Tax Refund Calculator 2023

The 2023 tax season is upon us, and as taxpayers navigate the complexities of filing their returns, one of the most anticipated outcomes is the potential tax refund. A tax refund is essentially a reimbursement of overpaid taxes throughout the year, and it can provide a welcome financial boost for many individuals and families. However, calculating this refund accurately can be a daunting task, given the myriad of factors and deductions that come into play. This comprehensive guide aims to demystify the process and equip you with the knowledge to estimate your 2023 tax refund with confidence.

Understanding the Basics of Tax Refunds

Before we delve into the intricacies of tax refund calculation, let’s establish a solid foundation by understanding the fundamental concepts.

A tax refund occurs when the taxes withheld from your income throughout the year exceed the actual tax liability you owe to the Internal Revenue Service (IRS). In simpler terms, it's the government returning the excess amount it collected from you. This scenario typically arises when your tax deductions and credits exceed your tax liability, resulting in a refund.

Conversely, if your tax liability exceeds the amount withheld from your income, you may owe money to the IRS, leading to a tax bill instead of a refund. Understanding this basic distinction is crucial for financial planning and tax management.

Factors Influencing Tax Refunds

Several factors contribute to the size of your tax refund. These include your income level, filing status (single, married filing jointly, head of household, etc.), deductions, credits, and tax brackets. Additionally, any changes in your financial situation, such as job changes, marriage, or having a child, can significantly impact your refund amount.

For instance, tax deductions reduce the amount of your income that is subject to taxation, thereby lowering your tax liability. Common deductions include contributions to retirement accounts, student loan interest, medical expenses, and charitable donations. On the other hand, tax credits directly reduce the amount of tax you owe, often dollar-for-dollar. Examples of tax credits include the Child Tax Credit, Earned Income Tax Credit, and the Credit for the Elderly or the Disabled.

Step-by-Step Guide to Estimating Your 2023 Tax Refund

Estimating your tax refund accurately requires a systematic approach. Here’s a detailed, step-by-step guide to help you through the process.

Gather Your Tax Documents

The first step is to collect all the necessary tax documents. This includes W-2 forms from your employer(s), 1099 forms for any freelance or contract work, and any other relevant documents, such as those pertaining to investments, retirement accounts, and deductions. Having all these documents organized will make the calculation process smoother.

Calculate Your Gross Income

Your gross income is the total amount of money you earned from all sources before any deductions or taxes. This includes income from employment, investments, business activities, and any other taxable sources. Add up all these amounts to determine your gross income.

Determine Your Adjusted Gross Income (AGI)

The Adjusted Gross Income is your gross income minus certain deductions. These deductions include contributions to retirement accounts, moving expenses, and certain other qualified expenses. You can find a comprehensive list of adjustments to gross income in IRS Publication 525.

For example, if you contributed $6,000 to your 401(k) retirement plan and had $1,500 in moving expenses, your AGI would be your gross income minus $7,500. This amount is crucial as it determines your eligibility for certain tax deductions and credits.

Identify Eligible Deductions and Credits

Now, it’s time to identify the deductions and credits you’re eligible for. As mentioned earlier, deductions reduce your taxable income, while credits directly reduce the amount of tax you owe. Here are some common deductions and credits to consider:

- Standard Deduction: This is a fixed amount that reduces your taxable income. The standard deduction amount varies based on your filing status.

- Itemized Deductions: These are specific expenses that you can deduct from your taxable income, such as medical expenses, state and local taxes, mortgage interest, and charitable contributions. You can choose to take the standard deduction or itemize, whichever results in a larger reduction.

- Child Tax Credit: If you have qualifying children under the age of 18, you may be eligible for this credit, which can significantly reduce your tax liability.

- Earned Income Tax Credit (EITC): This credit is for low- to moderate-income working individuals and families. It's based on earned income, number of qualifying children, and other factors.

