Can I File Taxes With No Income

Filing taxes is an annual ritual for most individuals and businesses, but what if you have no income to report? Is it still necessary to file a tax return, and if so, what are the implications and potential benefits? This article aims to explore the intricacies of filing taxes with no income, providing valuable insights and guidance for those navigating this unique tax scenario.

Understanding the Basics of Tax Filing with No Income

In the realm of tax compliance, the question of whether or not to file taxes when there is no income to report is a valid concern. The Internal Revenue Service (IRS) and other tax authorities worldwide have specific guidelines regarding tax obligations for individuals and entities, even in cases of zero or negligible income.

Let's delve into the key considerations and factors that come into play when contemplating tax filing with no income.

When is Tax Filing Mandatory, Regardless of Income Level?

While it might seem counterintuitive, there are instances where filing a tax return is mandatory, even if your income for the tax year is zero or negligible. Here are some scenarios where tax filing is a legal requirement:

- Qualifying for Refunds: Even if you have no taxable income, you might be eligible for tax credits or refunds. For instance, in the United States, certain tax credits like the Earned Income Tax Credit (EITC) are available to low-income individuals and families. By filing a tax return, you can claim these credits and receive a refund.

- Compliance with Specific Tax Laws: Some countries or jurisdictions have specific tax laws that require individuals to file a tax return, regardless of their income level. For example, in the United Kingdom, individuals must file a Self Assessment tax return if they have untaxed income or gains above a certain threshold, even if they are not required to pay tax.

- Maintaining Compliance History: Filing a tax return, even with no income, helps establish a consistent compliance history with tax authorities. This can be beneficial in the long run, especially if your financial situation changes and you begin earning income in subsequent years. It demonstrates a commitment to tax compliance and can simplify future tax obligations.

Exploring the Benefits of Filing Taxes with No Income

While it might seem like a hassle to file taxes when you have no income, there are several advantages to doing so:

- Claiming Tax Credits and Refunds: As mentioned earlier, filing a tax return can unlock access to various tax credits and refunds. These credits are designed to support individuals and families facing financial challenges, and by filing, you ensure you receive the financial assistance you're entitled to.

- Avoiding Penalties and Interest: Failing to file a tax return, even when you have no income, can lead to penalties and interest charges from tax authorities. By filing on time, you avoid these additional costs and maintain a good standing with tax agencies.

- Eligibility for Government Benefits: In some cases, filing a tax return can be a prerequisite for qualifying for certain government benefits or programs. These benefits might include healthcare subsidies, housing assistance, or other social welfare programs. By filing, you ensure you remain eligible for these essential support systems.

- Simplifying Future Tax Obligations: Filing a tax return with no income can simplify future tax obligations. It helps establish a consistent filing history, making it easier to track your tax situation over time. Additionally, it provides a foundation for more complex tax scenarios, such as claiming deductions or credits when your income increases.

Potential Challenges and Considerations

While there are benefits to filing taxes with no income, it’s important to be aware of potential challenges and considerations:

- Understanding Tax Laws: Tax laws can be complex, and interpreting them correctly is crucial. It's essential to familiarize yourself with the specific tax laws and regulations applicable to your situation. Consulting with a tax professional or using reputable tax software can help ensure you're filing accurately and capturing all potential benefits.

- Gathering Necessary Documentation: Even if you have no income to report, you may still need to gather certain documentation to support your tax return. This can include proof of identity, residency, and any applicable tax credits or deductions. Ensuring you have all the required documentation can streamline the filing process and avoid potential delays.

- Timing and Deadlines: Tax filing deadlines vary depending on your jurisdiction and individual circumstances. It's important to be aware of these deadlines and plan accordingly. Filing late can result in penalties and interest charges, so staying organized and filing on time is crucial.

Case Study: A Real-World Example

Let’s consider a hypothetical case study to illustrate the benefits and challenges of filing taxes with no income. Imagine a recent college graduate, Sarah, who has just entered the job market but hasn’t secured full-time employment yet. During her first year after graduation, she had minimal income from part-time jobs and freelance work.

By filing a tax return, Sarah was able to claim the Earned Income Tax Credit (EITC), which provided a substantial refund. Additionally, filing a tax return helped her establish a tax compliance history, ensuring she remained eligible for various government benefits, such as healthcare subsidies and student loan forgiveness programs. This proactive approach simplified her future tax obligations and helped her navigate the complex world of taxes with confidence.

Best Practices for Filing Taxes with No Income

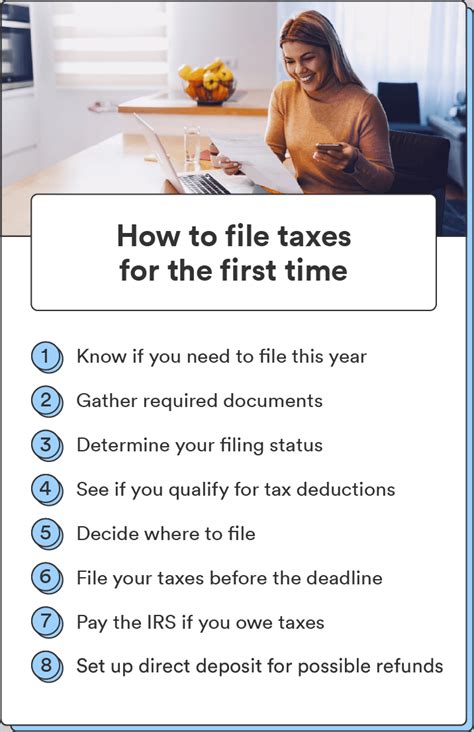

If you find yourself in a situation where you have no income to report, here are some best practices to ensure a smooth and accurate tax filing process:

Utilize Tax Preparation Software

Tax preparation software can be a valuable tool for filing taxes with no income. These programs guide you through the filing process, ensuring you capture all applicable credits and deductions. They also provide built-in error checks, reducing the risk of mistakes. Some popular tax preparation software options include TurboTax, H&R Block, and TaxAct.

