City Of Atlanta Sales Tax

The city of Atlanta, nestled in the vibrant state of Georgia, has a dynamic economic landscape that is influenced by various factors, including its robust sales tax system. Sales tax plays a crucial role in the city's revenue generation, contributing to the development and maintenance of essential infrastructure and services. In this article, we will delve into the intricacies of the City of Atlanta Sales Tax, exploring its rates, exemptions, and the impact it has on both businesses and consumers.

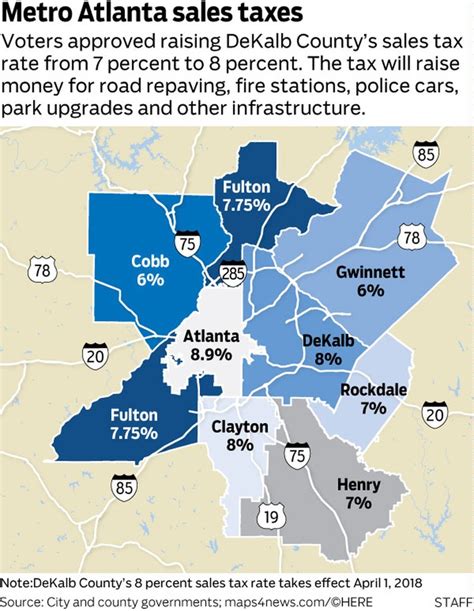

Understanding the City of Atlanta Sales Tax Rates

The sales tax system in Atlanta is a complex interplay of local, state, and additional taxes, each serving a specific purpose. As of [current year], the city’s sales tax rates are as follows:

| Tax Type | Rate |

|---|---|

| State Sales Tax | 4% |

| Metropolitan Atlanta Rapid Transit Authority (MARTA) Sales Tax | 1% |

| City of Atlanta Sales Tax | 3.9% |

| Total Sales Tax | 9% |

These rates are applicable to a wide range of goods and services, and they can significantly impact the final cost for consumers. It is essential to understand the breakdown of these taxes to grasp the financial implications for both businesses and individuals.

State Sales Tax

The State Sales Tax is a uniform tax applied across Georgia, with the revenue collected going towards funding various state-wide initiatives and programs. This tax forms the foundation of the sales tax structure in Atlanta and is a consistent factor for businesses operating within the state.

Metropolitan Atlanta Rapid Transit Authority (MARTA) Sales Tax

The MARTA Sales Tax is a unique addition to Atlanta’s sales tax landscape. It is dedicated to supporting the city’s public transportation system, specifically the Metropolitan Atlanta Rapid Transit Authority. This tax ensures a stable revenue stream for the maintenance and expansion of Atlanta’s transit network, benefiting both commuters and the environment.

City of Atlanta Sales Tax

The City of Atlanta Sales Tax is a crucial component, as it directly contributes to the city’s development and maintenance. The revenue generated from this tax is allocated towards various city-specific projects, such as infrastructure upgrades, community development initiatives, and the provision of essential services.

Exemptions and Special Considerations

While the City of Atlanta’s sales tax system is comprehensive, it also accommodates certain exemptions and special considerations. These provisions aim to support specific industries, promote economic growth, and provide relief to targeted sectors.

Food and Grocery Exemptions

One notable exemption within the City of Atlanta’s sales tax framework is the exclusion of certain food and grocery items. This exemption is designed to ease the financial burden on households, especially those with limited means. While the specifics of this exemption may vary, it generally applies to staple food items, ensuring that essential groceries remain more affordable for Atlanta’s residents.

Manufacturing and Industrial Incentives

The city recognizes the importance of fostering a robust manufacturing and industrial sector. As such, certain sales tax incentives are in place to encourage businesses in these industries to establish or expand their operations in Atlanta. These incentives can take the form of reduced tax rates, tax holidays, or other targeted benefits, making the city an attractive destination for businesses looking to invest in manufacturing and industrial ventures.

Special Event and Tourism Taxes

Atlanta’s vibrant culture and tourism industry are celebrated through special event and tourism taxes. These taxes are often applied to specific tickets or admissions, with the revenue generated supporting the organization and promotion of cultural events, festivals, and attractions. This unique tax structure not only enhances the city’s appeal to visitors but also ensures a sustainable funding model for its cultural offerings.

