Oklahoma State Income Taxes

Oklahoma is one of the many states in the United States that imposes an income tax on its residents and businesses. The state's income tax system is designed to contribute to the state's revenue and fund various public services and initiatives. Understanding the intricacies of Oklahoma's income tax system is crucial for individuals and businesses operating within the state.

The Oklahoma Income Tax System: An Overview

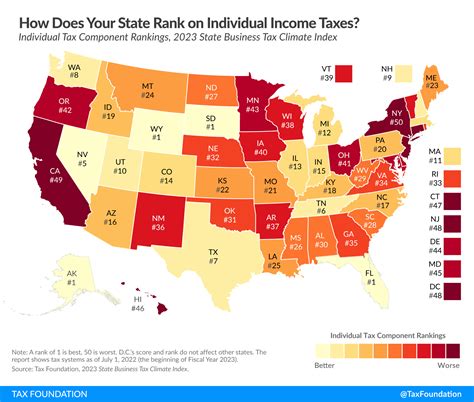

Oklahoma’s income tax structure is based on a progressive tax system, meaning that the tax rate increases as the taxable income rises. This approach ensures that higher-income earners contribute a larger proportion of their income to the state’s revenue. The state’s income tax rates and brackets are subject to periodic adjustments to account for inflation and economic changes.

The Oklahoma Tax Commission, a state agency, is responsible for administering and enforcing the income tax laws. They provide guidance, forms, and resources to assist taxpayers in complying with their tax obligations.

Taxable Income and Rates

Oklahoma’s income tax is applied to various sources of income, including wages, salaries, commissions, bonuses, investment earnings, and business profits. The state’s tax system recognizes both single and joint filing statuses, and the tax rates differ accordingly. As of my last update in January 2023, the tax rates for Oklahoma’s individual income tax are as follows:

| Tax Rate | Taxable Income Range (Single Filers) | Taxable Income Range (Joint Filers) |

|---|---|---|

| 0.5% | $0 - $1,000 | $0 - $2,000 |

| 1.0% | $1,001 - $2,000 | $2,001 - $4,000 |

| 1.5% | $2,001 - $3,000 | $4,001 - $6,000 |

| 2.0% | $3,001 - $4,000 | $6,001 - $8,000 |

| 2.5% | $4,001 - $5,000 | $8,001 - $10,000 |

| 3.0% | $5,001 - $7,500 | $10,001 - $15,000 |

| 3.5% | $7,501 - $10,000 | $15,001 - $20,000 |

| 4.0% | $10,001 - $12,500 | $20,001 - $25,000 |

| 4.5% | $12,501 - $15,000 | $25,001 - $30,000 |

| 5.0% | $15,001 - $20,000 | $30,001 - $40,000 |

| 5.25% | $20,001 - $25,000 | $40,001 - $50,000 |

| 5.5% | $25,001 and above | $50,001 and above |

These rates are subject to change, so it's essential to refer to the most recent tax guidelines provided by the Oklahoma Tax Commission.

Filing Requirements and Deadlines

All Oklahoma residents who earn income, whether from employment, self-employment, or other sources, are generally required to file an Oklahoma state income tax return. Non-residents who earn income from Oklahoma sources may also have filing obligations.

The tax year in Oklahoma runs from January 1st to December 31st. Taxpayers typically have until April 15th of the following year to file their state income tax returns. However, it's important to note that the deadline may be adjusted in certain circumstances, such as if it falls on a weekend or a state holiday.

The Oklahoma Tax Commission provides various forms and resources to assist taxpayers in filing their returns accurately and on time. These include the Form 511, the individual income tax return form, and various schedules and worksheets to account for different income sources and deductions.

Tax Credits and Deductions

Oklahoma offers a range of tax credits and deductions to alleviate the tax burden on individuals and businesses. These incentives aim to promote economic growth, encourage certain activities, and provide relief to specific taxpayer groups.

Some of the notable tax credits available in Oklahoma include:

- Earned Income Tax Credit (EITC): This federal credit, which Oklahoma allows taxpayers to claim, provides a refundable tax credit for low- to moderate-income working individuals and families.

- Child and Dependent Care Credit: Oklahoma residents can claim a credit for expenses incurred for the care of a qualifying child or dependent to enable the taxpayer to work or look for work.

- Oklahoma College Tuition Deduction: This deduction allows taxpayers to deduct qualified expenses for tuition and fees paid for post-secondary education in Oklahoma.

- Property Tax Rebate: Oklahoma provides a property tax rebate to eligible low-income homeowners to reduce the financial burden of property taxes.

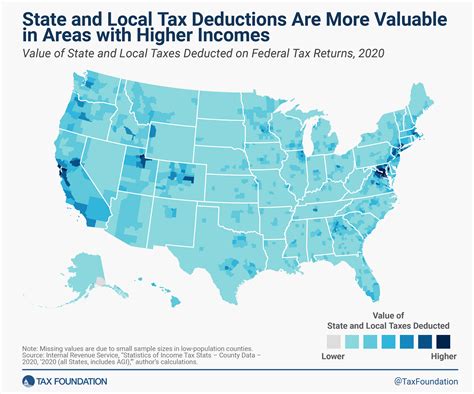

Additionally, Oklahoma allows taxpayers to itemize deductions for various expenses, including medical and dental costs, state and local taxes, charitable contributions, and certain business-related expenses.