Seek Professional Tax Advice

If you’re unsure about your tax obligations or have complex circumstances, consulting with a tax professional is advisable. A certified public accountant (CPA) or enrolled agent can provide personalized guidance and ensure you’re maximizing your tax benefits. They can also assist with more intricate tax situations, such as claiming specific credits or navigating international tax laws.

Stay Informed about Tax Laws and Updates

Tax laws and regulations can change frequently, so staying informed is crucial. Regularly check the official websites of tax authorities, such as the IRS in the United States, for updates and changes. Subscribing to tax-related newsletters or following reputable tax blogs can also keep you up-to-date with the latest developments.

Keep Accurate Records

Even if you have no income to report, maintaining accurate records is essential. Keep track of any expenses, deductions, or credits you might be eligible for. This can include medical expenses, educational costs, or charitable donations. Having a well-organized record-keeping system simplifies the tax filing process and ensures you don’t miss out on any potential benefits.

File on Time and Stay Organized

Timely filing is crucial to avoid penalties and interest charges. Mark your tax filing deadlines on your calendar and ensure you have all the necessary documentation ready. Staying organized throughout the year, such as by using tax planning apps or spreadsheets, can help you stay on top of your tax obligations and ensure a stress-free filing experience.

Explore Tax Planning Strategies

While you might not have income to report this year, tax planning can still be beneficial. Consider exploring strategies to optimize your tax situation in the future. This might include contributing to tax-advantaged retirement accounts, maximizing deductions, or exploring tax-efficient investment options. By planning ahead, you can minimize your tax burden and maximize your financial well-being.

Future Implications and Considerations

Filing taxes with no income may not seem like a significant event, but it can have lasting implications. Here are some key considerations for the future:

Establishing a Tax Compliance History

Filing a tax return, even with no income, helps establish a consistent tax compliance history. This can be especially beneficial if your financial situation improves in subsequent years. A solid compliance history demonstrates your commitment to tax obligations and can simplify future tax filings.

Qualifying for Government Programs and Benefits

Filing taxes with no income can impact your eligibility for various government programs and benefits. By filing, you ensure you remain eligible for essential support systems, such as healthcare subsidies, housing assistance, or educational grants. Staying informed about the specific requirements for these programs can help you make the most of available resources.

Navigating Future Tax Obligations

As your financial situation changes and you begin earning income, understanding your future tax obligations becomes crucial. By filing taxes with no income, you gain valuable experience with the tax filing process. This can simplify future filings and help you navigate more complex tax scenarios, such as claiming deductions or credits.

Maximizing Tax Benefits and Refunds

Filing taxes with no income can unlock access to various tax credits and refunds. By familiarizing yourself with these benefits and staying informed about tax laws, you can maximize your tax savings. Exploring tax planning strategies and consulting with tax professionals can further enhance your ability to optimize your tax situation in the future.

| Key Takeaways |

|---|

| Filing taxes with no income is mandatory in certain scenarios, such as qualifying for tax credits and refunds. |

| There are advantages to filing, including claiming credits, avoiding penalties, and maintaining eligibility for government benefits. |

| Utilize tax preparation software and seek professional advice for a smooth filing process. |

| Stay informed about tax laws, keep accurate records, and file on time to avoid complications. |

| Establishing a compliance history and understanding future tax obligations are crucial for long-term financial well-being. |

Can I file taxes if I have no income at all?

+Yes, in certain circumstances, it’s mandatory to file taxes even if you have no income. This is typically to claim tax credits or refunds. However, it’s important to understand your specific obligations based on your jurisdiction and individual circumstances.

What are the benefits of filing taxes with no income?

+Filing taxes with no income can unlock access to tax credits and refunds, avoid penalties and interest charges, maintain eligibility for government benefits, and establish a consistent tax compliance history.

Should I use tax preparation software or consult a tax professional?

+Both options have their advantages. Tax preparation software can be cost-effective and user-friendly, while tax professionals provide personalized guidance and expertise. Consider your specific needs and complexity of your tax situation to choose the best option for you.

What if I miss the tax filing deadline?

+If you miss the tax filing deadline, you may face penalties and interest charges. It’s important to file as soon as possible to minimize these consequences. In some cases, you can request an extension, but it’s best to stay organized and file on time.

How can I stay informed about tax laws and updates?

+Staying informed about tax laws is crucial. Regularly check official tax authority websites, subscribe to tax-related newsletters, and follow reputable tax blogs. Additionally, consulting with tax professionals or using tax preparation software can keep you up-to-date with the latest developments.