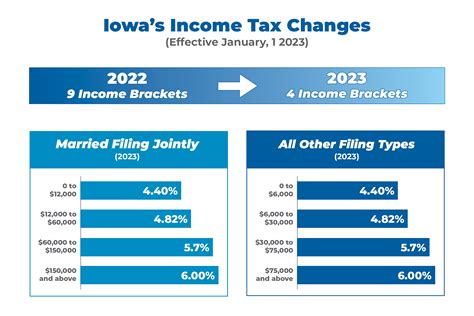

Income Taxes: A Progressive Approach

Chicago, much like the state of Illinois, employs a progressive income tax system. This means that as an individual’s income increases, so does their tax rate. The city imposes its own income tax, in addition to the state and federal income taxes.

Let’s take the example of Mr. Smith, a Chicago resident with an annual income of $75,000. His income falls within the 4.95% tax bracket for city income tax. With a state income tax rate of 4.95% and a federal rate of 22%, Mr. Smith’s total income tax burden adds up to a significant portion of his earnings.

| Income Range | City Tax Rate | State Tax Rate | Federal Tax Rate |

|---|---|---|---|

| $0 - $10,000 | 1.75% | 4.95% | 10% |

| $10,001 - $50,000 | 2.25% | 4.95% | 12% |

| $50,001 - $200,000 | 3.4% | 4.95% | 22% |

| Over $200,000 | 4.95% | 4.95% | 32% |

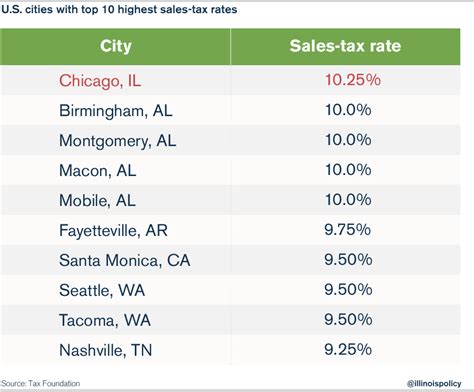

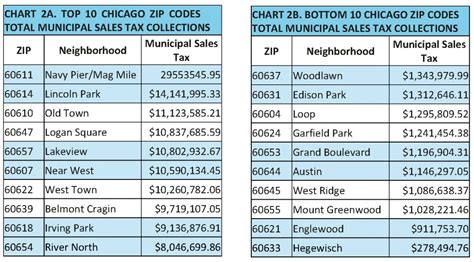

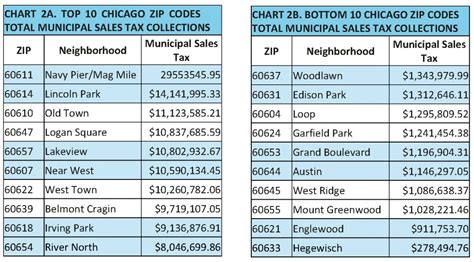

Sales and Use Taxes: Impact on Consumers

Sales and use taxes are a common feature of taxation in Chicago. These taxes are levied on the sale of goods and services, impacting both businesses and consumers. The city’s sales tax rate stands at 10.25%, which includes the state sales tax of 6.25% and additional local taxes.

Imagine you’re planning a shopping trip in Chicago. A pair of shoes priced at 100 will attract a sales tax of <strong>10.25, making the total purchase amount $110.25. This example highlights how sales taxes affect everyday purchases.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6.25% |

| City Sales Tax | 1.25% |

| Regional Transit Tax | 0.75% |

| Water Reclamation District Tax | 2% |

Business Taxes: A Complex Landscape

Chicago’s business landscape is diverse, and so is its tax structure for businesses. From corporate income taxes to various licenses and permits, businesses navigate a complex web of regulations.

For instance, TechCorp Inc., a thriving tech startup, must navigate the corporate income tax landscape. With a taxable income of 500,000, the company faces a corporate income tax rate of <strong>7.75%</strong>, resulting in a tax liability of 38,750.

Navigating Tax Compliance and Benefits

Understanding and complying with Chicago’s tax regulations is crucial for individuals and businesses. Here’s a glimpse into the world of tax compliance and the benefits it brings.