- Education Credits: You may be eligible for credits such as the American Opportunity Credit or the Lifetime Learning Credit if you or your dependents are enrolled in higher education.

For instance, if you're married filing jointly and have two qualifying children, you could potentially benefit from the Child Tax Credit, the Earned Income Tax Credit, and the Standard Deduction. These credits and deductions would significantly reduce your tax liability, leading to a larger refund.

Calculate Your Taxable Income and Tax Liability

Once you’ve identified your eligible deductions and credits, it’s time to calculate your taxable income and tax liability. Start by subtracting your deductions and credits from your AGI to determine your taxable income. Then, using the IRS tax tables or tax software, calculate the tax you owe based on your taxable income and filing status.

Determine Withheld Taxes and Estimate Your Refund

Finally, compare the tax you owe to the total amount of taxes withheld from your income throughout the year. This information is available on your W-2 forms. If the withheld amount exceeds your tax liability, you’re eligible for a tax refund. Subtract your tax liability from the total withheld amount to estimate your refund.

For instance, if your tax liability is $8,000 and your total withheld taxes amount to $10,000, your estimated tax refund would be $2,000.

Utilizing Tax Refund Calculators and Software

While the step-by-step process outlined above provides a comprehensive understanding of tax refund calculation, it can be time-consuming and complex. Fortunately, there are numerous tax refund calculators and software available to simplify the process.

Online Tax Refund Calculators

Online tax refund calculators are user-friendly tools that guide you through the process of estimating your refund. They often ask a series of questions about your income, deductions, and credits, and then provide an estimated refund amount. These calculators are a great way to get a quick estimate of your refund without diving into the details of tax calculations.

Some popular online tax refund calculators include the IRS's Tax Withholding Estimator, TurboTax's Tax Refund Calculator, and H&R Block's Refund Calculator. These tools are designed to be easy to use and provide accurate estimates based on your input.

Tax Preparation Software

Tax preparation software takes tax refund calculation a step further by guiding you through the entire tax filing process. These software programs ask a series of questions and use your responses to complete your tax return, including calculating your refund or tax liability. They often provide more accurate results than online calculators because they consider a broader range of deductions and credits.

Popular tax preparation software includes TurboTax, H&R Block, and TaxAct. These programs offer various features, such as audit support, tax optimization strategies, and the ability to e-file your return directly from the software.

Maximizing Your Tax Refund

While calculating your tax refund accurately is important, it’s equally crucial to explore strategies to maximize that refund. Here are some tips to consider:

Adjust Your Withholding

If you consistently receive large tax refunds, it may be worth adjusting your tax withholding to receive more of your money throughout the year. You can do this by filling out a new W-4 form with your employer, indicating that you want less tax withheld from each paycheck. This strategy can provide you with more disposable income each month.

Explore Additional Deductions and Credits

Review all eligible deductions and credits to ensure you’re maximizing your tax benefits. Consider consulting a tax professional or using tax preparation software to identify deductions and credits you may have overlooked.

Take Advantage of Retirement Contributions

Contributions to retirement accounts, such as IRAs or 401(k)s, can reduce your taxable income and increase your tax refund. Maximize your contributions to these accounts to take full advantage of this tax benefit.

Utilize Tax-Efficient Investment Strategies

Consider investing in tax-efficient vehicles, such as municipal bonds or tax-free savings accounts. These investments can reduce your taxable income and increase your refund.

Common Mistakes to Avoid

Estimating your tax refund is a complex process, and there are several common mistakes that taxpayers often make. Being aware of these pitfalls can help you avoid them and ensure a more accurate refund calculation.

Failing to Claim All Eligible Deductions and Credits

One of the most common mistakes is failing to claim all the deductions and credits you’re eligible for. This can result in a smaller refund or even a larger tax liability. Take the time to review all potential deductions and credits to ensure you’re maximizing your tax benefits.

