Government Agencies Don't Pay Taxes

In the intricate web of governmental operations and fiscal responsibilities, it is essential to unravel the understanding of how certain entities, such as government agencies, navigate the landscape of taxation. While the general populace and businesses shoulder the burden of taxes, there exists a unique exemption for government agencies, raising intriguing questions about the intricacies of the tax system and its implications.

This article aims to delve into the realm of tax exemptions for government agencies, exploring the legal foundations, practical implications, and the rationale behind this seemingly paradoxical arrangement. By examining real-world examples and analyzing the potential impact on the economy and society, we can gain a comprehensive insight into this aspect of fiscal policy.

Understanding the Tax-Exempt Status of Government Agencies

The exemption of government agencies from taxation is a principle deeply ingrained in many legal systems worldwide. This concept stems from the fundamental understanding that governments, as the entities responsible for creating and enforcing laws, should not be subject to the same fiscal obligations as their constituents. Thus, it is a matter of maintaining a balance between the powers of the state and the rights of its citizens.

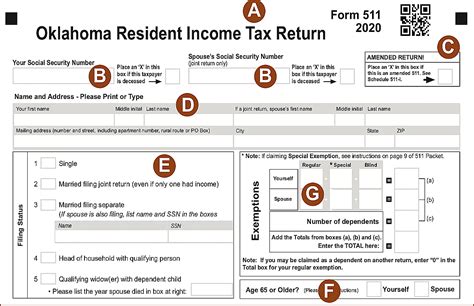

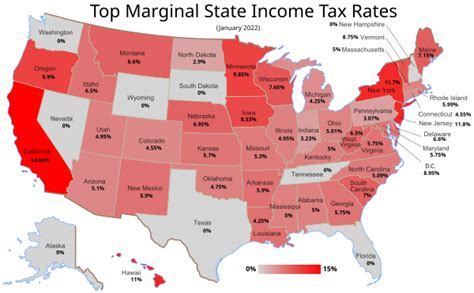

In the United States, for instance, the Internal Revenue Service (IRS) has established clear guidelines regarding the tax-exempt status of government entities. According to the IRS, "Federal, state, and local government agencies are generally exempt from Federal income tax." This exemption is not limited to the U.S.; many other countries follow similar practices, recognizing the unique role of government bodies in society.

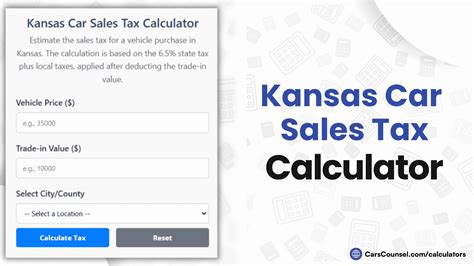

However, it is important to note that the exemption extends only to income taxes. Government agencies may still be subject to other forms of taxation, such as property taxes or certain excise taxes. The specific exemptions and obligations vary based on jurisdiction and the nature of the agency's operations.

Legal Foundations and Precedents

The legal basis for exempting government agencies from income taxes can be traced back to the concept of sovereign immunity, a principle that shields governments from certain legal actions and liabilities. In the context of taxation, this immunity extends to the financial realm, allowing governments to operate without the constraints of income tax obligations.

Furthermore, international law also recognizes the tax-exempt status of government entities. The Vienna Convention on Diplomatic Relations, for example, grants diplomatic missions and their staff immunity from certain taxes, reflecting the broader principle of respecting the sovereignty of states.

Real-World Examples of Tax-Exempt Government Agencies

To illustrate the practical application of this tax exemption, let us consider a few examples:

- The U.S. Department of Defense: With an annual budget surpassing $700 billion, the DoD is one of the largest government agencies in the world. Despite its immense financial footprint, the department is exempt from federal income taxes, allowing it to allocate resources solely to its core mission of national defense.

- The National Health Service (NHS) in the United Kingdom: The NHS, responsible for providing healthcare to the British population, operates as a tax-exempt organization. This exemption ensures that the funds allocated for healthcare are not diverted to income taxes, thus maintaining the integrity of the healthcare system.

- The European Central Bank (ECB): As a central bank and a key player in the European monetary system, the ECB is exempt from taxes in all member states of the European Union. This exemption facilitates the bank's operations and ensures its independence in conducting monetary policy.

These examples highlight the global nature of tax exemptions for government agencies and the diverse range of operations they cover, from defense and healthcare to monetary policy.

The Rationale Behind Tax Exemptions for Government Agencies

The decision to exempt government agencies from income taxes is not a mere oversight or an act of favoritism. Instead, it is grounded in several compelling rationales that aim to maintain the integrity and efficiency of governmental operations.

Efficient Resource Allocation

One of the primary reasons for exempting government agencies from income taxes is to facilitate efficient resource allocation. By exempting these entities, governments can ensure that the funds allocated to various agencies are used solely for their intended purposes, whether it be defense, education, or healthcare.

For instance, if a government agency were subject to income taxes, it would need to allocate a portion of its budget to cover these taxes. This could lead to a reduction in the agency's operational capacity or require additional funding from the government, potentially impacting other vital areas of public spending.

