Harris County Tax Collector

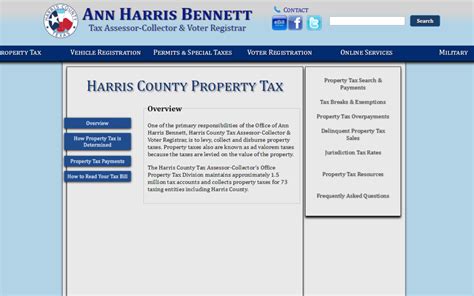

The Harris County Tax Office, often referred to as the Harris County Tax Collector, plays a pivotal role in the administrative and financial landscape of Harris County, Texas. This office is responsible for a multitude of crucial tasks that directly impact the residents and businesses within the county. From property tax assessments to vehicle registration and various other services, the Harris County Tax Office is a vital component of the local government infrastructure.

Understanding the Harris County Tax Office

The Harris County Tax Office is an administrative entity tasked with managing and collecting various taxes and fees within the county. This office is headed by the Harris County Tax Assessor-Collector, an elected official who serves as the custodian of records for property and personal property taxes, vehicle registration, and various other financial obligations.

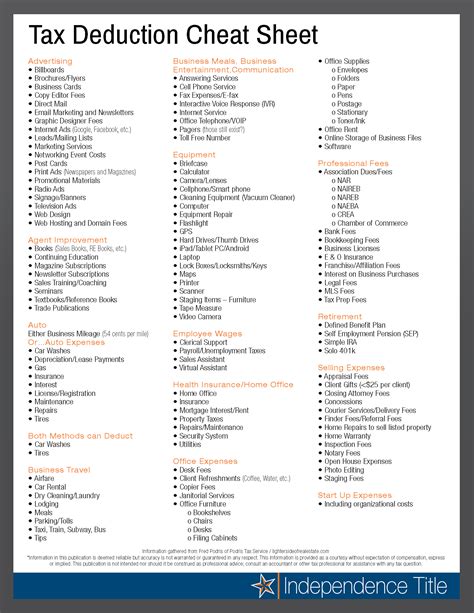

The primary functions of the Harris County Tax Office include:

- Property Tax Assessment and Collection: One of the most significant responsibilities is the assessment and collection of property taxes. The office evaluates the value of properties within the county, ensuring that the tax burden is distributed fairly among residents and businesses.

- Vehicle Registration and Titling: Harris County residents rely on the Tax Office for vehicle registration and titling services. This process involves issuing registration stickers, titles, and handling related paperwork.

- Motorcycle and Boat Registration: Beyond vehicles, the Tax Office also manages the registration of motorcycles and boats, ensuring compliance with state regulations.

- Voter Registration: In addition to its financial duties, the Tax Office plays a role in the democratic process by facilitating voter registration within the county.

- Passport Services: Another critical service offered is passport acceptance. Residents can apply for passports at designated locations, streamlining the process.

Harris County Property Taxes

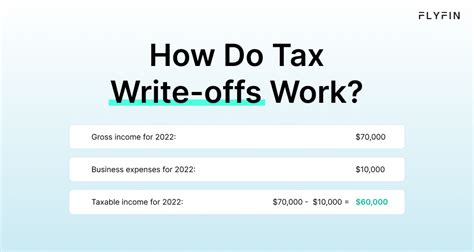

Property taxes in Harris County are an essential revenue source for local governments, contributing to the funding of schools, roads, emergency services, and other public services. These taxes are levied annually based on the assessed value of real estate properties.

The property tax assessment process in Harris County involves the following steps:

- Property Valuation: The Harris County Appraisal District (HCAD) assesses the value of each property within the county. This valuation is based on factors such as location, size, and improvements.

- Appraisal Notices: HCAD issues appraisal notices to property owners, detailing the assessed value of their properties. These notices provide an opportunity for property owners to review and potentially challenge the valuation.

- Protest Period: Property owners have the right to protest their appraised value during a designated protest period. The Harris County Appraisal Review Board (ARB) hears these protests and makes determinations on any adjustments.

- Tax Rate Adoption: After the protest period, local governing bodies, such as cities and school districts, adopt tax rates based on their revenue needs. The adopted tax rate, combined with the assessed property value, determines the tax liability for each property.

- Tax Bills: The Harris County Tax Office then issues tax bills to property owners, specifying the amount due and the payment deadline. Property owners have the option to pay in full or set up payment plans.

| Property Tax Timeline in Harris County |

|---|

| Appraisal Notices Mailed: Around April |

| Protest Period: Typically May to June |

| Tax Rate Adoption: Usually by October |

| Tax Bills Mailed: Generally in October |

| Payment Deadline: Typically by January of the following year |

Vehicle Registration and Titling

The Harris County Tax Office also serves as a vital hub for vehicle-related services. Residents can visit the Tax Office to register and title their vehicles, including cars, trucks, motorcycles, and even boats. The process involves:

- Providing Vehicle Information: Owners need to present their vehicle's make, model, year, and Vehicle Identification Number (VIN) for registration.

- Title Transfer: If purchasing a vehicle from a private seller, owners must transfer the title to their name. The Tax Office assists with this process, ensuring proper documentation.

- Registration and Fees: Owners pay registration fees, which vary based on the type and value of the vehicle. These fees contribute to road maintenance and other transportation-related projects.

- Registration Renewal: Vehicle registrations need to be renewed periodically, typically every year or two. The Tax Office handles these renewals, ensuring vehicles remain compliant with state regulations.

Voter Registration and Passport Services

Beyond its financial duties, the Harris County Tax Office also plays a role in the democratic process and international travel. Residents can utilize the Tax Office for:

- Voter Registration: Registering to vote is a critical step in participating in local, state, and federal elections. The Tax Office provides a convenient location for residents to register and update their voting information.

- Passport Services: For those planning international travel, the Tax Office offers passport acceptance services. Residents can apply for passports, making the process more accessible and efficient.

Contact Information and Online Services

The Harris County Tax Office maintains a comprehensive website, hctax.net, where residents can find detailed information on various services, including property tax assessments, vehicle registration, and voter registration. The website also provides online tools for tax payments, property tax searches, and more.

Additionally, the Tax Office has multiple physical locations across Harris County for in-person services. These locations are strategically placed to ensure convenient access for residents. Contact information and hours of operation are available on the official website.

Conclusion

The Harris County Tax Office stands as a vital pillar of the county’s administrative system, managing a range of essential services that directly impact the lives of residents. From property tax assessments to vehicle registration and voter registration, the office’s responsibilities are diverse and critical to the smooth functioning of the county’s infrastructure. By understanding the role and services provided by the Harris County Tax Office, residents can navigate their financial and administrative obligations with ease and confidence.

What is the role of the Harris County Tax Office?

+

The Harris County Tax Office is responsible for assessing and collecting various taxes, including property taxes, and providing services such as vehicle registration, titling, and voter registration.

How often do property taxes need to be paid in Harris County?

+

Property taxes in Harris County are typically paid annually. The exact payment deadline varies, but it is generally due by January of the following year.

Can I register my vehicle online through the Harris County Tax Office website?

+

Yes, the Harris County Tax Office website offers online vehicle registration services. However, certain documents and fees may still need to be submitted in person.

How can I protest my property tax appraisal in Harris County?

+

To protest your property tax appraisal, you need to file a protest with the Harris County Appraisal Review Board (ARB) during the designated protest period. You can find more information and the necessary forms on the Harris County Tax Office website.

Where can I find the physical locations of the Harris County Tax Office?

+

The physical locations of the Harris County Tax Office can be found on their official website, along with contact information and hours of operation for each branch.