Sales Tax In Va On Cars

Sales tax is an essential aspect of purchasing a vehicle, and it's crucial to understand the rules and regulations surrounding it to avoid any unexpected costs. In the state of Virginia, sales tax on cars is a complex yet vital component of the automotive sales process. This comprehensive guide will delve into the specifics of sales tax in Virginia, shedding light on its application, calculation, and implications for car buyers.

Understanding Sales Tax in Virginia

Virginia imposes a sales and use tax on the purchase of motor vehicles, including cars, trucks, motorcycles, and certain other types of vehicles. The tax is calculated based on the purchase price or the fair market value of the vehicle, whichever is higher. It’s important to note that Virginia’s sales tax is applied uniformly across the state, with a standard rate applicable to all vehicle purchases.

The current sales tax rate in Virginia for motor vehicles is 6%. This rate is in addition to any applicable local taxes, which can vary by jurisdiction. Localities in Virginia have the authority to impose additional taxes, so it's essential to check with your specific county or city to determine the total sales tax you may be liable for.

How Sales Tax is Calculated

Calculating sales tax on a vehicle purchase in Virginia involves a straightforward formula. The tax is determined by multiplying the vehicle’s purchase price or fair market value by the applicable tax rate. For instance, if you purchase a car for $25,000 and the sales tax rate is 6%, the sales tax amount would be calculated as follows:

$25,000 (purchase price) x 0.06 (tax rate) = $1,500 (sales tax)

In this example, you would owe $1,500 in sales tax on top of the vehicle's purchase price.

Special Considerations

It’s important to be aware of certain scenarios that may impact your sales tax liability. If you’re trading in your old vehicle as part of the purchase, the sales tax may be calculated based on the difference between the trade-in value and the new vehicle’s price. Additionally, if you’re purchasing a used car from a private seller, you may be responsible for paying use tax, which is similar to sales tax but applied to purchases made outside of the traditional sales tax system.

Steps to Pay Sales Tax on a Vehicle Purchase

To ensure a smooth process, it’s essential to follow these steps when paying sales tax on a vehicle purchase in Virginia:

- Obtain a Sales Tax Invoice: When purchasing a vehicle from a dealership, you will receive a sales tax invoice. This document outlines the purchase price, any applicable fees, and the calculated sales tax. Review this invoice carefully to ensure accuracy.

- Register Your Vehicle: In Virginia, you must register your vehicle with the Department of Motor Vehicles (DMV) within 30 days of purchase. During the registration process, you will be required to pay the sales tax amount specified on your invoice.

- Pay the Sales Tax: You can pay the sales tax either online, by mail, or in person at a DMV customer service center. Ensure you have the necessary payment methods and documentation ready.

- Keep Records: It's crucial to retain all records related to your vehicle purchase, including the sales tax invoice and proof of payment. These documents may be required for future reference or audits.

Sales Tax Exemption

In certain circumstances, you may be eligible for a sales tax exemption. Virginia offers exemptions for specific groups, such as active-duty military personnel, individuals with disabilities, and organizations purchasing vehicles for charitable purposes. To claim an exemption, you must provide the necessary documentation and meet the eligibility criteria outlined by the Virginia Department of Taxation.

The Impact of Sales Tax on Vehicle Purchases

Sales tax on vehicle purchases can significantly impact the overall cost of ownership. While the 6% rate may seem modest, it can quickly add up for more expensive vehicles. For example, on a 50,000 car, the sales tax alone would amount to 3,000. This additional cost should be factored into your budget when considering a vehicle purchase.

Additionally, sales tax can influence purchasing decisions. Buyers may opt for lower-priced vehicles or explore financing options to manage the upfront costs, including sales tax. Understanding the sales tax implications can help buyers make more informed choices and negotiate better deals with dealerships.

Comparative Analysis

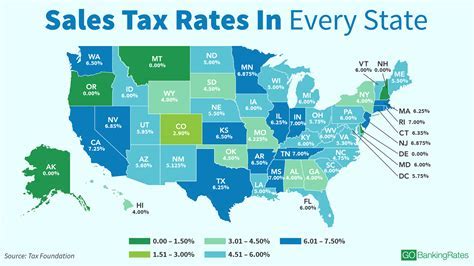

Compared to other states, Virginia’s sales tax rate for vehicles is relatively average. Some states have higher rates, while others have lower or no sales tax on vehicles. For instance, neighboring states like Maryland and North Carolina have similar sales tax rates, while states like Delaware and New Hampshire have no sales tax on vehicle purchases. This variation can impact consumer behavior and influence purchasing decisions across state lines.

| State | Sales Tax Rate |

|---|---|

| Virginia | 6% |

| Maryland | 6% |

| North Carolina | 3-7% |

| Delaware | 0% |

| New Hampshire | 0% |

Future Implications and Trends

The landscape of sales tax on vehicle purchases is subject to change. While the current rate in Virginia is relatively stable, there have been discussions and proposals for tax reform. Some policymakers have suggested implementing a flat tax rate on all vehicle purchases, regardless of value, to simplify the process and potentially reduce the tax burden on consumers.

Additionally, with the rise of electric vehicles (EVs) and autonomous technology, there may be shifts in how sales tax is applied. Some states have already implemented additional fees or taxes specifically for EVs to offset potential losses in fuel tax revenue. Virginia may follow suit, introducing new taxes or incentives to encourage the adoption of environmentally friendly vehicles.

Stay Informed

As a car buyer in Virginia, staying informed about sales tax regulations and any upcoming changes is crucial. Keeping up with local news and following updates from the Virginia Department of Taxation can help you anticipate any shifts in sales tax policies. Additionally, consulting with tax professionals or dealerships can provide valuable insights into the latest trends and potential implications for your vehicle purchase.

Conclusion

Understanding the intricacies of sales tax on cars in Virginia is essential for making informed and financially responsible decisions. By familiarizing yourself with the current tax rate, calculation methods, and potential exemptions, you can navigate the vehicle purchasing process with confidence. Remember to consider sales tax as a significant factor in your budget and explore all available options to ensure a smooth and cost-effective transaction.

How often does Virginia update its sales tax rates for vehicles?

+Virginia’s sales tax rates are typically reviewed and updated annually, with any changes taking effect on July 1st. However, it’s important to note that while the overall sales tax rate may remain the same, specific local taxes can vary from year to year.

Can I negotiate the sales tax amount with the dealership?

+Sales tax is a mandatory fee set by the state and cannot be negotiated with the dealership. However, you can negotiate the vehicle’s purchase price, which will directly impact the sales tax amount you owe.

Are there any online resources to estimate my sales tax liability before purchasing a vehicle?

+Yes, the Virginia Department of Taxation provides an online sales tax calculator that allows you to estimate your sales tax liability based on your vehicle’s purchase price and location. This tool can help you budget effectively.