Preserving Governmental Independence

Tax exemptions for government agencies also serve to preserve the independence and impartiality of these entities. By removing the potential influence of tax obligations, governments can ensure that agencies make decisions based solely on the public interest, without the pressure of financial considerations.

Consider the example of a central bank. If a central bank were subject to income taxes, its decisions on monetary policy could be influenced by the need to generate sufficient revenue to cover these taxes. This would undermine the bank's independence and potentially distort its primary mission of maintaining price stability.

Avoiding Double Taxation

In many cases, exempting government agencies from income taxes helps prevent double taxation. This occurs when both the government and its agencies are taxed on the same income, leading to an inefficient and potentially burdensome tax system.

For example, if a government-owned corporation were subject to income taxes, the government would essentially be taxing itself. This double taxation could hinder the corporation's ability to compete with private enterprises and may even discourage governments from establishing such entities in the first place.

Implications and Potential Concerns

While the tax-exempt status of government agencies is a well-established practice, it is not without its implications and potential concerns. These considerations are important to address in order to maintain a balanced and fair tax system.

Impact on the Economy

One of the primary concerns surrounding tax exemptions for government agencies is their potential impact on the economy. Critics argue that by exempting these entities, governments are essentially favoring certain sectors or industries, which can distort the market and create an unfair advantage.

For instance, if a government agency operating in the energy sector is exempt from income taxes, it may be able to offer its services at a lower cost compared to private competitors, potentially driving them out of the market. This could lead to a concentration of power and a reduction in market competition, ultimately impacting consumer choices and economic efficiency.

Equity and Fairness Considerations

The tax-exempt status of government agencies also raises questions of equity and fairness. While these entities are exempt from income taxes, they still benefit from the infrastructure, security, and other services provided by the government, which are funded through taxes paid by citizens and businesses.

This raises the question of whether it is fair for certain entities to receive the benefits of taxation without contributing to the system. Critics argue that this creates an uneven playing field, where some entities enjoy the privileges of tax exemptions while others bear the full burden of taxation.

Potential for Abuse

Additionally, the tax-exempt status of government agencies can create opportunities for abuse or misuse. In some cases, government agencies may exploit their tax-exempt status to engage in commercial activities that compete unfairly with private enterprises. This could lead to a situation where government entities are using their tax-exempt status as an advantage to undercut private businesses, potentially harming the overall business environment.

Moving Forward: Balancing Tax Exemptions and Fiscal Responsibilities

As we navigate the complex landscape of tax exemptions for government agencies, it is evident that a delicate balance must be struck between preserving the efficiency and independence of these entities and ensuring a fair and equitable tax system.

To address the potential concerns and implications, governments can consider the following approaches:

- Clarify and Limit Tax Exemptions: Governments can establish clear guidelines and limitations on the tax-exempt status of government agencies. This could involve specifying the types of taxes from which agencies are exempt and setting boundaries on their commercial activities to prevent unfair competition.

- Transparent Reporting: Government agencies should be required to provide transparent financial reporting, detailing their operations, expenditures, and any potential benefits derived from their tax-exempt status. This transparency can help address concerns about fairness and accountability.

- Review and Adjust Exemptions Periodically: Regular reviews of tax exemptions for government agencies can ensure that these exemptions remain relevant and aligned with the evolving needs of the economy and society. This approach allows for adjustments to be made as circumstances change.

By adopting these measures, governments can maintain the efficiency and integrity of their agencies while also ensuring a fair and balanced tax system that promotes economic growth and social welfare.

Conclusion: A Complex Equilibrium

The exemption of government agencies from income taxes is a complex issue that requires a nuanced understanding of the legal, economic, and societal implications. While this exemption serves important purposes, such as preserving governmental independence and facilitating efficient resource allocation, it also raises legitimate concerns about fairness, competition, and potential abuse.

As governments strive to maintain a balanced and equitable tax system, the tax-exempt status of government agencies will remain a topic of ongoing discussion and refinement. By carefully considering the implications and taking proactive measures, policymakers can ensure that the tax system remains fair, efficient, and aligned with the best interests of society.

Are there any government agencies that are not exempt from taxes?

+While most government agencies are exempt from income taxes, there are certain exceptions. For example, government-owned corporations that operate in a commercial capacity may be subject to income taxes. Additionally, some government agencies may be required to pay specific taxes, such as property taxes, depending on the jurisdiction and the nature of their operations.

How do tax exemptions for government agencies impact the overall tax burden on citizens and businesses?

+Tax exemptions for government agencies can have both positive and negative impacts on the overall tax burden. On one hand, these exemptions can reduce the financial strain on government agencies, allowing them to allocate resources more efficiently. However, critics argue that these exemptions can also lead to an uneven distribution of tax burdens, as certain sectors or industries may benefit disproportionately.

What measures are in place to prevent government agencies from abusing their tax-exempt status?

+To prevent abuse of tax exemptions, governments often impose strict guidelines and limitations on the activities of tax-exempt agencies. These guidelines may restrict the types of activities the agency can engage in and the extent to which they can compete with private enterprises. Additionally, transparent financial reporting and regular audits can help ensure that agencies are not misusing their tax-exempt status.