Impact on Businesses and Consumers

The City of Atlanta Sales Tax has a profound impact on both businesses and consumers within the city’s economic ecosystem. Understanding these effects is crucial for stakeholders to make informed decisions and navigate the financial landscape effectively.

Business Implications

For businesses operating in Atlanta, the sales tax system can present both opportunities and challenges. On the one hand, the city’s robust tax structure provides a stable revenue stream for essential city services, creating a favorable business environment. However, businesses must also consider the impact of sales tax on their pricing strategies and competitiveness in the market.

Businesses may need to factor in the sales tax when setting their product or service prices. Additionally, they must ensure compliance with the city's tax regulations, which can be complex. To navigate these challenges, many businesses opt for specialized tax software or consult with tax professionals to streamline their operations and stay compliant.

Consumer Perspective

From a consumer standpoint, the City of Atlanta Sales Tax directly affects purchasing power and spending habits. Consumers may need to budget for the additional tax when making purchases, especially for higher-value items. However, the city’s tax structure also ensures that essential services and infrastructure are well-maintained, indirectly benefiting the quality of life for Atlanta’s residents.

Moreover, the sales tax system can influence consumer behavior. For instance, consumers may opt to purchase certain items online or from neighboring jurisdictions with lower tax rates. This dynamic underscores the importance of businesses offering competitive pricing and value propositions to retain their customer base.

Sales Tax Compliance and Enforcement

Ensuring compliance with the City of Atlanta Sales Tax regulations is a critical aspect of doing business in the city. The Atlanta Department of Finance, in collaboration with state tax authorities, plays a vital role in enforcing tax laws and ensuring fair taxation. Businesses must adhere to specific registration, reporting, and payment requirements to avoid penalties and legal consequences.

The city employs a range of strategies to promote tax compliance, including education initiatives, outreach programs, and streamlined online tax filing systems. By fostering a culture of compliance, the city aims to create a level playing field for businesses and maintain a sustainable revenue stream for essential city services.

Future Outlook and Implications

As Atlanta continues to evolve and grow, the sales tax system will likely undergo adjustments and refinements to adapt to changing economic dynamics. The city’s leaders and policymakers play a pivotal role in shaping the future of sales taxation, considering factors such as economic growth, inflation, and the evolving needs of the community.

One potential area of focus is the exploration of alternative tax structures or incentives to attract specific industries or promote economic diversification. Additionally, the city may consider further streamlining the tax filing process and exploring digital solutions to enhance efficiency and convenience for taxpayers.

Frequently Asked Questions

How often are sales tax rates updated in Atlanta?

+Sales tax rates in Atlanta are typically updated annually, reflecting changes in state and local tax policies. These updates ensure that the tax system remains aligned with the evolving economic landscape.

Are there any online resources to help businesses calculate sales tax in Atlanta?

+Yes, the Atlanta Department of Finance provides online calculators and tools to assist businesses in determining the applicable sales tax rates for their products or services. These resources ensure accuracy and ease the tax calculation process.

What happens if a business fails to comply with sales tax regulations in Atlanta?

+Non-compliance with sales tax regulations can result in penalties, fines, and even legal consequences for businesses. It is crucial for businesses to stay informed about their tax obligations and seek professional advice if needed.

Are there any tax incentives for small businesses in Atlanta?

+Yes, Atlanta offers various tax incentives and programs to support small businesses. These incentives may include reduced tax rates, tax credits, or grants, making it more affordable for small businesses to operate and thrive in the city.

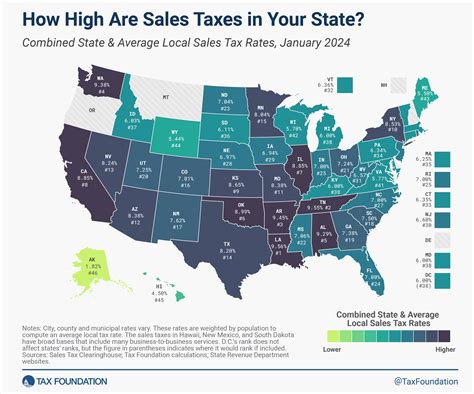

How does Atlanta’s sales tax system compare to other major cities in the US?

+Atlanta’s sales tax system is relatively competitive compared to other major US cities. While the total sales tax rate is higher than some cities, the city’s exemptions and incentives make it an attractive destination for businesses and consumers alike.