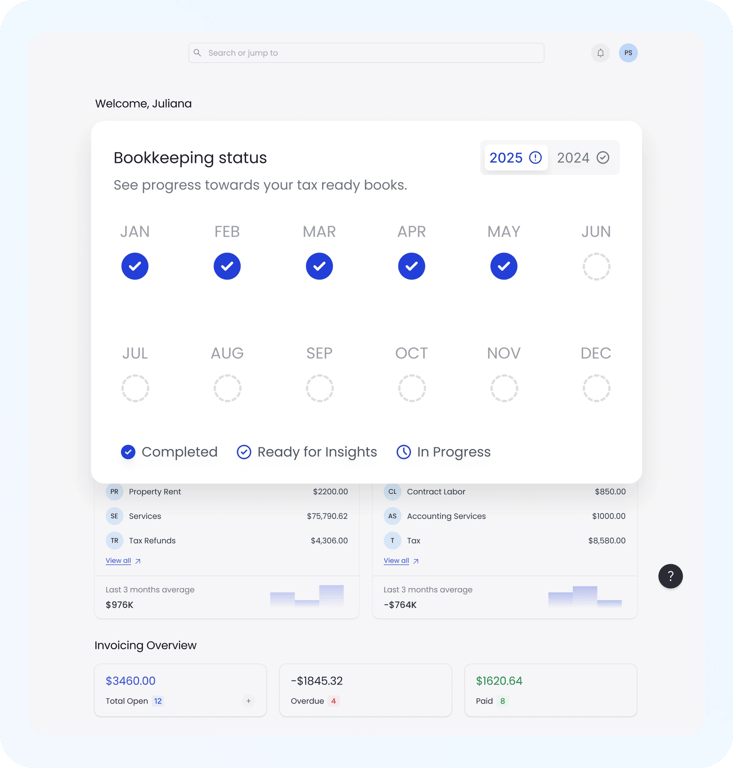

Tax Compliance: A Step-by-Step Guide

- Register: All businesses must register with the Illinois Department of Revenue to obtain a tax registration number.

- Understand Tax Forms: Familiarize yourself with the relevant tax forms, such as the Form IL-1040 for individual income tax or Form IL-1120 for corporate income tax.

- Timely Filing: Ensure timely submission of tax returns to avoid penalties. The due dates vary based on tax type.

- Stay Informed: Keep up with tax law changes and updates to ensure compliance.

Tax Benefits and Incentives

Chicago offers a range of tax benefits and incentives to promote economic growth and support various industries.

- Research and Development Tax Credit: Encourages innovation with tax credits for eligible R&D expenses.

- Manufacturing Deduction: Provides tax relief for qualifying manufacturers.

- Historic Preservation Tax Credit: Incentivizes the preservation and rehabilitation of historic properties.

- Small Business Improvement Fund: Offers grants to support small business development.

The Future of Taxation in Chicago

As Chicago continues to evolve, so does its tax system. Here’s a glimpse into the potential future of taxation in the city.

Potential Tax Reforms

Discussions around tax reforms are ongoing, with proposals aiming to simplify the tax system and provide relief to taxpayers. Some potential reforms include:

- Flattening the income tax brackets to reduce complexity.

- Introducing a local tax incentive program to attract businesses.

- Exploring property tax reforms to address fairness concerns.

The Impact of Economic Trends

Economic trends and shifts in the business landscape can influence tax policies. As Chicago’s economy adapts to changing circumstances, tax policies may need to evolve to support growth and stability.

Conclusion: A Comprehensive Tax Landscape

Taxation in Chicago is a complex yet essential aspect of the city’s economic fabric. From property taxes to income taxes and sales taxes, each component plays a crucial role in funding public services and infrastructure. Understanding and navigating this landscape is key to ensuring compliance and leveraging available benefits.

What is the difference between sales tax and use tax in Chicago?

+Sales tax is applied to the sale of goods and services within Chicago, while use tax is levied on goods and services purchased outside the city but used or consumed within Chicago. Use tax ensures that all purchases are taxed, regardless of where they are made.

Are there any tax exemptions for seniors in Chicago?

+Yes, Chicago offers a Senior Citizen Real Estate Tax Deferral Program, which allows eligible seniors to defer property taxes on their primary residence. This program provides much-needed relief to older residents.

How can I stay updated on tax law changes in Chicago?

+The Chicago Department of Finance and the Illinois Department of Revenue websites provide up-to-date information on tax law changes. Additionally, subscribing to their newsletters or following their social media accounts can ensure you stay informed.