Overlooking Changes in Your Financial Situation

Changes in your financial situation, such as a new job, marriage, or having a child, can significantly impact your tax refund. Make sure to update your tax calculations to reflect these changes accurately.

Using Outdated or Incorrect Tax Tables

Using outdated tax tables can lead to inaccurate refund calculations. Always ensure you’re using the most recent tax tables and guidelines provided by the IRS.

Not Understanding the Impact of Tax Brackets

Tax brackets determine the rate at which your income is taxed. Failing to understand how tax brackets work can result in incorrect refund calculations. Make sure you understand how your income is taxed and how changes in your income can affect your refund.

The Future of Tax Refunds: Electronic Filing and Direct Deposit

The process of claiming tax refunds has evolved significantly with the advent of technology. Electronic filing and direct deposit have become the preferred methods for many taxpayers, offering convenience, speed, and security.

Electronic Filing (e-Filing)

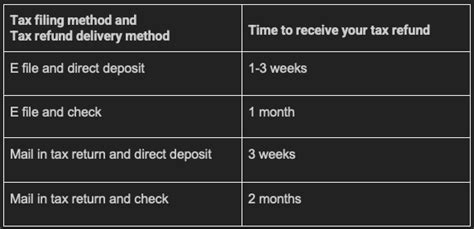

Electronic filing, or e-filing, is the process of submitting your tax return electronically to the IRS. This method is faster, more secure, and less prone to errors than traditional paper filing. It also allows you to receive your tax refund faster, often within a few weeks.

To e-file your tax return, you can use tax preparation software or engage the services of a tax professional. Many tax software providers offer e-filing as part of their services, making the process seamless and straightforward.

Direct Deposit for Tax Refunds

Direct deposit is a secure and convenient way to receive your tax refund. Instead of receiving a paper check in the mail, your refund is deposited directly into your bank account. This method is faster, more secure, and reduces the risk of lost or stolen refund checks.

When filing your tax return, simply provide your bank account and routing numbers to the IRS or your tax preparer. Your refund will then be deposited directly into your account, often within a few days of your return being accepted.

Conclusion

Understanding and estimating your tax refund is a crucial aspect of financial planning. By following the step-by-step guide outlined in this article and utilizing the available tools and software, you can accurately estimate your 2023 tax refund. Remember to explore strategies to maximize your refund and be aware of common mistakes to avoid. With the right approach, you can navigate the tax refund process with confidence and make the most of your hard-earned money.

What is the average tax refund in the United States?

+The average tax refund in the United States varies from year to year. According to IRS data, the average tax refund for the 2021 tax year was around $3,000. However, it’s important to note that individual refunds can vary significantly based on personal circumstances and tax strategies.

How long does it take to receive a tax refund after filing electronically with direct deposit?

+When you file your tax return electronically and choose direct deposit, you can typically expect to receive your refund within 3 to 4 weeks. However, it’s important to note that processing times can vary, and certain factors, such as errors or additional review by the IRS, can delay the refund process.

Can I still file a paper tax return and receive a paper refund check?

+Yes, it is still possible to file a paper tax return and receive a paper refund check. However, it’s important to note that paper filing is less common and can take significantly longer to process. The IRS encourages taxpayers to use electronic filing and direct deposit for faster and more secure refunds.

What should I do if I think I made a mistake on my tax return and my refund estimate is incorrect?

+If you suspect a mistake on your tax return that could impact your refund estimate, it’s crucial to amend your return as soon as possible. You can file an amended return using Form 1040X. It’s also recommended to consult a tax professional or the IRS website for guidance on correcting errors.

Are there any penalties for receiving a large tax refund instead of adjusting my withholding throughout the year?

+Receiving a large tax refund is not penalized by the IRS. However, it’s important to note that a large refund often indicates that you had more taxes withheld from your paycheck than necessary. Adjusting your withholding can provide you with more disposable income throughout the year and reduce the risk of owing money at tax time.