Oklahoma Sales and Use Tax

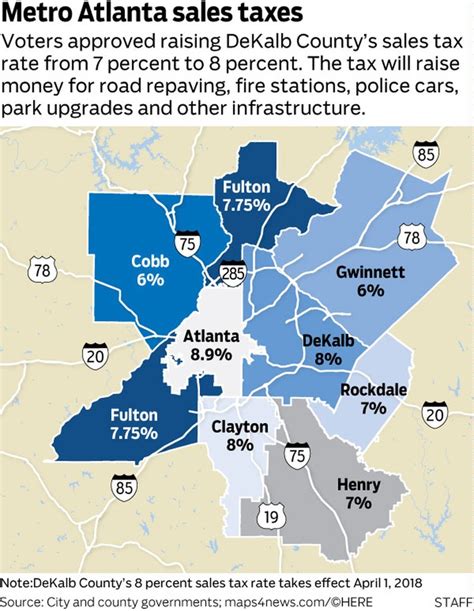

In addition to income tax, Oklahoma imposes a sales and use tax on the sale of tangible personal property and certain services within the state. The sales tax rate in Oklahoma is 4.5%, and it is applied to the retail sale of most goods and some services. However, certain items, such as groceries, prescription drugs, and some agricultural products, are exempt from sales tax.

Oklahoma's sales tax system is a combined system, meaning that the state's sales tax rate is applied uniformly across the state, but local jurisdictions can also impose additional sales taxes. These local sales taxes can vary by county and municipality, resulting in different effective sales tax rates across the state.

Compliance and Enforcement

The Oklahoma Tax Commission is responsible for enforcing tax laws and ensuring compliance. They have the authority to audit taxpayer records, impose penalties for non-compliance, and pursue legal action against taxpayers who fail to meet their tax obligations.

It's crucial for individuals and businesses to maintain accurate records, file their returns on time, and pay their taxes accurately to avoid penalties and legal consequences. Seeking professional tax advice and utilizing the resources provided by the Oklahoma Tax Commission can help ensure compliance with the state's tax laws.

Future Outlook and Implications

Oklahoma’s income tax system, like that of many states, is subject to ongoing discussions and potential reforms. Proposals to simplify the tax code, adjust tax rates, or introduce new tax incentives are regularly debated by policymakers and stakeholders.

One potential area of focus for Oklahoma's tax system is the consideration of a flat tax rate. While the current progressive tax system aims to distribute the tax burden more equitably, a flat tax rate could offer simplicity and ease of compliance. However, such a reform would require careful consideration of its impact on different income groups and the state's revenue needs.

Additionally, the state's tax system may need to adapt to changing economic conditions, such as shifts in the job market, technological advancements, and the increasing prevalence of remote work and gig economy jobs. These changes may necessitate adjustments to the tax code to ensure fairness and adequacy in revenue collection.

Frequently Asked Questions

What is the income tax rate in Oklahoma for the year 2023?

+

The income tax rates in Oklahoma for the year 2023 are progressive, meaning they increase as taxable income rises. As of my knowledge cutoff in January 2023, the tax rates range from 0.5% to 5.5% for single filers and 0.5% to 5.25% for joint filers. However, these rates are subject to change, so it’s advisable to refer to the most recent tax guidelines provided by the Oklahoma Tax Commission for accurate and up-to-date information.

Are there any tax credits or deductions available in Oklahoma to reduce my tax burden?

+

Yes, Oklahoma offers various tax credits and deductions to alleviate the tax burden on individuals and businesses. Some notable credits include the Earned Income Tax Credit (EITC), Child and Dependent Care Credit, Oklahoma College Tuition Deduction, and Property Tax Rebate. Additionally, taxpayers can itemize deductions for expenses like medical costs, charitable contributions, and certain business-related expenses. It’s advisable to consult the Oklahoma Tax Commission’s resources for a comprehensive list of available credits and deductions.

What is the sales tax rate in Oklahoma, and does it apply to all purchases?

+

The sales tax rate in Oklahoma is 4.5% as of my knowledge cutoff. This rate applies to the sale of tangible personal property and certain services within the state. However, certain items like groceries, prescription drugs, and some agricultural products are exempt from sales tax. Additionally, local jurisdictions may impose additional sales taxes, resulting in varying effective sales tax rates across the state.

How do I file my Oklahoma state income tax return, and what are the deadlines?

+

To file your Oklahoma state income tax return, you typically need to complete Form 511 or the appropriate form for your filing status. The tax year runs from January 1st to December 31st, and the deadline to file is typically April 15th of the following year. However, it’s important to note that the deadline may be adjusted in certain circumstances, such as if it falls on a weekend or a state holiday. The Oklahoma Tax Commission provides resources and guidance to assist taxpayers in filing their returns accurately and on time.

What happens if I fail to file my Oklahoma state income tax return or pay my taxes on time?

+

Failing to file your Oklahoma state income tax return or pay your taxes on time can result in penalties and interest charges. The Oklahoma Tax Commission has the authority to audit taxpayer records and impose penalties for non-compliance. In some cases, legal action may be pursued against taxpayers who consistently fail to meet their tax obligations. It’s crucial to maintain accurate records, file returns on time, and pay taxes accurately to avoid penalties and legal consequences.